Solana Q3 Report is here - Read NOW.

Our Solana Q3 Report has finally been released - here it is.

KEY INSIGHTS

Solana has improved resiliency, reliability and security.

Solana TVL is at yearly highs, showing consistent growth sparked by a shift in sentiment and the rise of DeFi protocols launching liquidity incentives.

On-Chain activity remains strong, relative to the overall crypto markets.

Solana is the largest network by number of active developers.

Visa, Shopify and MakerDAO are among the many entities developing and integrating with Solana.

🚨FULL REPORT 👉 SOLANA Q3 REPORT

INTRODUCTION

Solana is a decentralized, open-source blockchain that aims to provide fast, secure, and scalable infrastructure for decentralized applications (dApps) and smart contracts. It was created in 2017 by Solana Labs, a San Francisco-based company co-founded by Anatoly Yakovenko.

In addition to its high transaction throughput, Solana boasts several other notable features, including low transaction fees, fast block confirmation times, and support for a wide range of programming languages.

In this report, we will provide an overview of Solana’s main events, technological innovations, and use cases of the third quarter. We will also discuss the current state of the Solana ecosystem, including its adoption and growth. Finally, we look into 2023 and highlight some of the most exciting narratives and projects.

Although it has been a tough year for Solana, data supports the assumption that the ecosystem has matured enough for it to be somewhat impermeable to black swan events, given that the core user and developer base has not abandoned the ecosystem, having instead doubled down on the chain.

TOKEN PRICE

The SOL token price experienced volatility in Q3, with a significant correction of 30% in June, sparked by the Securities and Exchanges Commission's (SEC) move to sue Binance and Coinbase, which stated that Solana and several other tokens were securities. The recovery was fast, ending with a strong touch of pre-FTX levels. In Q3, the SOL token price reached a low of ~$12.50 and a high of $32.00. As with the entirety of the crypto market, August was a period of cooldown and apparent apathy, as trading volumes dropped sharply.

Another factor that contributed to the volatility of the crypto markets and the SOL price was Blackrock Bitcoin ETF filling. The Blackrock news sparked a wave of ETF fillings from other hedge funds and companies, further igniting the Bitcoin and Altcoin rally.

At the time of writing, Solana is in a strong uptrend with a rally of over 30% in the last weeks.

MARKET CAPITALIZATION

The market capitalization of the Solana blockchain has increased from under $8B to ~$10B in the third quarter, outperforming all other majors and most altcoins in the top 100.

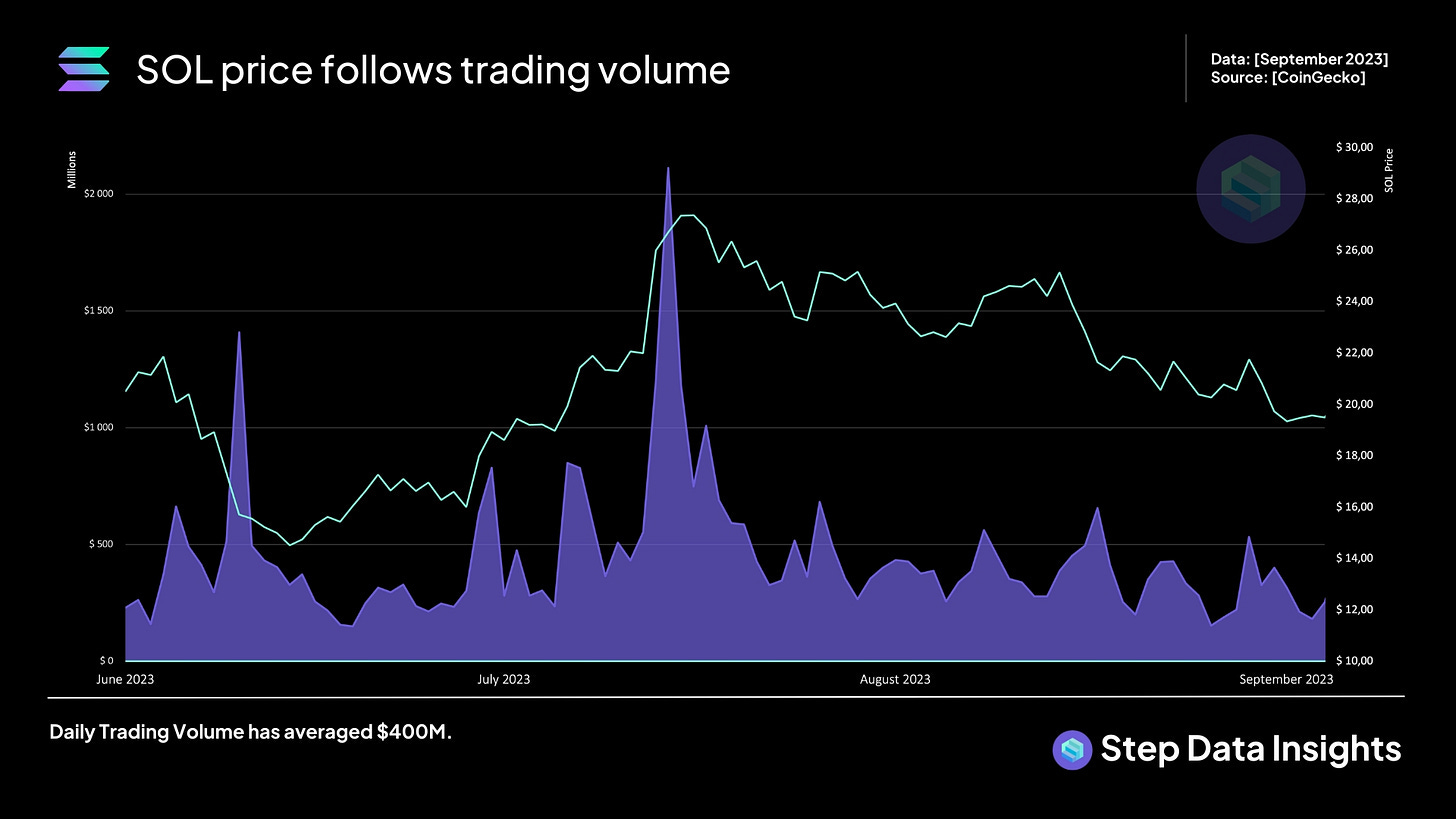

TRADING VOLUME

Trading volume is a relevant metric for assessing market liquidity, price discovery, efficiency, and risk management.

Solana's daily trading volume has averaged $400M, with outliers such as the Securities and Exchanges Commission (SEC) suit against Coinbase and Binance in early June. Trading volume hit a quarterly high of $2.1B in July, on the day that SOL’s price touched pre-FTX levels for the first time ever since the November crash.

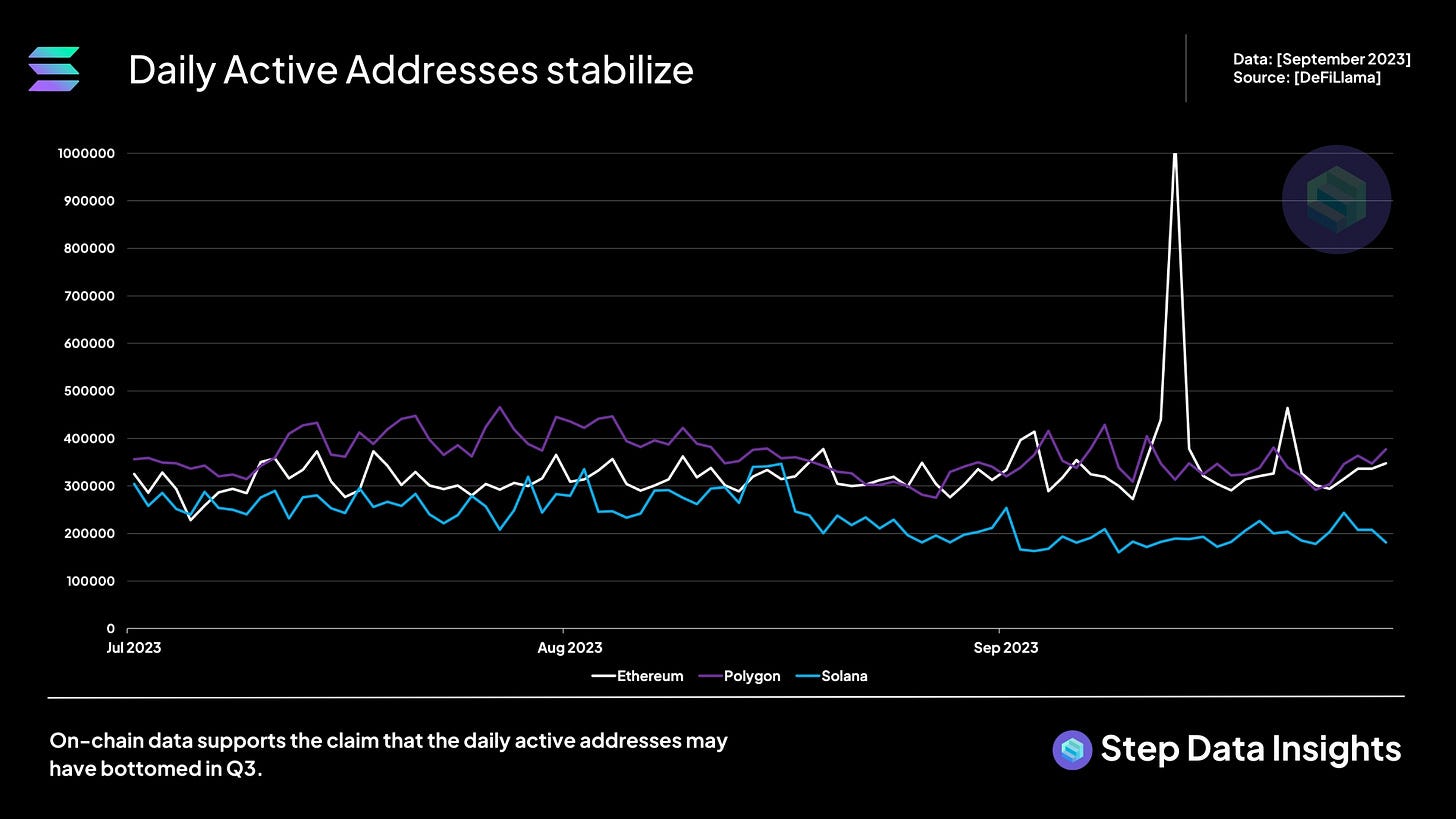

DAILY ACTIVE ADDRESSES

The Solana Daily Active Addresses chart shows the daily number of unique addresses that were active on the network as a sender or receiver. Solana's daily active addresses have been, on average, hovering at the 250k mark. Since the price of SOL reached $32, daily active addresses have been trending down from the local high of 350K to an average of 200K, at the time of writing.

Although active addresses have recently been trending down, Solana is in close competition with other blockchains such as Ethereum and Polygon. This stability in daily active addresses suggests that the Solana network and its user base are resilient.

FEE PAYERS

As each transaction (which contains one or more instructions) is sent through the network, it gets processed by the current leader validation client. Once confirmed as a global state transaction, this transaction fee is paid to the network to help support the economic design of the Solana blockchain. Solana has averaged 100 thousand daily fee payers in Q3.

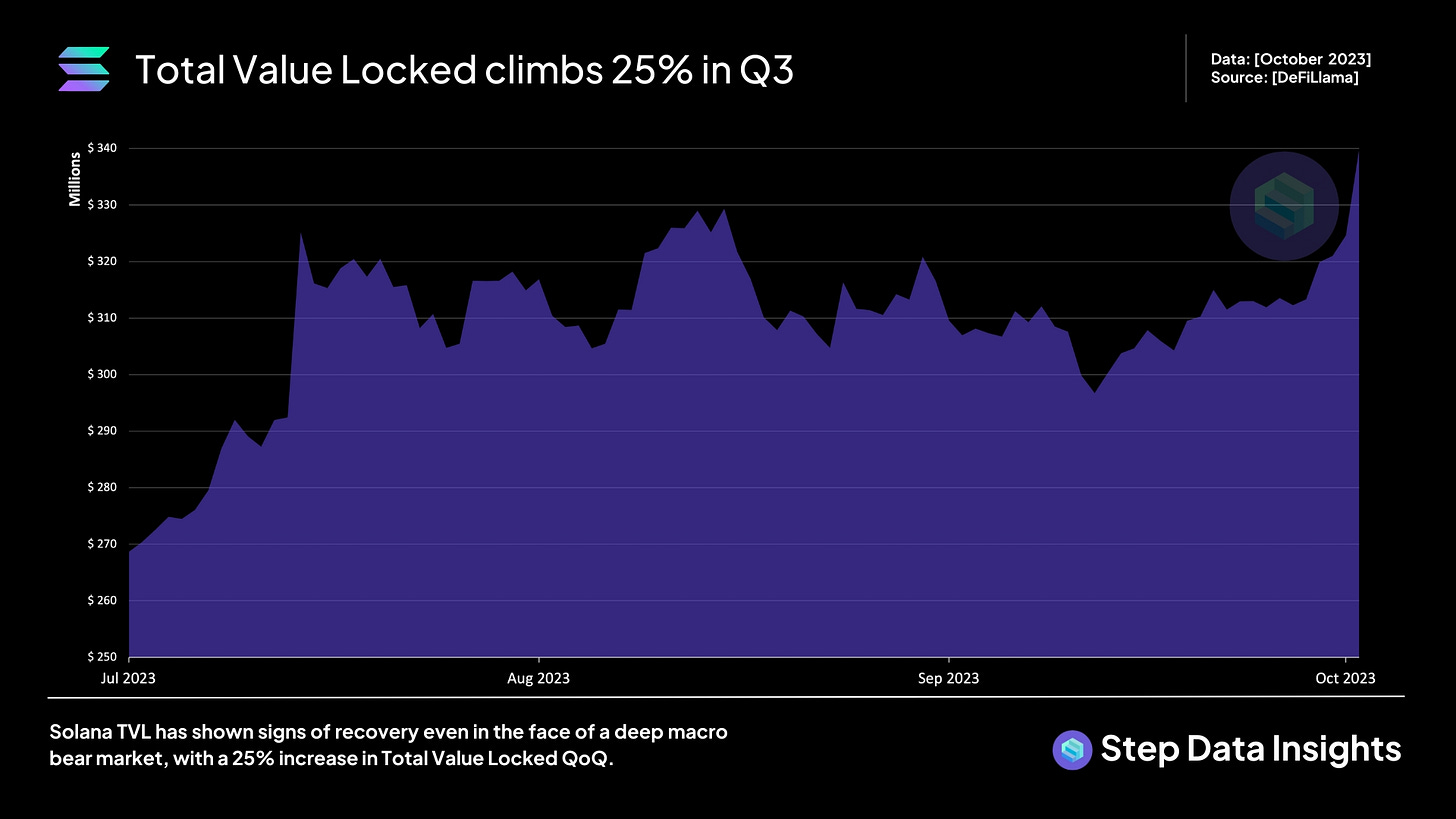

TOTAL VALUE LOCKED (TVL)

After the initial shock caused by the SEC claims of SOL being a security, TVL climbed 31% to yearly highs. Solana Total Value Locked has hit a yearly high of $328M in August. Although the SOL price went up to yearly highs and dropped 35%, TVL did not slow down or decrease and instead has reached the highest number since the FTX crash, of ~$430M. A major reason for this is due to the positive change in sentiment among crypto investors, in addition to the rise of new DeFi protocols in the ecosystem such as marginfi and SolBlaze experiencing rapid growth in Q3.