Summary

Introduction

Token Price

Total Value Locked

Marginfi

DEX Volume

Memecoins

Daily Active Addresses

Drill-Down to the Protocol Level

Conclusion

Introduction

In 2023, despite certain metrics like TVL not fully recovering, other indicators suggest a resurgence in DeFi. This counters the notion that the decline of SBF, Alameda/FTX had permanently damaged Solana DeFi.

Data reflects a significant improvement in sentiment towards Solana, with a revival of its DeFi and NFT ecosystem. In addition, the overall sentiment in the crypto space has shifted from panic to greed, leading to a broad rally across various crypto assets.

Today we will dive into the current State of Solana DeFi with the latest on-chain data and the most relevant news of the week.

Token Price

Similar to most major cryptocurrency assets, Solana went through a period of increased volatility to the upside, as Bitcoin attempted to break the $30K level.

It reached its highest point at $26.80 and has since been ranging in the $20.00 to $23.00 area.

Major Resistance at $27.00

Major Support at $20.00

Total Value Locked (TVL)

TVL has been at around the $200M to $300M range since the FTX crash and bankruptcy. In the last month, TVL dropped around 25% from $295M to $268M, as DeFi appears to struggle with retaining money in the ecosystem. A recent push for liquid staking may contribute to positive growth of TVL in the coming months, as less than 2% of staked Solana tokens are in Liquid Staking.

Solana’s TVL hit a monthly high of $298M and a monthly low of $265M.

Project Spotlight - marginfi

MarginFi is a decentralized lending protocol built on the Solana blockchain, designed to prioritize risk management and offer a secure and dependable solution for users seeking leverage and enhanced capital efficiency.

The protocol consists of a comprehensive suite of smart contracts deployed on Solana, accompanied by real-time risk management and automated liquidation mechanisms. MarginFi enables seamless integration with third-party protocols, fostering composability, and allowing users to consolidate their on-chain portfolios and gain access to a diverse array of decentralized finance (DeFi) services.

Although relatively new, data suggests it is becoming of the most well-established projects in the Solana DeFi ecosystem. It is the fastest-growing Solana DeFi protocol in the last month, by TVL, with a 142% growth.

DEX Volume

Tracking DEX volume is important for transparency, assessing market efficiency and understanding the growth of the adoption of a blockchain.

In the last month, the volume of decentralized exchanges (DEXs) on Solana reached its highest point since January 2023, largely due to the memecoin and the growth of active addresses on the chain.

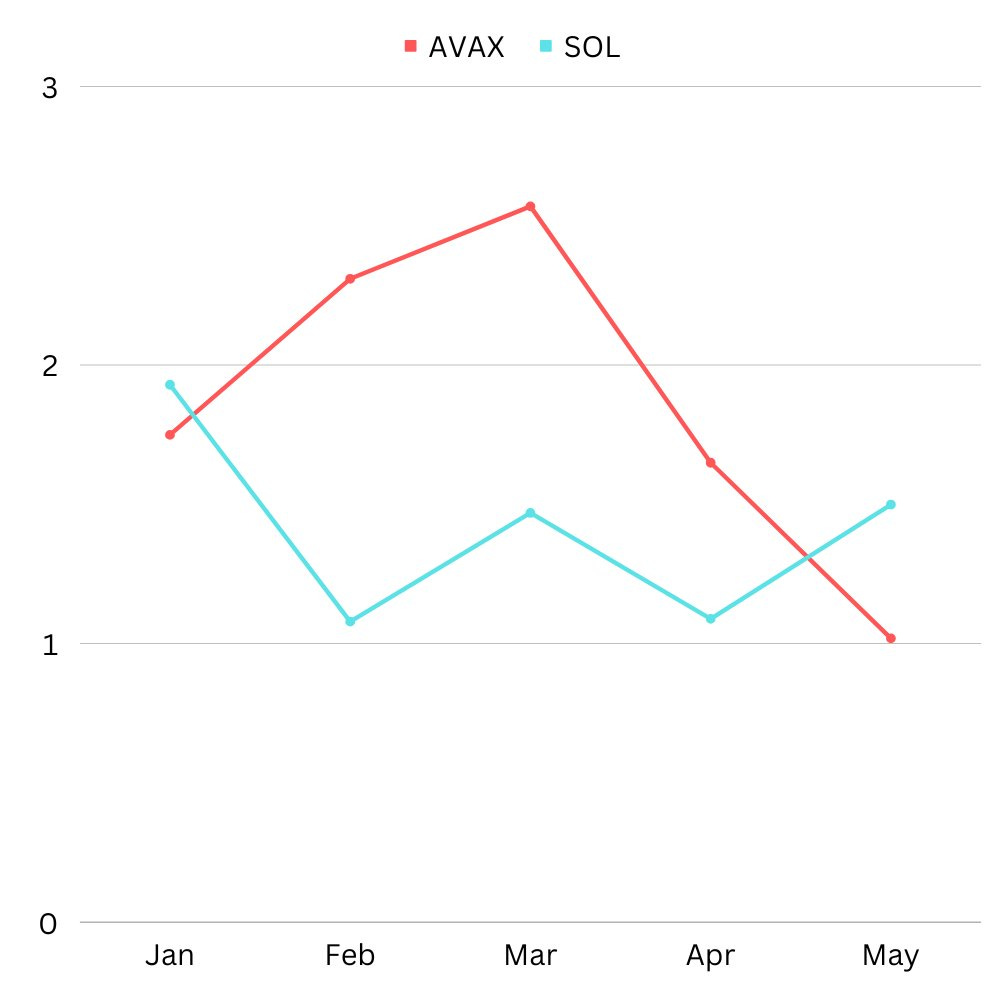

DEX Volume reached $700M in the first two weeks of May and is on track to beat April. Another data point to note is that Solana is on track to surpass Avalanche in its monthly DEX Volume in 5 months.

Memecoins

Meme coins can play a valuable role in fostering crypto adoption by offering a low barrier to entry that appeals to newcomers in the market. These coins often foster the creation of strong communities that provide support and educational resources, helping to reduce the learning curve and foster a sense of camaraderie. Meme coins often serve as a gateway into the world of cryptocurrencies, as evidenced by the significant influx of new participants attracted by the growth of coins like SAMO or BONK.

The last three weeks marked the biggest memecoin season since January. The memecoin GUAC kickstarted the Solana memecoin season with an explosive 100x growth in the first 24 hours. In the following days, KING and SWTS launched and have since been, along with GUAC, the Top 3 memecoins on Solana by market cap.

Daily Active Addresses

The Solana Daily Active Addresses chart shows the daily number of unique addresses that were active on the network as a sender or receiver.

The daily active addresses increased around 72% month-over-month (MoM), from ~290K to ~500K. Solana had its biggest day of the month on May 4th, with almost 565K active addresses in a single day. For reference, Polygon and Ethereum Active Addresses grew 17% and 13%, respectively, in the same period.

Drill-Down to the Protocol Level

Data suggests that memecoin season brought an inflow of liquidity and activity to the Solana blockchain. Data shows that Jupiter Aggregator, Orca, and Raydium are the most used protocols for decentralized trading.

Conclusion

On-chain data indicates that while the DeFi ecosystem has yet to fully recover, progress is being made in healing its wounds. In addition, both NFT and DeFi projects are exploring novel ways to integrate their strengths and create innovative products within the Solana ecosystem.

Several factors have contributed to the rally in various metrics, including market sentiment, the restoration of confidence in Solana, the frenzy around memecoins, and the commitment of NFT and DeFi founders to leverage the capabilities of the chain.