Introduction

TVL Summary

Why is Solana TVL growing?

Positive Shift in Sentiment

Marinade Finance and Liquid Staking

marginfi

Is TVL a good measure?

More TVL, more opportunities

Adoption and Stability

Incentives and Growth

Conclusion

Introduction

Determining the health of a blockchain is a complex task that requires an analysis of multiple variables. It's not enough to rely on a single factor with a negative or positive outcome to draw conclusions about the blockchain's performance. To get a clear picture of what's happening in the ecosystem, it's necessary to study a vast amount of data and variables. So, which measures are the most important? Only a thorough examination of the data can answer this question.

Today we will talk about Total Value Locked and what it means for an ecosystem.

TVL Summary

TVL refers to the total amount of assets (usually in the form of cryptocurrency tokens) that are currently locked or deposited within a specific DeFi protocol or platform.

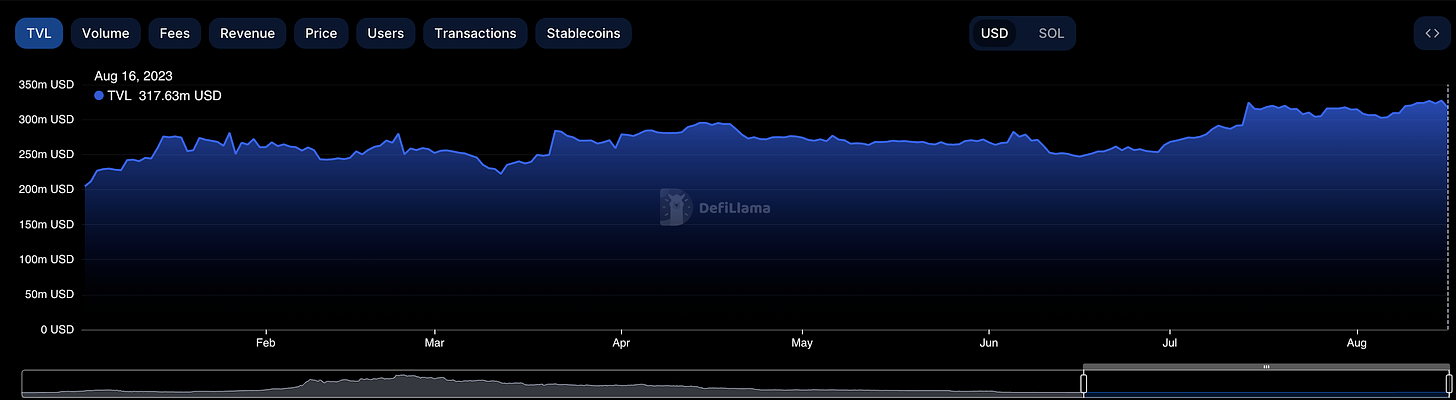

Year-to-Date, the Solana TVL is up over 50%. From the low of $200M to a current value of $315M, it is fair to point out how resilient the ecosystem is, considering what was arguably the most challenging period Solana has been through since its infancy.

Why is Solana TVL growing?

The growth of TVL is explained by the appearance of several DEXes and other DeFi protocols, as well as the continuous development of existing ones. Here are three of the many catalysts for this growth.

Positive Shift in Sentiment

Solana’s resilience has not been unnoticed. Many prominent traders, investors and X (Formerly Twitter) personalities who were once Ethereum maxis have recently shifted their opinion around Solana’s investment thesis. The Solana ecosystem token $SOL reflected the shift in sentiment, with a 100% rise in 2 weeks, providing further evidence that the ecosystem is viewing Solana from a different perspective.

Marinade Finance and Liquid Staking

Marinade Finance is the biggest Solana DeFi Protocol by TVL. Marinade has recently been gaining traction with its push for Liquid Staking, where users can stake SOL in exchange for mSOL tokens that accrue value over time, while still being tradable and usable in several DeFi protocols such as Orca. Industry specialists and players in the crypto ecosystem consider Liquid Staking a strong narrative for driving growth as crypto approaches the early stages of a bull market.

marginfi

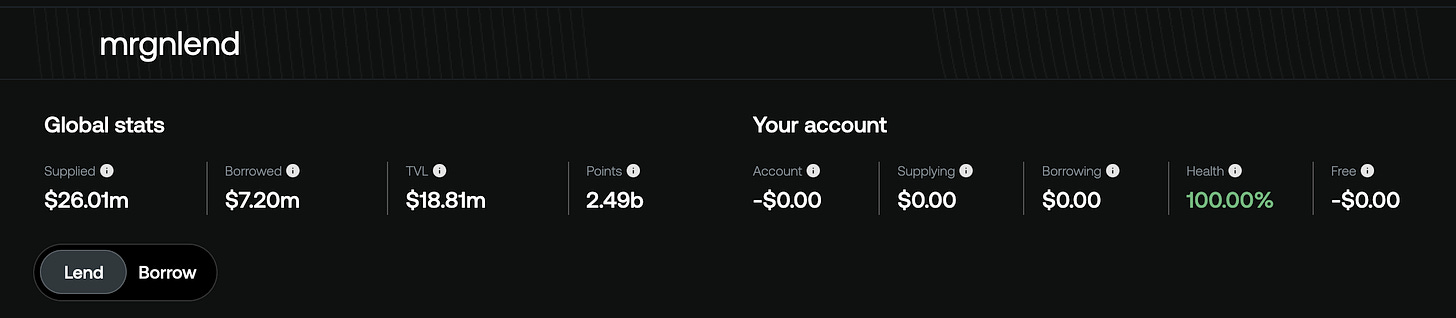

The fastest-growing protocol on Solana is marginfi. With a product-focused, user-centric approach, marginfi has managed to grow its TVL to $20M in recent times due to its Points incentive. We’ve covered marginfi in a previous newsletter here.

Is TVL a good measure?

Is Total ValueLocked a good measure? Yes. Should a blockchain be judged entirely on how low/high its TVL is? Definitely not. For instance, Solana has significantly less TVL than Ethereum, however, it has as many or more daily active addresses. Many variables contribute to determining the health of a blockchain, and any investor needs to consider as many as possible.

Although low TVL does not necessarily mean that a blockchain is bad or exhibiting low activity and growth, a growing TVL has benefits and is a sign of a thriving ecosystem.

More TVL, more opportunities

Adoption and Stability

A higher Total Value Locked generally indicates a greater pool of assets available for lending, borrowing, trading, and other financial activities within a DeFi platform. This increased liquidity can lead to higher trading volumes, tighter bid-ask spreads and reduced price slippage making it more attractive for traders and users. The risk of sudden liquidity shortages or market manipulation becomes relatively lower, resulting in increased stability.

When TVL rises, it may be a result of the growing adoption of ecosystem protocols like DEXes or other DeFi platforms. For instance, Solana TVL is at yearly highs while DEX Volume is growing at a steady pace, indicating that Solana users are increasingly more confident in the existing protocols.

Incentives and Growth

DeFi platforms often offer incentives and rewards to attract users. A higher TVL allows platforms to distribute more rewards and benefits, such as governance tokens, airdrops, and other incentives, which can further stimulate user participation.

Higher TVL can translate into a more engaged and active community around a particular DeFi protocol and the rest of the ecosystem. This community engagement is essential for decentralized governance processes, as more participants can lead to more diverse perspectives and decisions that better represent the interests of the platform's users.

Conclusion

The Solana ecosystem is resilient. Although several DeFi Protocols shut down due to the FTX collapse, the existing teams continued to build and develop better protocols as well as better tokenomics. When looking at data such as Daily Active Addresses, DEX Volume and TVL, it is fair to say that the Solana community is one of the most battle-tested in crypto. Although the Solana TVL is still far from its all-time highs, data supports that the lows are behind us and growth will soon accelerate.

Lots of words I don’t get, but I think I can either find Nemo, or not ;/ so, thank you David Taylor. Goodbye David Taylor. 🖖