Introduction

Why do you need data?

Solana Data

Step Analytics

SolanaFloor

WolfCapital

Broad Ecosystem Data

DeFiLlama

Artemis

Conclusion

Introduction

Many traders argue that Technical Analysis and charts are the only thing needed to make money in crypto. As a data centric newsletter and team, we believe that data has the power to provide insights into early trends and value that can not be obtained anywhere else. Data can be turned into valuable information which has the power to change one’s perspective on an asset, for better or for worse.

We’re giving you all the alpha today - for free.

Why do you need data?

Crypto is highly volatile and complex. By analyzing data, you can make more informed investment decisions based on trends, patterns, and historical performance.

Data analysis can help you assess the risk associated with certain projects. Understanding factors such as TVL, active addresses, market sentiment, and trading volumes can guide you in managing your risk exposure effectively.

Data analysis allows you to understand the market dynamics and the factors influencing price movements. This knowledge can help you anticipate market trends and make strategic investment choices. Through data analysis, you can identify potential investment opportunities based on insights such as fundamentals, development progress, partnerships, and community sentiment.

Today we will take a look at some of the best places you can use to get ahead of the curve and potentially make more money.

Solana Data

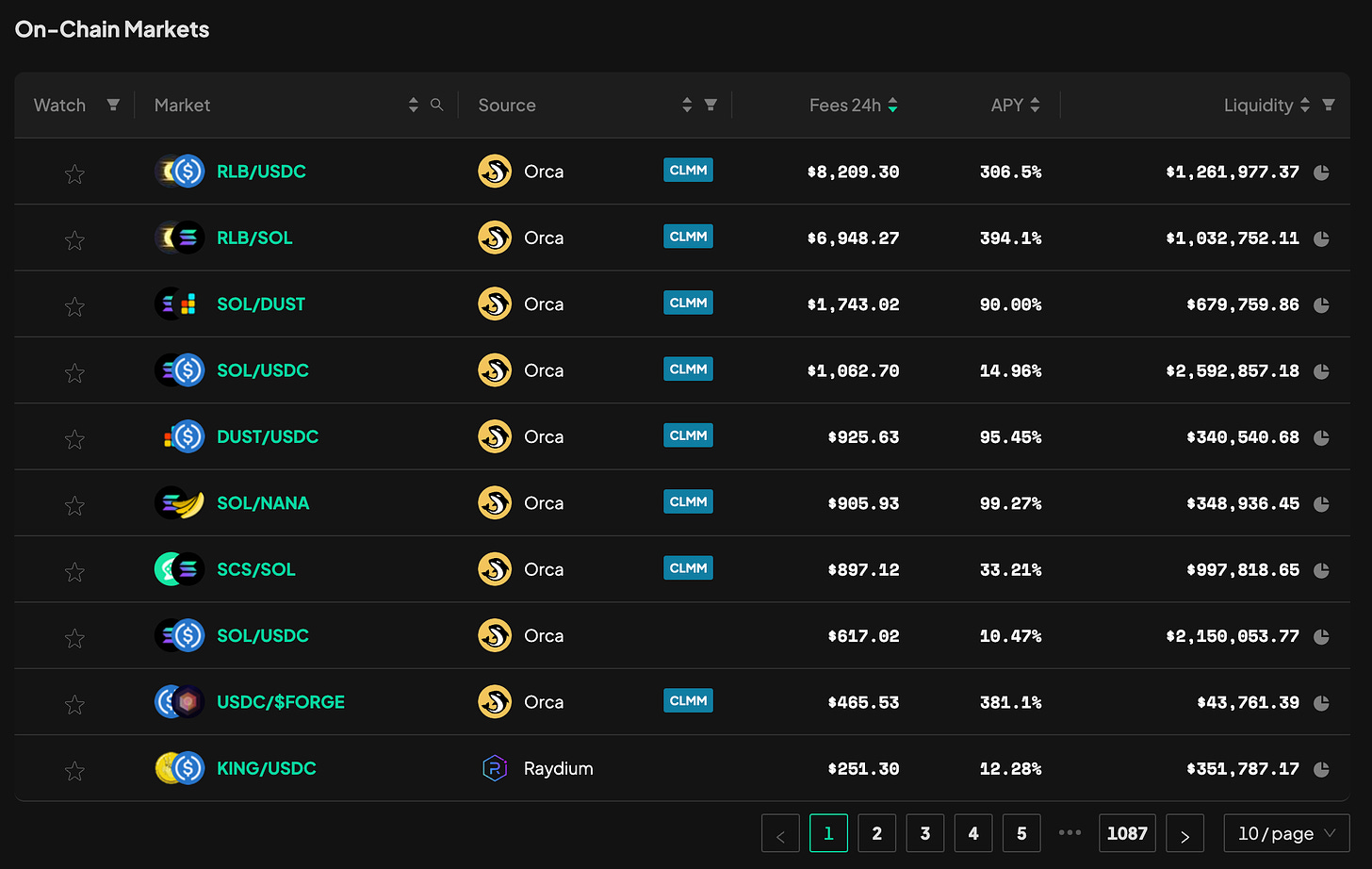

Step Analytics

Step Analytics is our analytics page. In ongoing development, we’re building on Step's extensive data integrations for Solana ecosystem specific data. With Step Analytics, users can have access to near real-time data on Solana tokens, their liquidity and price movements, as well as countless other DeFi data points.

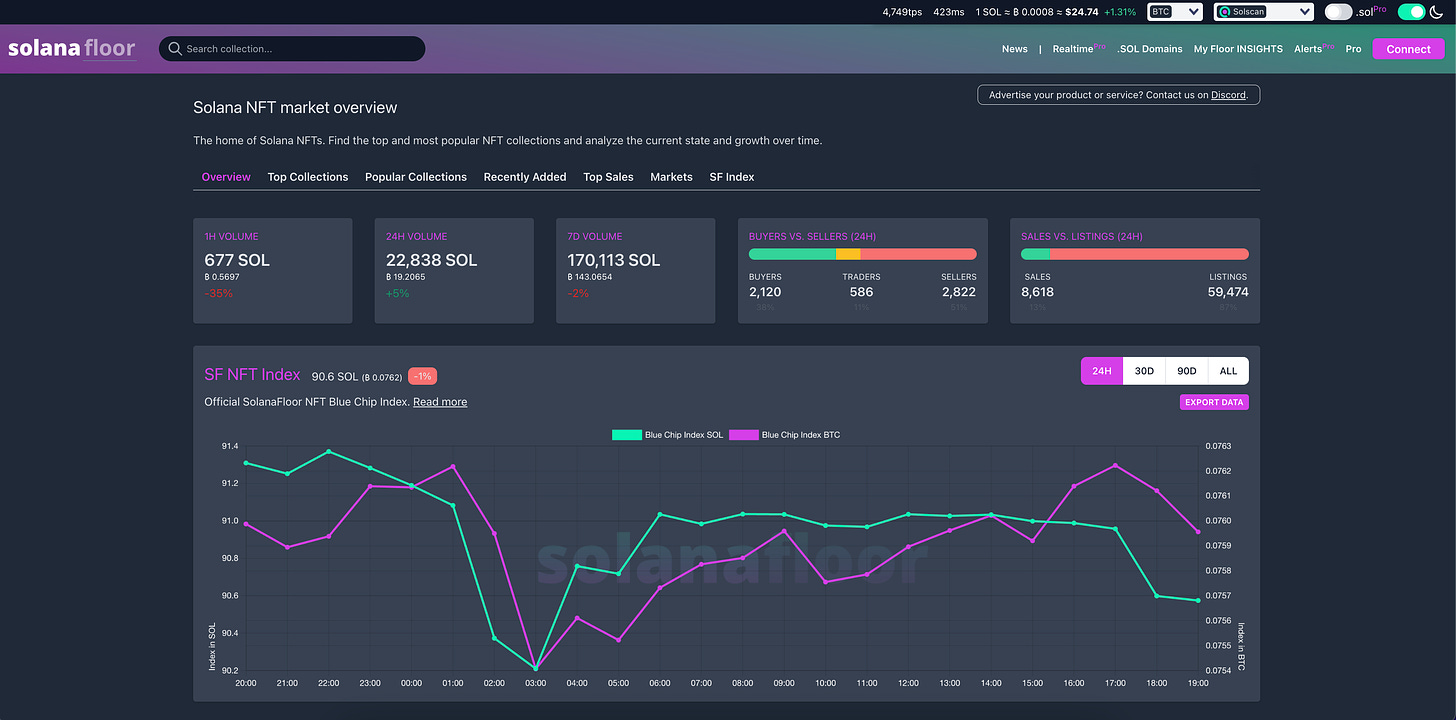

SolanaFloor

SolanaFloor is Step Finance’s NFT dashboard. SolanaFloor is the leading NFT analytics platform on Solana. All users have free access to real-time aggregated data on every Solana NFT Collection as well as broad market insights such as trading volume, biggest NFT sales, market trends and more. One of SF’s most unique features is the SF NFT Index. The SolanaFloor NFT Index consists of a carefully selected basket of Bluechip collections based on multiple weighted criteria: volume, social trends, age, and other statistics. This basket is reviewed monthly.

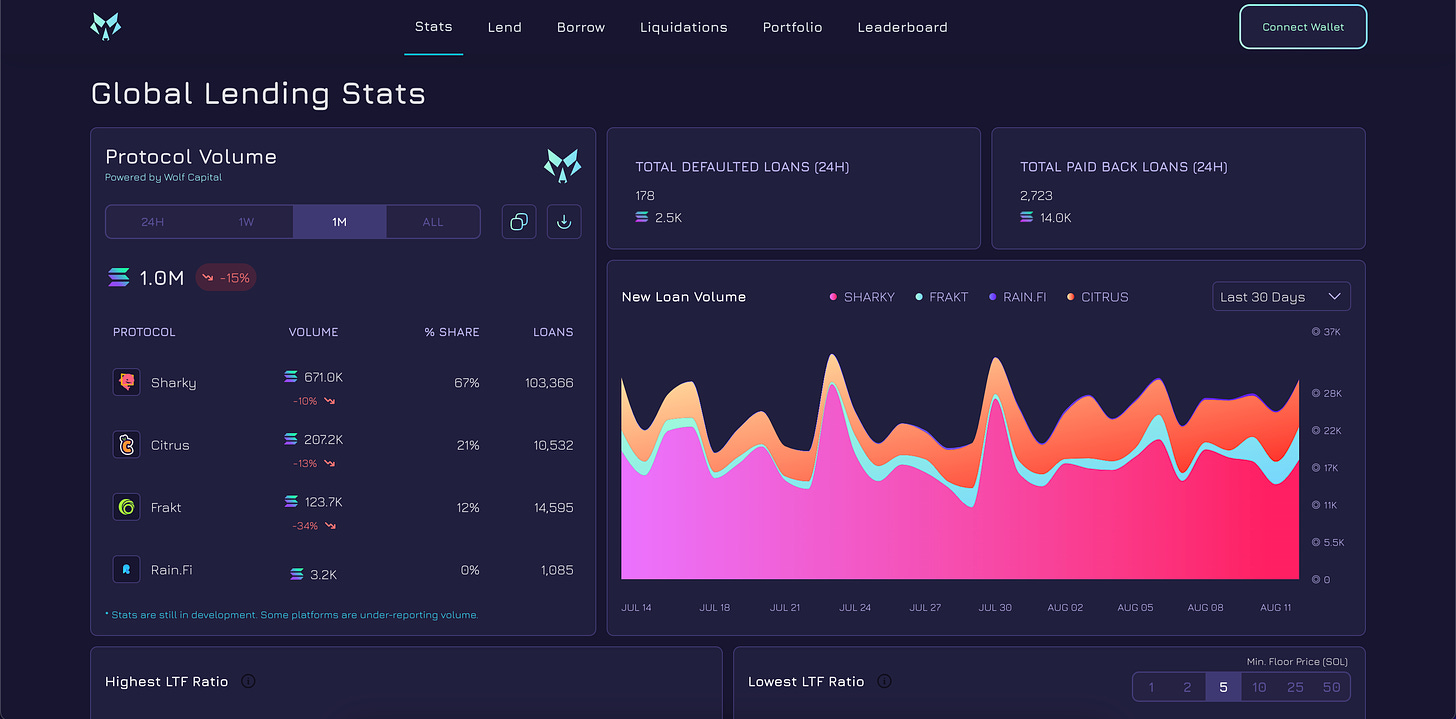

WolfCapital

NFT Lending is a growing narrative on Solana. Wolf Capital is an NFT Lending aggregator which allows users to see all the available lending opportunities on platforms such as Sharky, Citrus and Frakt. Some of the available features for users are the Loan-To-Floor Ratios and the Underwater Loans table.

Broad Ecosystem Data

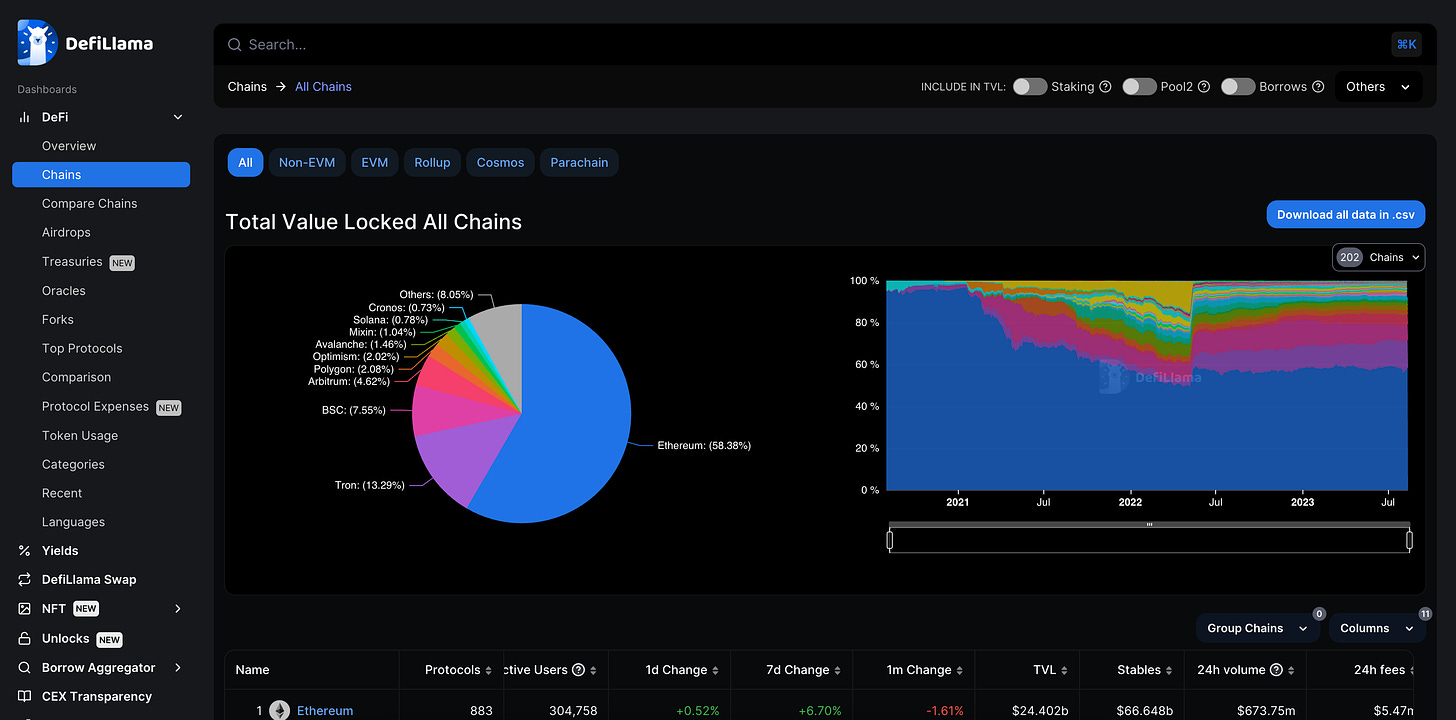

DeFiLlama

DeFiLlama provides information and data about DeFi protocols (TVL) whole crypto ecosystem, not just Solana. DeFiLlama tracks and displays this data in an easy-to-understand format, allowing users to monitor the growth and performance of various DeFi projects.

While Step Analytics is under development to be the best, broadest Solana ecosystem data provider, DeFiLlama is a good option for users looking to compare chains like Ethereum, Polygon, Avalanche, Fantom and more.

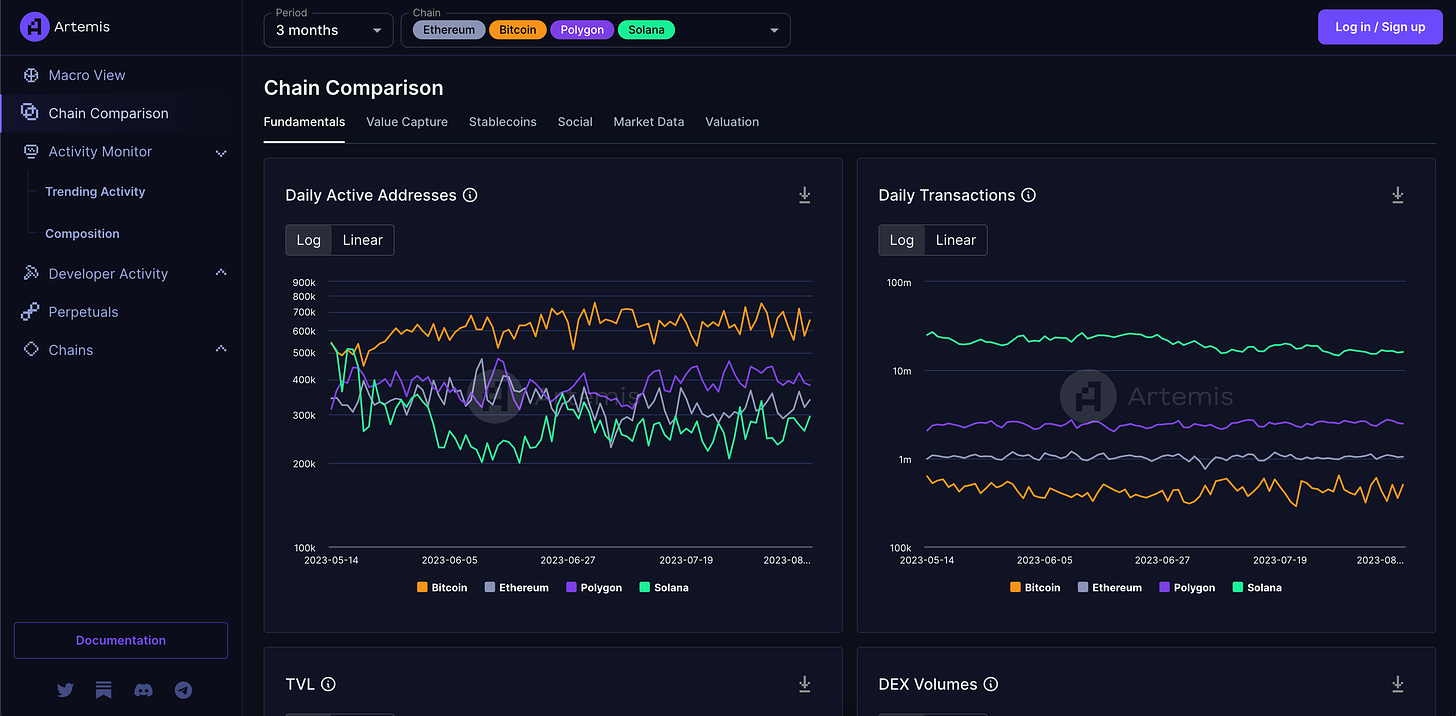

Artemis

Artemis is a blockchain comparison platform. Users can customize their charts with data on Daily Active Addresses, Daily Transactions, TVL, DEX Volume and much more.

Conclusion

Data is everywhere. Data is useful. Data may provide insights into the future of a project as it measures health, sentiment, status and quality. Hedge Funds, Investment Funds, Institutional Investors and small investors use data to support decision making. If you’re aiming to be a serious investor, you should consider using data as it may potentially increase your profits in the longterm.