Summary

Introduction

TVL Growth

DEX Volume

Daily Active Addresses

Liquid Staking

Points Farming

marginfi

Cypher Protocol

Conclusion

Introduction

Solana Summer 2023 may have already started. Data points to an overall increase in metrics such as TVL and DEX Volume. Several DeFi projects have started to release updates and strategic announcements, to take advantage of the boost in sentiment around their ecosystem. We often hear about Airdrop farming on other chains such as Ethereum or its L2s, but it seems like Solana now has similar opportunities around.

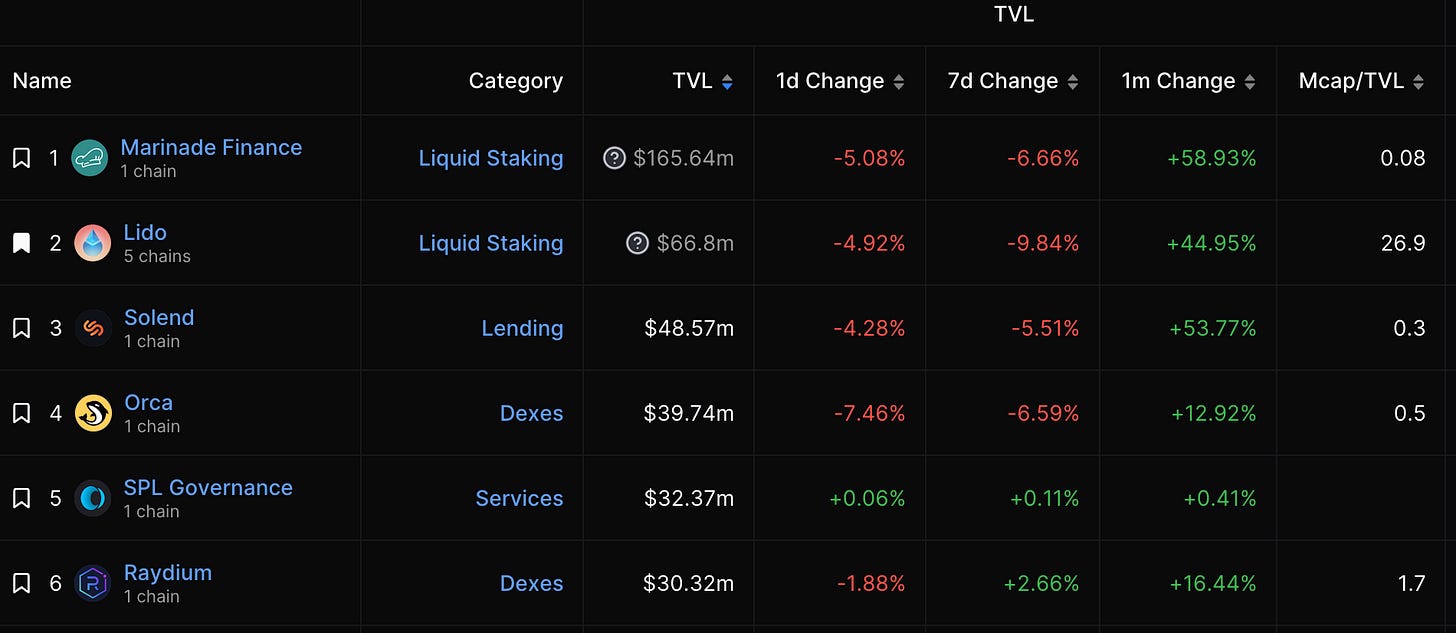

TVL Growth

The Solana DeFi ecosystem is expanding with the growth of projects like Marinade and mrgnfi which have consistently been developing incentives for DeFi adoption, as we will cover below. TVL is currently at its highest level so far in 2023, and data shows that the trend may continue for the foreseeable future.

DEX Volume

Year-over-Year, volume on decentralised exchanges is four times higher in the first six months of the year when compared with the same period of 2022. The sharp increase is explained by the investment and development of DEXs and Perpetual Trading DEXs like Drift Protocol, Jupiter Aggregator and Zeta Markets, among many others.

July has seen a sharp increase in trading volume on exchanges, sparked by a positive shift in sentiment around the Solana ecosystem.

DAILY ACTIVE ADDRESSES

Solana has shown resilience over the first six months of 2023, averaging 300K daily active addresses. Solana is on par with Ethereum and Polygon’s active addresses and slightly below Bitcoin’s average numbers. It is important to note that the FTX crash happened at the end of 2022, and data suggests that the Solana user base did not decrease.

The stability in daily active addresses suggests that the Solana network and its user base are resilient.

Liquid Staking

On Ethereum, the Liquid Staking market is big and has found its key players. Marinade Finance is the key liquid staking player on Solana, with its non-custodial liquid staking protocol, allowing users to stake their SOL tokens using automated staking strategies and receive “marinated SOL” tokens (mSOL). Users can then use the mSOL tokens to participate in several decentralized finance activities.

Marinade has a $165M TVL, making it the biggest DeFi app on Solana, with roughly 50% market share. Its token mSOL has 74,395 holders and a $162M market capitalization.

Points Farming

July has seen a broad increase in interest in the Solana DeFi ecosystem. The NFT ecosystem volume decreased by 50% in the last 30 days, while DEX Volume is more than 2x from June.

Much of the excitement around the Solana DeFi ecosystem comes from the speculation around airdrops. The ecosystem seems to be excited around airdrops from projects such as Jupiter, Drift, Zeta Markets and more. None of them is confirmed, however, Cypher Protocol and Marginfi have taken the spotlight with the launch of their Points systems, which may give the idea that an airdrop will happen sometime in the future. Let’s take a look at how users can earn these points.

marginfi

Users can earn points on mrgnlend through three lending and borrowing assets, as well as referring new users.

Lending Points

For users who currently have deposits on marginfi, points are automatically earned in the background. Each dollar lent yields 1 point per day, meaning the more assets loaned, the more points accumulated. Furthermore, the duration of a user’s lending activity plays a role in boosting the points earning rate.

The users with the largest deposits for the longest time currently hold the highest points, and this trend will persist unless someone surpasses their deposit amounts.

Borrowing Points

Borrows play a pivotal role in the success of a lending protocol, contributing to the growth of the overall DeFi ecosystem. Consequently, borrowers receive more points than lenders. For every $1 borrowed, 4 points are earned daily.

Referral Bonuses

Apart from lending and borrowing, users can also earn points through referrals. When a user refers a new participant to the platform, they receive 10% of the referred user's earned points.

Referring users enjoy an additional 10% of the 10% earned by any user they refer, who, in turn, refers others, and it goes on as the network expands.

The mrgnlend points system is designed to foster engagement, community growth, and user-friendly interactions within the DeFi landscape. Whether you're lending, borrowing, or referring, there are ample opportunities to earn points and be a vital part of the thriving mrgnlend ecosystem.

marginfi is one of the fastest growing DeFi protocols on Solana not only due to the points system but to its easy-to-use platform and marketing team behind their social media pages.

Currently, marginfi has a global TVL of ~$18M, with almost $5M borrowed from its users.

Cypher Protocol

Cypher Protocol is a trading engine developed on the Solana blockchain. This protocol brings forth two essential market types: margined spot markets, employing Openbook's order books, and derivatives markets, enabled by the asset agnostic order book (AOB). By leveraging the AOB, Cypher optimizes pricing discovery and protocol efficiency.

Cypher's Responsibility Points

Cypher's Responsibility Points is a rewards system designed to encourage active participation and contributions to the Cypher protocol. Users can earn these points through two types of protocol usage: Trading and Borrowing/Lending.

Trading

Trading is a central offering on Cypher and is heavily incentivized. The platform's native liquidity on perpetual (perp) markets makes trading there the fastest way to accumulate points. Cypher's spot markets, which share liquidity with OpenBook, also provide opportunities to earn points but at a comparatively lower rate than perp markets.

Points for Trading on Perp Markets

Maker Volume: 20 points per dollar

Taker Volume: 15 points per dollar

Points for Trading on Spot Markets:

Maker Volume: 10 points per dollar

Borrowing/Lending

Borrowing and lending are vital mechanics on any trading platform, and Cypher rewards users for engaging in these activities. When using margin or leverage to open a trade, users participate in Cypher's borrowing and lending pools. Borrowing is incentivized at a rate five times higher than lending.

Points for Borrowing:

5 points per dollar per 24-hour period

Points for Lending:

1 point per dollar per 24-hour period

One can speculate that if/when Cypher Protocol releases a token, the points will play a major role in who receives an airdrop, as well as the size of the airdrop.

Conclusion

Data points to a steady increase in interest in the Solana DeFi ecosystem. Several protocols are driving growth, such as Orca, Marinade Finance, Drift Protocol, marginfi and Cypher Protocol. So far, two protocols are incentivizing adoption through a points system. Although farming points do not guarantee an airdrop, it does increase your chances of getting an airdrop, if/when there’s one.

Nice read, let's start farming and hoping 😄