Introduction

Standalone Metrics do not Provide Deep Value

Solana vs Other Blockchains

Active Addresses growth in the last quarter

Market Cap per Active Address

DEX Volume per Active Address

DeFi Velocity

Why does Money Velocity matter?

Solana has the highest DeFi Velocity

Conclusion

Introduction

News articles, opinion-based newsletters, Twitter threads, and influencer callouts showcase the amount of misinformation about Solana. Does Ethereum Really destroy Solana in all metrics? Are the rumours true?

Today we will look into the most recent data covering several major L1 and L2 blockchains, to provide an unbiased comparison between them. Data shows that standalone metrics may not provide the necessary information to make a conclusion.

Standalone Metrics do not Provide Deep Value

Drawing conclusions based on a single data point is not advisable due to insufficient information, variability, potential outliers, sampling error, lack of reproducibility, and confirmation bias. It is essential to analyze multiple data points for a more comprehensive understanding and to remove bias and errors.

Solana has repeatedly been a target of fear, uncertainty and doubt, with either incorrect or biased tweets and reports using single metrics to measure the network’s value and legitimacy.

One of the metrics used against Solana is its TVL.

Although low, a direct comparison of Solana's Total Value Locked (TVL) with other blockchains may not provide a comprehensive overview, for several reasons. The cases for adopting Solana have often been products serving use cases other than DeFi, such as NFT-DeFi and DePIN. Both use cases are not accounted for when calculating TVL.

Should Solana choose to activate incentives, it's possible that its trading volume could rapidly approach levels similar to those of leading Layer 2 solutions.

Solana vs Other Blockchains

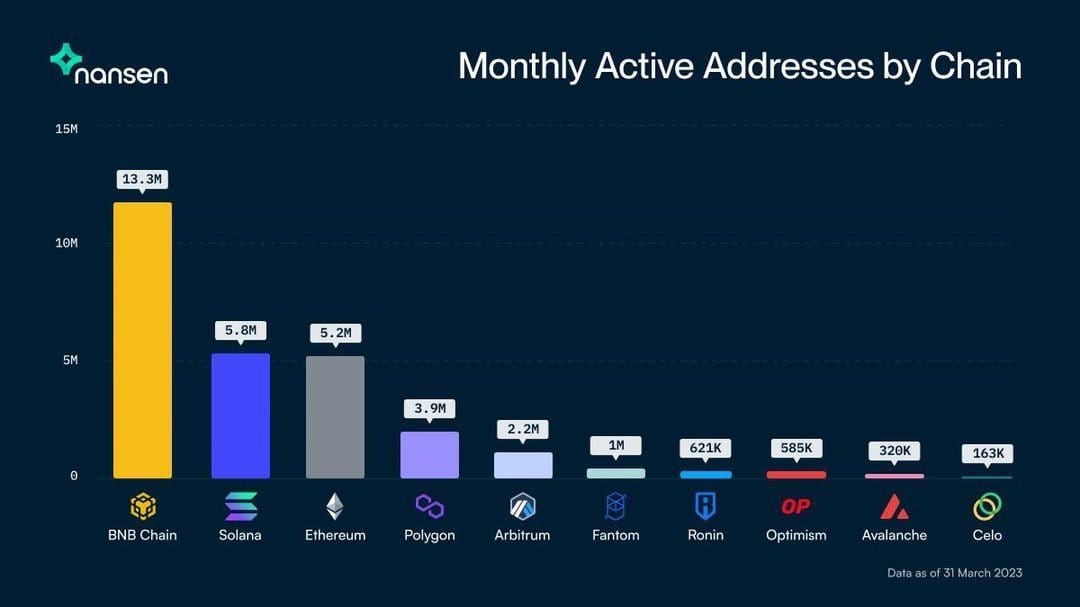

Active Addresses growth in March

Solana (SOL) surpassed Ethereum (ETH) in the number of monthly active wallets during March. As per data from Nansen, Solana outperformed Ethereum, the second-largest cryptocurrency by market capitalization, signalling a potential shift in the crypto landscape. Although Binance Smart Chain remains the leader with 13.3 million active wallets, Solana experienced the most substantial growth, boasting a remarkable 58% increase in active wallets over the past year.

Market Cap per Active Address

Market Capitalisation is one of the most used measures in crypto and traditional finance. The higher the market cap, the higher the perception of the value and robustness of a company/cryptocurrency. It can also be interpreted as a measure of opportunity. Good fundamentals often precede price action, and crypto is a market where it seems to happen more often than not.

The chart below aims to provide insight into the value the market perceives a protocol has, compared to how much activity is there. A higher value, in dollars, may show that a protocol is overvalued, while a lower value hints at a possible investment opportunity. We have calculated this metric by dividing the most recent Market Capitalisation by the 15-day average daily active addresses.

According to this metric, Ethereum shows the highest discrepancy between Market Cap and Active Addresses, with an average of $650K of market cap per active address. Solana, Near and Polygon show the best investment opportunity.

It is important to note, that this metric does not consider the several narratives playing out on Ethereum, such as its deflationary token economics model which attracts many large investors, thus partially explaining its high market cap.

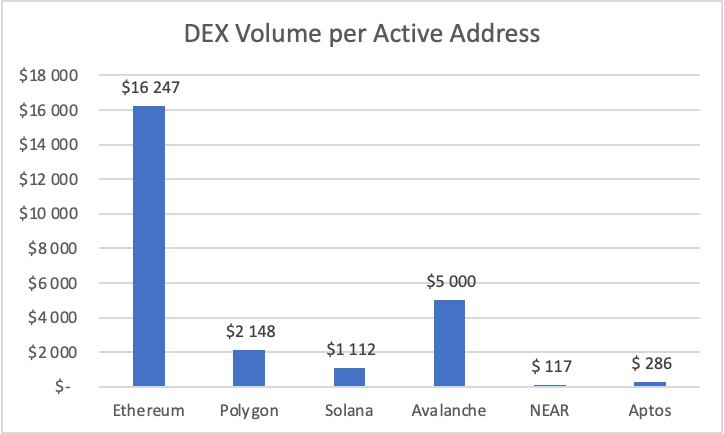

DEX Volume per Active Address

The next metric we will look into is the dex volume per Active Address. The metric evaluates how much money, on average, is transacted by an active address. The measure is the result of dividing the 7-day DEX volume by the average number of active addresses in that same period, giving us a short-term view of how much money each address is moving on average. Data shows that Ethereum ranks first with over $16K, followed by Avalanche with $5K. Solana is ranked fourth in this metric, with an average of $1.1K transacted by each active address.

Considering the discrepancy in TVL between Ethereum and Solana, this number is not as low as it seems. Ethereum’s TVL is over 100 times higher than Solana’s, yet DEX Volume per Active Address is 16x higher than on Solana, providing further evidence that money velocity is much higher on Solana.

DeFi Velocity

In the chart below, Ben Sparango, of the Solana Foundation gathered data on the top chains based on their reported Total Value Locked (TVL), as well as their reported 24-hour and 7-day trading volumes.

This metric, called DeFi Velocity, aims to show how active money is in an ecosystem by determining trading volume per dollar of TVL. The higher the Volume per Dollar of TVL, the more active the money is on the blockchain.

Why does Money Velocity matter?

Money velocity matters because it is a key indicator of economic activity and the overall health of an economy. It measures the rate at which money changes hands in an economy and is used to buy goods and services. A higher velocity implies that money is spent more frequently, stimulating economic growth, while a lower velocity indicates that money is being held onto and not being spent as quickly, which can lead to stagnation or contraction.

Solana has the highest DeFi Velocity

Data shows that Solana has the best result for this metric. With 1.83 Volume per dollar of TVL on the 7-d Volume, Solana is ranked first, followed by Polygon and Arbitrum with 0.87. Although Ethereum has the highest TVL, its money velocity is one of the lowest.

Conclusion

Solana has the highest DeFi Velocity, which suggests the ecosystem is healthy. In addition, Solana has one of the lowest values when measuring Market Capitalisation per Active Address, a metric that suggests the protocol is undervalued. In March, Solana surpassed Ethereum in active addresses, by over 500K.

Does Ethereum destroy Solana? No. Although data shows that Ethereum has better results in certain metrics, the difference overall is not that big. It is also important to consider the damage done by FTX to the Solana ecosystem, and how Solana still continues to outperform most L1 and L2 blockchains.

This newsletter proves that not only Solana’s overall metrics are more bullish than public sentiment, but also better than the majority of other blockchains.