Put your SOL to work: Complete Guide

Today, we will discuss four methods of earning yield from your SOL tokens.

At the time of writing, the Solana market cap is $8.04 billion with a 24-hour volume of $479 million. The price of SOL is $21.23 and market dominance is 0.79%. The Total Crypto Market Cap is $1.03T, down 3.89%. The NFT transaction volume surpassed 500,177 SOL, closing in on $10.6M in the last 7 days.

Summary

Introduction

Staking

Validator Staking

Step Validator

Liquid Staking

Marinade

Jito

NFT-Lending

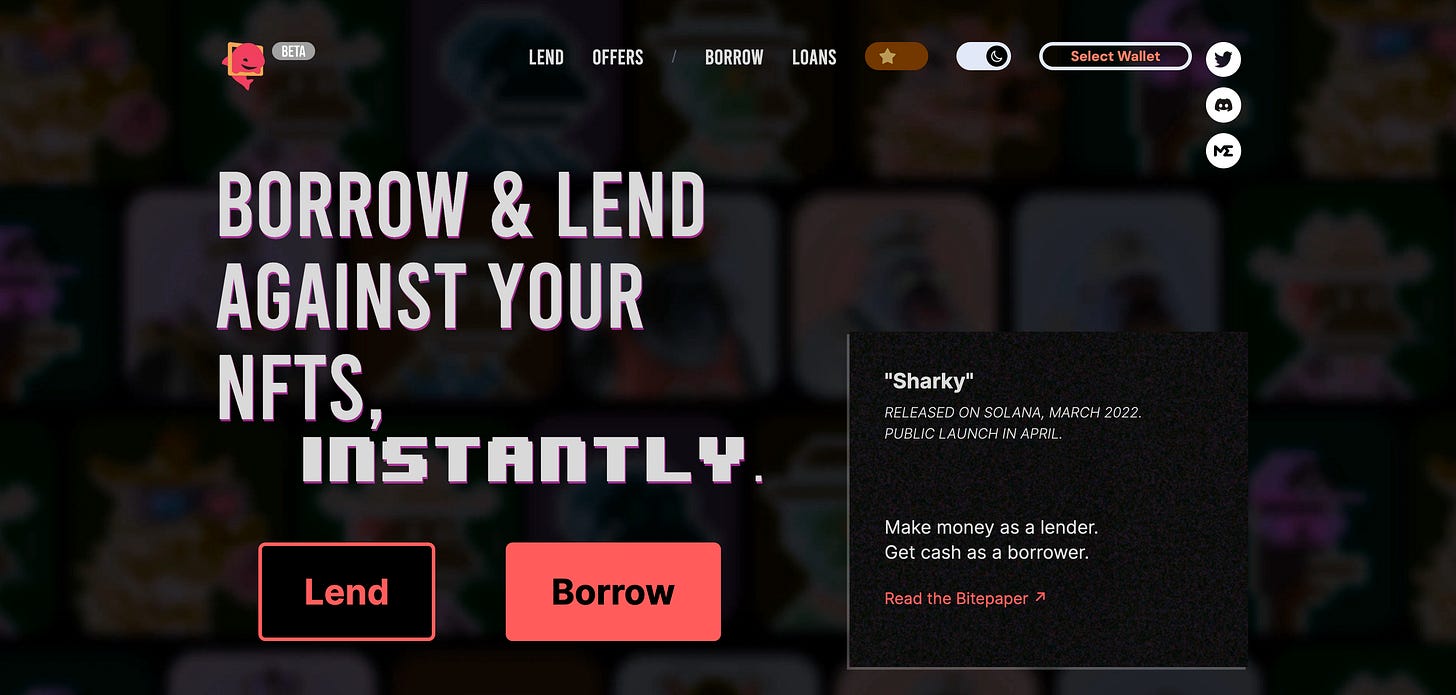

Sharky

FRAKT

Atadia

Famous Fox Federation

Yield Farming

Orca

AMMs

Hadeswap

Elixir

Conclusion

Introduction

Solana can process thousands of transactions per second, significantly faster than many other popular blockchains. This allows for fast and efficient processing of transactions, making it attractive for developers and users who want to avoid high gas fees associated with other blockchains.

Solana enables developers to build complex and sophisticated decentralised applications, which is why the network appears to be speed-running the rest of the industry both in the DeFi and the NFT sector, as we’ve seen with the NFT Marketplace wars around the zero royalty meta.

How NFT DeFi can Offset Solana’s Inflationary Mechanics

Solana, like many other cryptocurrencies, has an inflation rate. Solana's annual inflation rate is currently ~6.5% and will decrease by 15% every year. It will eventually stop at a fixed rate of 1.5%.

In 2022, the Solana token circulating supply increased by 20%. This is a result of token unlocks and staking rewards. Today we are going to show you six different ways in which you can put your Solana tokens to work.

Disclaimer: None of the following practices are financial advice. The purpose of this newsletter is to educate. Always do your own research.

Staking

Staking involves holding tokens in a wallet to help secure the network and validate transactions. In return, stakers receive rewards in the form of additional tokens.

As a user, you can stake your $SOL tokens in a validator node, to help secure the network, or in DeFi protocols.

🧱 Staking on a Solana Validator

Solana is a delegated proof-of-stake network, meaning you can stake your SOL tokens, or ‘delegate’ them to validators who are responsible for processing transactions, running the network and keeping it secure. For doing this, validators earn rewards in a similar fashion to how one might understand Bitcoin mining.

👉 Stake SOL with STEP: https://www.step.finance/learn/validators-staking-with-step

Liquid Staking

Liquid Staking allows users to earn rewards for staking their tokens while still being able to use those assets for other purposes. This provides stakers with greater liquidity and flexibility, as they can participate in other DeFi activities using their staked assets as collateral.

Marinade Finance

Marinade Finance is a protocol that enables users to stake their SOL using automated strategies and receive staked SOL tokens (mSOL) in return. mSol can be used in other DeFi applications.

Marinade currently holds the majority of TVL on Solana, according to DeFiLlama, with a ~55% Market Dominance.

6.28% APY

20,800 Monthly Rewards

$140M TVL

Jito

Jito is the only liquid staking service for Solana that offers holders the distribution of MEV (Maximal Extractable Value) rewards. MEV is the max reward value that validators can receive while adding blocks to a network. By using the Jito Stake Pool, users can stake their Solana tokens and receive a liquid stake pool token (JitoSOL) in return. This token provides both liquidity and a combination of staking and MEV rewards.

6.16% APY

502,727 SOL of Total TVL

NFT-Lending

Solana DeFi platforms allow users to lend their tokens to borrowers who require them for various purposes.

Lenders earn interest on their loans, while borrowers gain access to cryptocurrency without having to buy it themselves. In 2022, Solana saw the birth of a new narrative merging NFT with DeFi. NFT DeFi added several new use cases to the ecosystem and created new ways of generating yield with $SOL, such as NFT-collateralised loans.

Sharky

Sharky is the biggest NFT DeFi platform on Solana, with over 3.5 million SOL in Total Loan Volume.

FRAKT

Although FRAKT has a lower APY %, many people would argue it is theoretically safer due to its liquidation mechanism.

Liquidated NFTs which haven’t been repaid during their 12H Grace Period will automatically become eligible for the liquidation raffles in which Frakts stakers and Gnomies holders can participate.

Atadia

Atadia has developed the ability to offer instant, zero-collateral loans without the need for KYC. They use a machine learning credit scoring model trained on $300,000 worth of zero-collateral loans from Lending Lab to guide their underwriting criteria. Currently, their default rate on a volume basis is around 3-4%.

Note: Currently, Atadia’s Lending Lab only allows borrowing.

Citrus (FFF)

Famous Fox Federation recently launched its own peer-to-peer Lending platform. Citrus lending mechanics are similar to Sharky, however, loan duration time and APY % are generally smaller.

Be Careful

Recently, there was a liquidation cascade event which caused a major downtrend in several NFT collections. Be aware of the risks of NFT-Lending platforms. If the collateral suffers a major price drop and the borrower does not pay back, you will have lost money on your loans.

Yield Farming

Yield farming allows users to earn rewards or interest by providing liquidity to decentralised protocols through staking, lending or providing liquidity.

Although yield farming can be an extra source of income, it also carries significant risks, such as price volatility, smart contract vulnerabilities and liquidity risks.

Orca

Being the largest DEX on Solana, Orca requires a large amount of liquidity. This is obtained through pools.

While browsing the Liquidity tab, users can choose to provide liquidity to a diversified amount of trading pairs.

AMMs

Automated market makers (AMMs) are a type of algorithm that facilitates trading on decentralized exchanges (DEXs). They are designed to provide liquidity to the market by continuously buying and selling assets based on pre-determined rules.

Hadeswap

Hadeswap has several features, including 0% platform fees (subject to governance decisions using the $HADES token), 0% royalty fees by default (with an option to pay them), and progressive selling/buying of NFTs. Additionally, users can earn SOL while using the platform.

Elixir

Elixir is an ecosystem focused on NFT utility that includes an app powered by automated market maker (AMM) pools. The app offers various features, including instant selling, NFT exchanging, borrowing, earning passive income, and long/shorting. These features enable users to participate in NFT financialization and generate returns through various means. The Elixir ecosystem includes other core products in addition to the app.

Conclusion

In conclusion, there are many ways to put your SOL to work beyond just buying and holding them. From trading and staking to lending and yield farming, the opportunities are plentiful.

Recommend you don't use staking websites to source your yields (or any self-sourcing tbh). Methodologies vary widely so they are not apples-to-apples. Would recommend a site like Solana Compass for staking tokens: https://solanacompass.com/stake-pools

It produces very different results: mSOL: 6.391% | JitoSOL: 7.461% | Lido: 5.845%

Other third party sites will show a similar gap. This uses the same methodology so you can trust the relative difference.