Introduction

Why does Decentralization matter?

How Centralised is Solana?

Solana vs Ethereum - Token Supply Distribution

Validator & Node Count

Nakamoto Coefficient

Stake Distribution

Founder’s Impact

Conclusion

Introduction

Solana is one of the most criticized blockchains. Many argue it is because it is one of the most relevant pieces of the crypto ecosystem while being one of the most misunderstood. Many influential personalities of Solana, including their Co-Founder and Head of Strategy & Communication, have recently voiced their discontent over news outlets publishing misinformation, wrong data, biased news articles against Solana and more. This led the Solana community to rally and contribute to creating factual, up-to-date content on a daily basis.

One of the most used arguments is how Solana is centralized. Today we will look into what centralization means and how Solana ranks amongst others.

Why does Decentralization matter?

Decentralization is important for several reasons. It makes systems more robust and harder to disrupt while giving people greater control and influence over decisions. This approach fosters innovation by encouraging new ideas and inventions. Additionally, decentralization enhances privacy and security for users, making it harder for governments or other entities to control information. It also allows more people to join and benefit from the system and can lead to greater efficiency and cost-effectiveness.

In general, decentralization enables more open systems that work better for everyone. However, it's worth noting that it may not always be the ideal solution and can come with its own challenges.

How Centralized is Solana?

The Solana Foundation published a report highlighting the most recent developments in the ecosystem, focused on decentralization and validator data.

Solana has a high number of validators, which has increased over time. The higher number of validators helps improve the decentralization of the network. However, some critics argue that the hardware requirements for running a Solana validator node can be demanding, potentially leading to centralization as only well-funded participants can afford to run these nodes. The opposing argument is that, on the long-term horizon, technology and software will advance to the point where any hardware will be sufficient.

The distribution of the native ecosystem token SOL is important. Initially, a large portion of SOL tokens was held by the Solana Foundation and early investors. Over time, token distribution improved through various methods, including community grants, incentives, and token sales.

Solana vs Ethereum - Token Supply Distribution

Critics argue that Solana is mainly controlled by venture capitalists, but it's worth noting that the top 1% of holders own most tokens in any major blockchain.

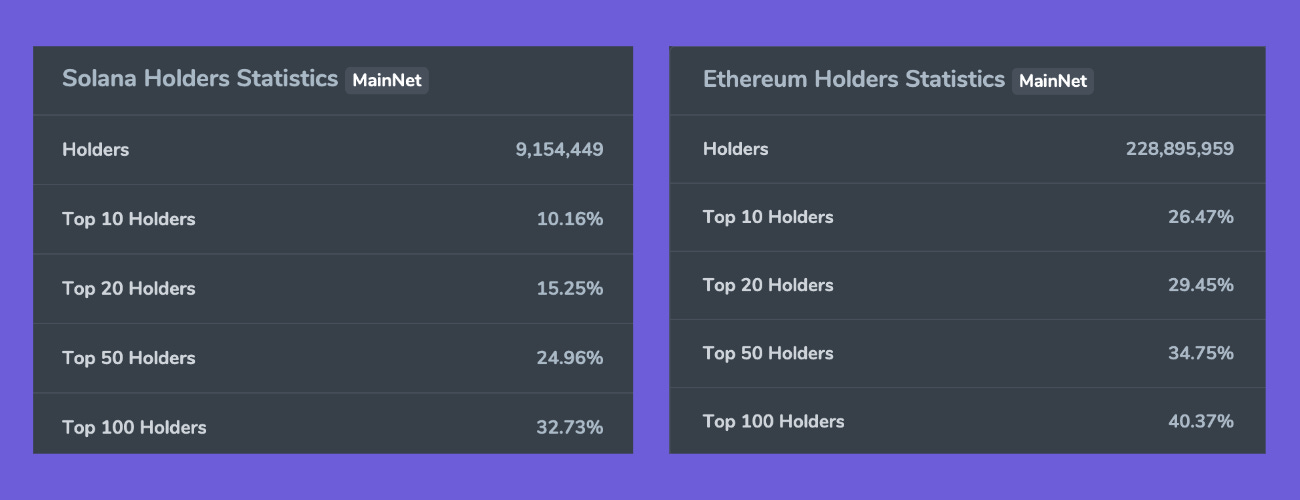

Comparing Solana and Ethereum, data from Coincarp shows that Solana has 9.1 million holders, while Ethereum has nearly 230 million. The top 10 Solana holders own 10% of the total supply, while the top 10 Ethereum holders own 26%. Additionally, the top 100 Solana holders own 32% of the supply, compared to 40% owned by the top 100 Ethereum holders.

Considering the data provided, it can be inferred that Solana exhibits a higher degree of decentralization. This is because a more evenly dispersed token supply diminishes the influence of individual holders.

Validator & Node Count

In March 2020, the mainnet was launched and has since expanded to include more than 3,400 validators, with over 2,400 consensus nodes. The number of validators on Solana is significantly higher than on other proof-of-stake blockchains. For reference, Avalanche has 1,256, Cosmos has 175 and Cardano has 2076 validators.

The Foundation is now focusing on node quality, not just quantity.

Nakamoto Coefficient

Solana's Nakamoto Coefficient is 33, meaning that the lowest number of validators that would have to collude to censor the network is 33. The coefficient steadily increased from the network's launch in March 2020 through September 2022, before stabilising.

The Solana Foundation is exploring ways to attract more high-quality validators, possibly leading to a rise in the Nakamoto Coefficient, as users have incentives to stake with a larger pool of validators.

Stake Distribution

Stake distribution by geography is crucial for maintaining the decentralization, security, and resilience of crypto networks, ensuring they remain censorship-resistant, and promoting fair representation in decision-making processes.

The stake distribution of Solana by country is as follows: 23.5% from the US, 13.2% from Great Britain, 11.9% from Ireland, 8.6% from Lithuania, 7.6% from Japan, 6.0% from Canada, 5.8% from Singapore, 5.1% from Poland, 4.2% from the Netherlands, 3.2% from Germany, 1.9% from France, and 2.2% from Russia. Additionally, 4.0% of Solana's stake comes from Other countries.

Founder’s Impact

One of the key aspects of Bitcoin is that it doesn’t have a face, making it fair and resistant to corruption. This also means that the system is reliable without needing to trust a specific person or group. With no main person in charge, it's harder to attack or shut down Bitcoin, providing additional security. The lack of a leader makes it difficult for governments to target Bitcoin, offering legal protection.

Many argue that this is not the case for either Solana or any other L1 or L2 blockchain, highlighting a point of weakness.

Conclusion

Decentralization matters as it makes systems more robust, fosters innovation, enhances privacy and includes more people. Solana has a high number of validators, and its token supply distribution appears less decentralized than Ethereum's. In addition, the network has over 3,400 validators and a Nakamoto Coefficient of 33.

Stake distribution by geography is important for decentralization, and Solana's stake is distributed across various countries. While Bitcoin lacks a central figure, making it resistant to corruption, Solana and Ethereum have central figures, which some argue is a point of weakness.

Overall, Solana is not as centralized as it seems when reading news outlets’ headlines or Twitter threads.

Excellent newsletter guys