Step Data Insights #5 (WK 31)

The "Big Five" Solana NFT Projects

Introduction

In this week's volume of the Step Finance newsletter, we will be evaluating the latest NFT trends in the Solana ecosystem. All analysis for this newsletter will be created using SolanaFloor. If you didn’t hear, we recently acquired SolanaFloor, with the NFT analytics platform now a part of the Step Finance ecosystem.

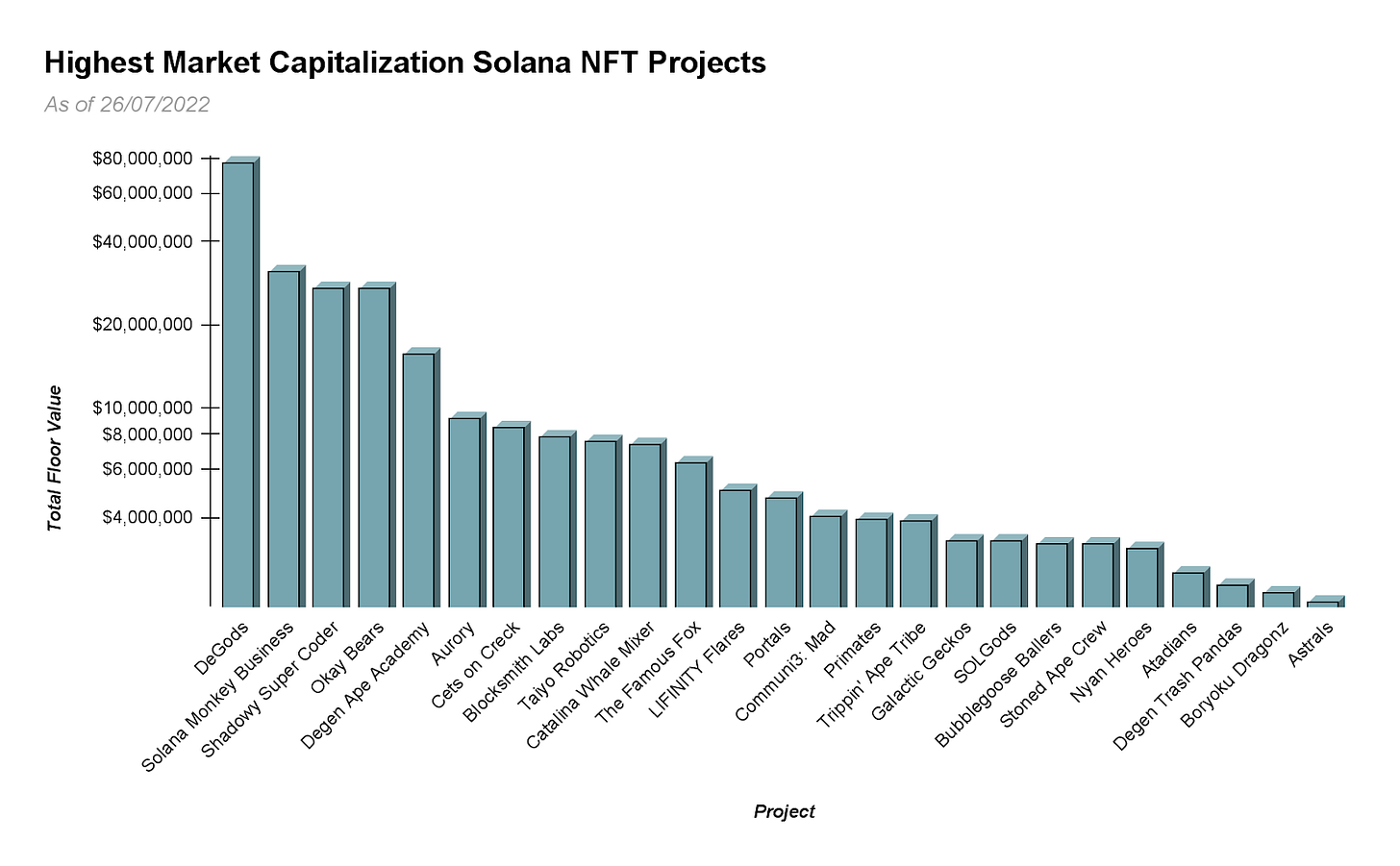

At time of writing, there are 25 Solana NFT projects with a market capitalization over $2m USD. Within this 25 are the Solana ‘big five’, the five largest Solana NFT projects, all valued over $15m USD.

This week's newsletter will be evaluating trends across the big five, conducting volume, price, and whale analysis.

Price Trends

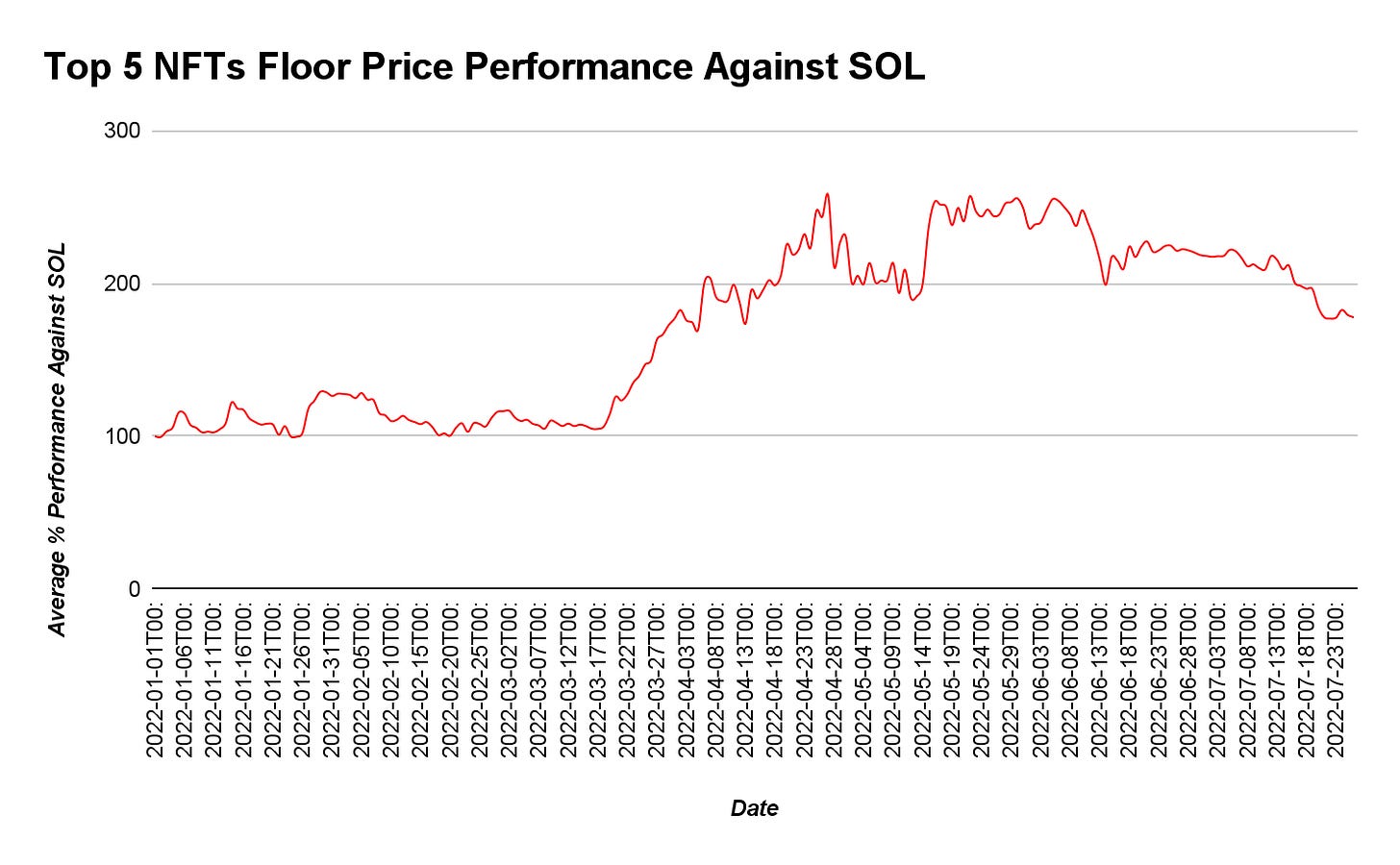

Since the start of February 2022, the big five have held their value better than perhaps anticipated. As we can see in the image below, the majority of projects are at a similar SOL price now as at the start of February 2022.

In this chart, the noticeable outlier is DeGods. The rise of DeGods has been astronomical, with the floor price of DeGods increasing +4,897% in only 178 days, equating to an average daily gain of +27.51%. This is despite the overarching bear market which has gripped the cryptocurrency ecosystem. When evaluating the average performance of the big five, we can see that the average performance of these projects is exceptional when compared against SOL. Since February, the average performance of these projects has led to them gaining +77.83%. This makes them some of the top performing assets within the cryptocurrency ecosystem during this period.

Sceptics of the chart above may point to DeGods and exclaim that this chart is only bullish due to the performance of this project. However, when evaluating the starting floor price of each project in February 2022 to present, we can see that all except from Shadowy Super Coder (down only −5.7%) have seen an increase in floor price.

From analyzing the price trends of the big five, it can be derived that Solana bluechip NFT projects have not only remained bullish during this period, although could be deemed as an alternative store of value.

Volume Analysis

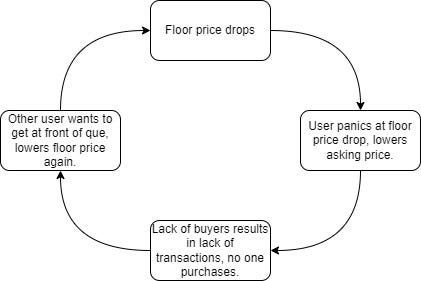

One of the primary concerns with holding NFTs is the sudden lack of demand, which can cause floor prices to drop in dramatic fashion. This occurs due to a lack of buyers and sellers, with sellers desperately lowering their purchase price in an attempt to recoup value. This does occur with standard cryptocurrencies, although liquidity is typically much lower with NFTs, resulting in the issue we see below.

However, during the recent minor big five downturn, these Solana NFT projects have seen a steady number of transactions. The average number of transactions per day since late June has been 8.78 transactions. During this period, we have only seen below an average of five transactions per day three times.

Furthermore, during this period the average SOL transferred daily has fallen below 500 SOL only once (466.33 SOL, valued at $20,052 USD). We can derive from this that significant value is being transferred on a daily basis, displaying continued confidence in the Solana bluechip NFT market, despite the overall negative trajectory of the cryptocurrency market.

In terms of the volume make up, we can see that the majority of volume is occurring from Okay Bears (55.79% average).

After Okay Bears, Degen Ape Academy follows at 14.61%, DeGods (12.1%), Shadowy Super Coders (10.2%), with Solana Monkey Business (7.38%) the lowest by average volume. Figure 9 below represents the shifts in volume across the NFT market.

Volume analysis further displays significant health within the big five NFT projects analysed. Okay Bears has displayed the most volume, while promisingly all projects have shown signs of life, with little to no stagnation. However, what is not clear is where interest in these projects is coming from. If whales hold the majority of NFTs, then this could display potential manipulation, washing volume, presenting an issue with data uncovered.

Whale Wallet Analysis

When evaluating current whale wallet holdings, we can derive that a healthy percentage of NFTs are held outside of the top 20 owners. The exception to this is Shadowy Super Coders with only 65.20% being held outside the top 20 owners. However, with 97.27% of Shadowy Super Coders NFTs being ‘staked’, the 34.80% of NFTs owned by the top 20 wallets is from the 2.73% of NFTs remaining on the open market.

From this data, we can determine that on average 82.90% of NFTs from the big five are owned by wallets outside of the top 20 owners. This displays a healthy retail market for the bluechip Solana NFT space. Furthermore, it shows that the likelihood of price and volume manipulation is low, while it also presents potential DAOs of these projects in a favourable light as community representative voting is more likely.

Conclusion

In conclusion we can determine that the bluechip Solana NFT market is currently in a great place, despite issues seen within the cryptocurrency space as a whole. This is bullish for Solana as when coupled with DeFi positivity displayed in our previous newsletter, we can determine that the retail investors onboarded to the Solana ecosystem in 2021 have stuck around, despite the bear market currently gripping the crypto space. This displays confidence in Solana, and shows promise in maintaining adopters during periods of economic downturn.

Author: @page_analyst

Shouldn't Star Atlas be listed as a Solana NFT project? The StepFinance Twitter account posted about integration with them just yesterday. Using the market cap of either of their tokens would put them in the top 5 on that list in marketcap and probably transactions. It makes me wonder what other projects are missing from the analysis.