Here's how Stablecoins can make you money

Yes, stablecoins can make you money.

Summary

Introduction

The State of Solana DeFi

USDC Liquidity increases on Solana

DEX Volume

Why Solana is the go-to blockchain for DeFi power users

High Throughput

Low Transaction Fees

Solana speedruns trends

The use cases of Stablecoins

Hubble Protocol and USDH

Strategies for Leveraging Stablecoins

Manually Leveraging Positions in One Asset

Leveraging Positions for Volatile Yield

Leveraging Positions for Stable Yield

Avoiding Liquidations When Borrowing Stablecoins

Conclusion

Introduction

The USDC depeg event took the crypto markets by surprise. As fears of bank contagion spread across the banking and the world financial markets, crypto prices declined sharply. Many crypto users concluded that stablecoins are not only sidelined capital but have risks too. The recent development of use cases for DeFi and Stablecoins has led to a positive inflow of capital to yield-generating products based on stablecoin strategies.

USDC Liquidity increases on Solana

Bank run fears on Signature Bank, Silicon Valley Bank, Silvergate Bank, and many others caused widespread concerns about the dollar-backed stablecoin USDC. The stablecoin depeg event caused a reduction of liquidity in the ecosystem, in dollar terms, considering that USDC dropped to $0.88 at the bottom. Now that the peg has reestablished to the 1:1 parity, data from Step Analytics shows that the liquidity among USDC pairs has increased from pre-depeg levels.

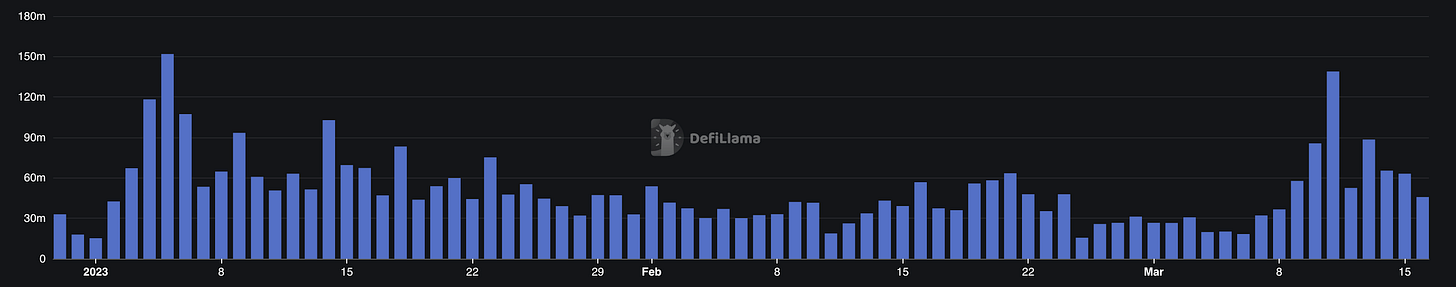

Data shows that the USDC depeg fears brought life to Solana DeFi. Investors rushed to safeguard their investments away from USDC while speculators and traders bet on the different possible outcomes from this event. Solana DEX volume saw its biggest week since the BONK rush earlier in January.

Why Solana is the go-to blockchain for DeFi power users

Solana is one of the most promising blockchains for DeFi power users due to several key attributes.

High Throughput

Solana is processing between 3,000 to 5,000 transactions per second, a significant difference compared with other major blockchains. Its high throughput ensures that the network remains efficient and responsive during periods of heavy usage.

Low Transaction Fees

In addition to being a very fast blockchain, transaction fees are virtually non-existent. Transactions typically cost the user $0.00025, much less than any other major blockchain like Ethereum, where transactions often reached $500 in the last bull run. The cost-effectiveness of Solana is particularly attractive for DeFi power users and developers aiming to launch protocols targeting mass adoption.

Solana speedruns trends

Several months before the decentralised perpetual trading narrative gained strength place, Solana already had many working DEX trading protocols. The zero-royalty NFT meta that started in February on Ethereum had already happened to Solana five months earlier. DeFi power users tend to look for trends and competitive advantages over others, which is why Solana is the only blockchain that can offer the best opportunities to stay ahead of the curve.

Stablecoins are far more interesting than you think

Stablecoins have several uses. One of the most popular uses is for cross-border remittances, allowing people to send and receive money without needing a traditional bank account or to wait several days or weeks. Users can use them in DeFi protocols for lending and borrowing, where users can earn interest on their holdings or use them as collateral for loans. Stablecoins are increasingly used for e-commerce and micropayments, providing a faster and more secure alternative to traditional payment methods.

As the DeFi landscape changes, stablecoins use cases evolve. While most people still see stablecoins as sidelined capital, many DeFi users are using them to find new ways to generate more passive income.

We will look at what Hubble Protocol is and what yield-generating opportunities its stablecoin USDH offers.

Hubble Protocol and USDH

Several active Solana-native stablecoin projects participate in DeFi. At the time of writing, one of the most widely used of these stablecoins is Hubble Protocol’s USDH, a collateralized debt position (CDP) stablecoin backed by a basket of assets, including:

SOL

Liquid Staking Tokens: stSOL (Lido), mSOL (Marinade), daoSOL (MonkeDAO)

ETH (Wormhole)

kTokens (Kamino Finance)

USDH enters the Solana DeFi ecosystem when users borrow the stablecoin against the value of their collateral. This DeFi-centric and crypto-backed method of issuing stablecoins has been battle tested for years, and USDH has survived not one but two major stress tests where the protocol managed to remain on par with USD.

Hubble Protocol has instituted several pegging mechanisms to keep USDH as closely tied to USD as possible. These mechanisms include a Peg Stability Module (PSM) and Stability Fees. The Peg Stability Module (PSM) allows for risk-free arbitrage with USDC. Stability Fees act as an incentive for users to repay debts when fees rise, reducing supply.

The repayment of debt on-chain is a large differentiation between fiat-backed and algorithmic stablecoins. Since tokens are held within Hubble’s smart contracts as collateral for minting USDH loans, there is a systematic assurance that USDH will be removed from the market to repay debts and reach an equilibrium where users can retrieve something of value in a trustless manner.

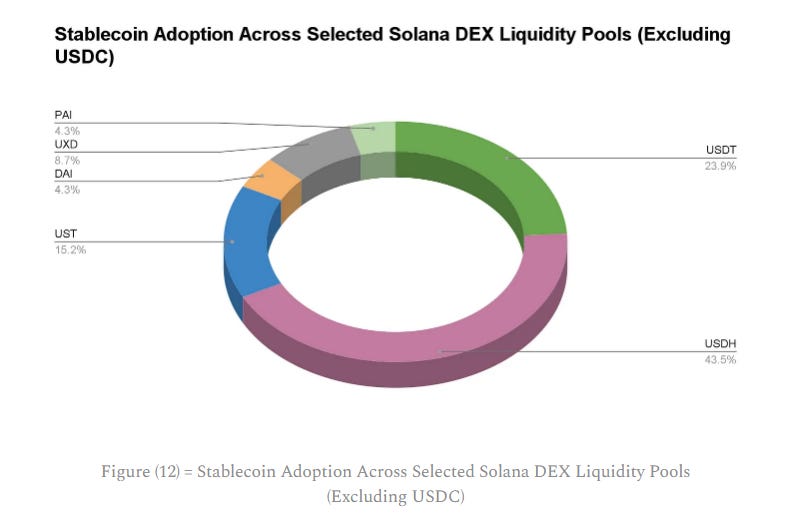

As reported in the pre-FTX meltdown Step Data Insights: Solana Stablecoins, USDH was the most widely adopted Solana-native stablecoin in Solana liquidity pools. Excluding USDC, the stablecoin adoption of USDH in Solana DeFi was at 43.5%, while the next closest competitor for DEX pairs was USDT, at 23.9%.

Since then, USDH has maintained its position as the most widely paired Solana-native stablecoin on the network’s DEXs. Furthermore, it has also closed the gap on other CDP stablecoins with a growing active user count, signalling continuous and rising adoption of USDH across the network.

Strategies for Leveraging Stablecoins

CDP stablecoins are a tool for leveraging the value of crypto assets while minimizing counterparty risk. By borrowing against one’s own assets, users can more predictably increase the value of their positions while increasing their capital on hand to participate in DeFi.

Due to the extreme composability of DeFi on Solana, there are several steps users can take to increase their leverage while borrowing against their assets. Some of these positions can participate in earning yield while benefiting from the price appreciation of their deposited assets:

Manually Leveraging Positions in One Asset

Users with a positive outlook on SOL can deposit SOL and borrow USDH to increase their position in Solana’s native token. After borrowing USDH against an SOL deposit, swapping from USDH to SOL increases exposure to SOL, and this can be amplified by depositing SOL to borrow more USDH and continuing the loop.

By performing this loop using a liquid staking token like stSOL, users can also earn LDO rewards on Hubble Protocol for borrowing against stSOL with a minimum LTV of 40%. This means that on top of the stSOL rewards from staking, users can also generate a yield from rewards provided by Lido Finance.

Deposit stSOL on Hubble Protocol

Borrow USDH with >40% LTV

Swap USDH for more stSOL

Deposit stSOL on Hubble Protocol

Repeat, or maintain an LTV >/= 40%

Maximize exposure to SOL price action

Earn stSOL staking rewards (Currently 6.6%)

Earn LDO rewards while borrowing (Currently 8% APR)

Leveraging Positions for Volatile Yield

Users with a positive outlook on SOL can use their borrowed USDH to participate in market making on Kamino Finance. This strategy earns multiple forms of yield: staking rewards, fees paid by traders on a DEX, and LDO rewards provided by Lido Finance.

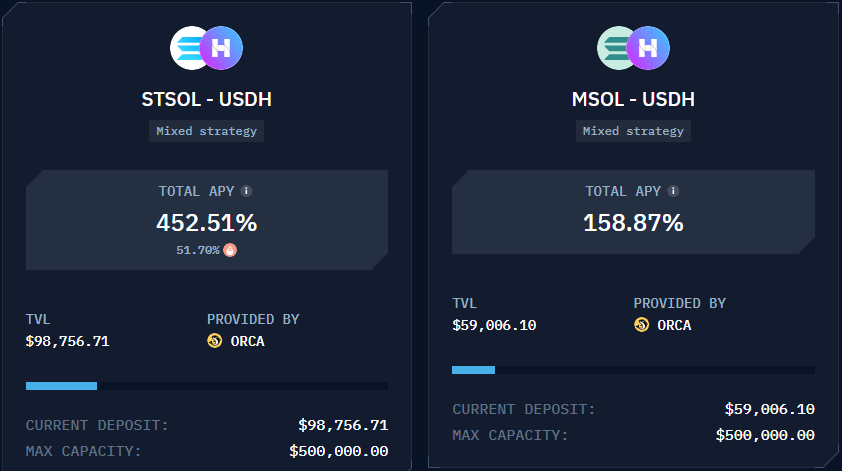

By depositing stSOL to borrow USDH, users can earn LDO rewards for borrowing, as previously mentioned. Then, by depositing USDH into a Kamino Finance vault like stSOL-USDH, users can earn fees from trades and additional LDO rewards.

This position maintains 100% exposure to SOL price movements, and LDO rewards are auto-compounded regularly back into the position. By providing liquidity for stSOL-USDH trades, users gain additional exposure to stSOL staking rewards and LDO rewards while minimizing the risk of impermanent loss by market making with borrowed USDH.

Note: The yields from market-making with Kamino Vaults are variable and depend on trading activity. It’s best to provide liquidity during periods of high trading volume with low volatility, or periods of sideways or rising market outlooks.

Deposit stSOL on Hubble Protocol

Borrow USDH with >40% LTV

Earn LDO rewards while borrowing (Currently 8%)

Deposit USDH on Kamino Finance

Earn fees from trades (Currently 401% APY)

Earn auto-compounded LDO rewards (Currently 51% APY)

Earn staking yield from stSOL (Currently 6.6%)

Leveraging Positions for Stable Yield

Borrowed USDH can be used to provide concentrated liquidity for stablecoins pairs such as USDH-USDC on Kamino Finance. While providing liquidity for these pairs, users incur minimal to no impermanent loss while earning fees from trades, and since kTokens have been integrated as collateral on Hubble Protocol, these positions can also be looped.

Borrowed USDH can be used to provide concentrated liquidity for stablecoins pairs such as USDH-USDC on Kamino Finance. While providing liquidity for these pairs, users incur minimal to no impermanent loss while earning fees from trades. Since kTokens have been integrated as collateral on Hubble Protocol, these positions can also be looped.

Note: At the time of writing, the kToken vault on Hubble Protocol has reached full capacity.

Deposit stSOL on Hubble Protocol

Borrow USDH with >40% LTV

Earn LDO rewards while borrowing (Currently 8%)

Deposit into USDH-USDC on Kamino Finance

Deposit kUSDH-USDC on Hubble Protocol

Borrow USDH with 97% LTV maximum

Earn fees from trades (Currently 0.88%)

Earn staking yield from stSOL (Currently 6.6%)

Avoiding Liquidations When Borrowing Stablecoins

Opening a loan on a CDP stablecoin involves the risk of facing liquidation if one’s collateral assets fall in value. The closer one’s collateral value reaches the value of their borrowing, the closer one reaches the point of liquidation. Additionally, the greater leverage users seek by participating in DeFi, the greater risk they face of having their assets liquidated to repay their loan.

Maintaining a healthy LTV ratio is one of the key elements for avoiding liquidation. This can be done by topping up one’s collateral with additional assets to increase the value of their collateral, or users can repay their stablecoin loans instead. Paying close attention to the market and deciding when to exit a position is incredibly important when seeking leverage.

Sometimes this might not be possible, but there are other alternatives. If the market crashes and users do not have capital on hand to repay their loans, they can instantly close their position on Hubble with the click of a button. Users can opt to repay their loan using their collateralized assets and receive the remainder in return without facing liquidation.

Conclusion

Stablecoins are more than sidelined capital. They are tools which can be used for several purposes on DeFi applications, from staking, to lending and borrowing, to being used as collateral for trading. Hubble Protocol opens up a box of yield-generating opportunities for stablecoins, however, there are risks which should be very well calculated beforehand.

Advisory

This document is not financial advice and is for education purposes only. Always do your own research before investing or trading cryptocurrencies.