GUAC: What you missed

GUAC has taken over everyone's timeline. This week we look at the memecoin's impact on the Solana ecosystem.

Introduction

GUAC is doing numbers.

Daily Active Addresses rise sharply

$GUAC is generating the most Fees

The GUAC Effect

History doesn't repeat, but it often rhymes

Can the same happen with GUAC?

Conclusion

Introduction

It is only the third day since GUAC was released, however, the Solana memecoin has already reached everyone on Crypto Twitter (CT) and in the Solana ecosystem.

With the Ethereum memecoin season going in full throttle, speculation started for when it would begin on Solana. Data suggests that attention has shifted from NFTs to Memecoin trading.

Today we will cover the most up-to-date data on GUAC and how it has been able to start the Solana memecoin season, four months after BONK.

GUAC is doing numbers.

Birdeye shows that GUAC’s on-chain daily volume reached over $8M. The token hit its all-time high of $0.000000047667 on May 4th.

At the time of writing, BONK has a $2,93M Fully Diluted Market Capitalization, down 40% from its high of around $5M FDMC.

The token supply was distributed in a stealth, fair launch, which is why token distribution is considered healthy and non-predatory. Top 100 holders hold 56% of the supply, as opposed to 76% of BONK held by the Top 100 holders.

GUAC currently has ~7,000 holders.

Daily Active Addresses rise sharply

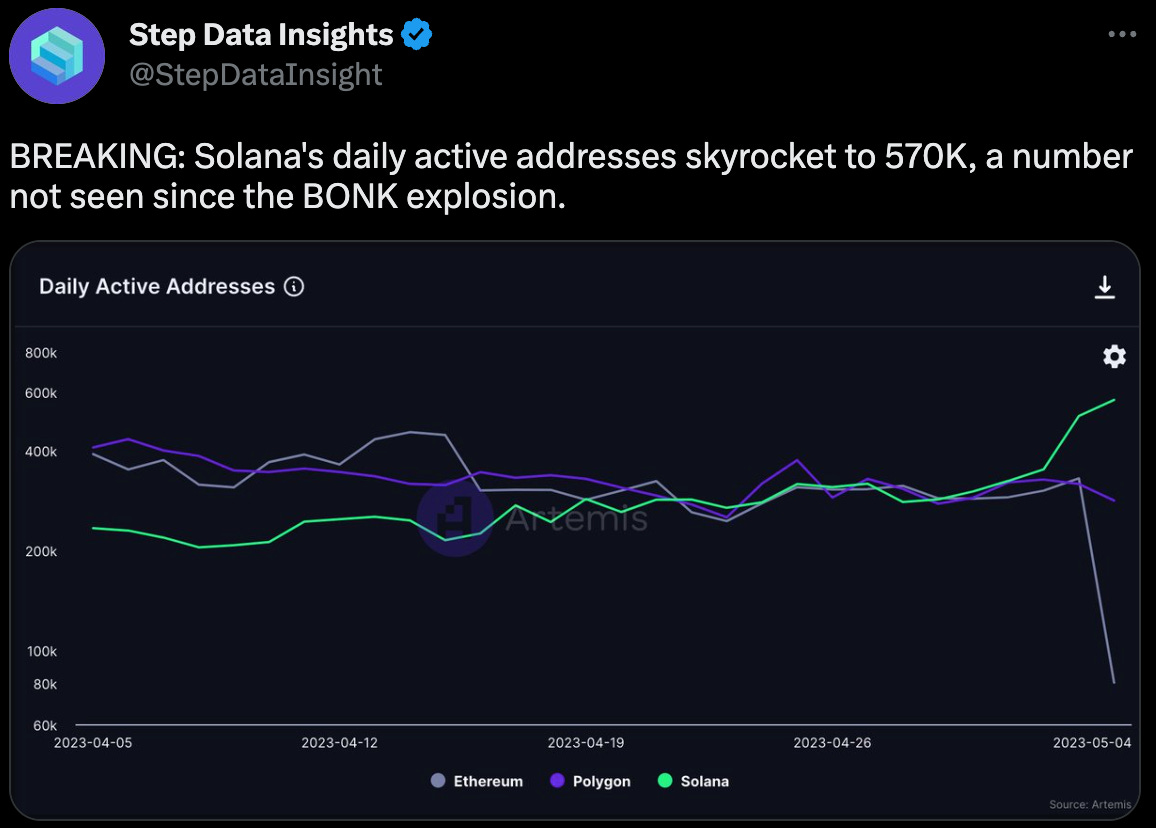

Solana is seeing a prolonged uptrend in daily active addresses in the last 30 days. A positive shift in sentiment, seemingly more accurate news reporting from crypto news outlets and the Ethereum gas fee increase may explain the sustained growth. At the time of writing, Solana reached the highest number of daily active addresses since the memecoin BONK took the spotlight in early January.

Contrasting with the increase of daily active addresses on Solana, Polygon and Ethereum have seen a month-long downtrend. At the time of writing, Solana has 570K daily active addresses.

$GUAC is generating the most Fees

Data from Step Finance Analytics shows that $GUAC generates the most fees in the Solana ecosystem. The memecoin has generated over $10K in fees in the last 24 hours, as much as the next 6 trading pairs on Solana, as shown below.

The GUAC Effect

The recent run of GUAC sparked a Solana memecoin mania. Mexican food-themed memecoins like TACO, CHIPS, SALSA, and other coins saw their token price increase as speculators placed bets to catch the next runners.

On-Chain data shows an increase in Active Addresses, DEX Volume and an overall positive shift in sentiment.

It's important to note that buying memecoins can be highly risky, and investors should do their due diligence and carefully consider the potential risks and rewards. Additionally, the hype and buzz around these coins can be short-lived, and their prices can rapidly decline as quickly as they rise.

History doesn't repeat, but it often rhymes

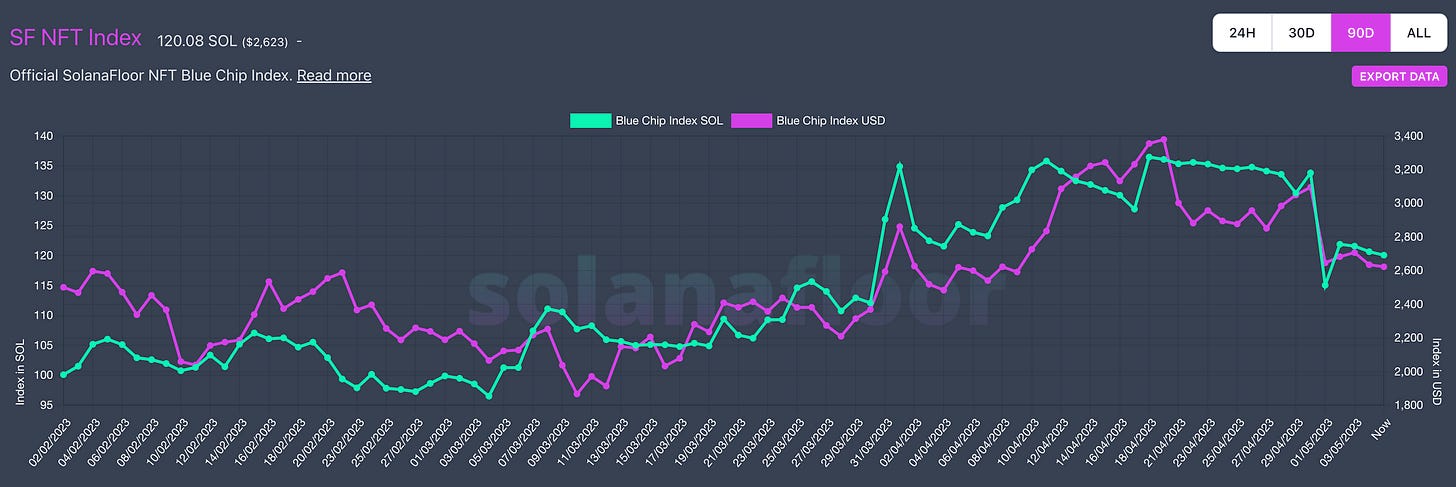

Earlier this year, BONK sparked a wave of liquidity for NFTs. Given that 50% of the token supply was airdropped to NFT holders, it is possible to say that many users rotated their profits into NFT projects.

Can the same happen with GUAC?

BONK launched in one of the hardest periods in the Solana ecosystem. Although “just” a memecoin, BONK has contributed to a much-needed sentiment shift within the Solana ecosystem.

Data shows although it is unlikely that GUAC creates a similar period of abnormal growth, it may accelerate Solana DeFi adoption, as the token gave a lot of exposure to Solana on Twitter, with over 500 thousand tweets mentioning $GUAC in just 24 hours.

Why do memecoins have such powerful runs?

A memecoin is a type of cryptocurrency that has gained popularity primarily due to its internet memes, social media buzz, and community-driven marketing campaigns, rather than any inherent technological or financial innovations. These coins typically have catchy names and logos and are often associated with specific communities or cultural references.

Some well-known examples of crypto memecoins include Samoyed Coin, BONK, Doge and Shiba Inu. These coins often have no real-world use cases or fundamental value, and their prices are largely driven by speculation and hype. Despite their lack of utility, crypto memecoins can be highly volatile and have attracted significant investment from traders and investors who hope to profit from their price swings.

Conclusion

Memecoin rallies may occur at market bottoms and tops, although the latter is more likely. Data and sentiment show that, like BONK, GUAC acted as a proof of life for the Solana ecosystem. It is showing the crypto world that Solana is well and alive and that its price doesn’t represent its fundamentals. As an investor, it is important to understand the difference between the two.