Step Data Insights: Alternative DeFi Yields

An in-depth analysis and comparison of covered call strategies from Solana DeFi protocols Friktion and Katana.

Advisory

This document is not financial advice and is for education purposes only. Always do your own research before investing or trading cryptocurrencies.

Introduction

When the word DeFi is mentioned, products such as liquidity pools, farms, swaps, and lending will likely spring to mind. Furthermore, if referring to Solana DeFi, platforms such as Raydium, Orca, and Serum will often be referred to.

However, since late 2021 we have seen the emergence of new Solana DeFi platforms, with different products available. In this week's newsletter, we will be focusing on Solana DeFi platforms which have created automated DeFi products for covered calls.

What are Covered Calls?

Covered call strategies allow users to take a neutral stance on a cryptocurrencies price action. When conducting a covered call strategy, investors hold a long position, while having a call option (shorting the asset). From this, investors will receive the options premium. They are a highly effective way of generating APY when prices are stable, with volatility low. From this train of thought, their applicability across the cryptocurrency market seems unlikely. However, Friktion and Katana have created automated covered call selling strategies, which have been highly effective during the 2022 bear market. This newsletter will analyse current covered call products, while comparing Friktion against Katana.

Friktion

Overview

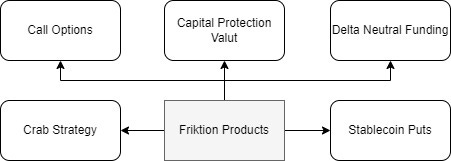

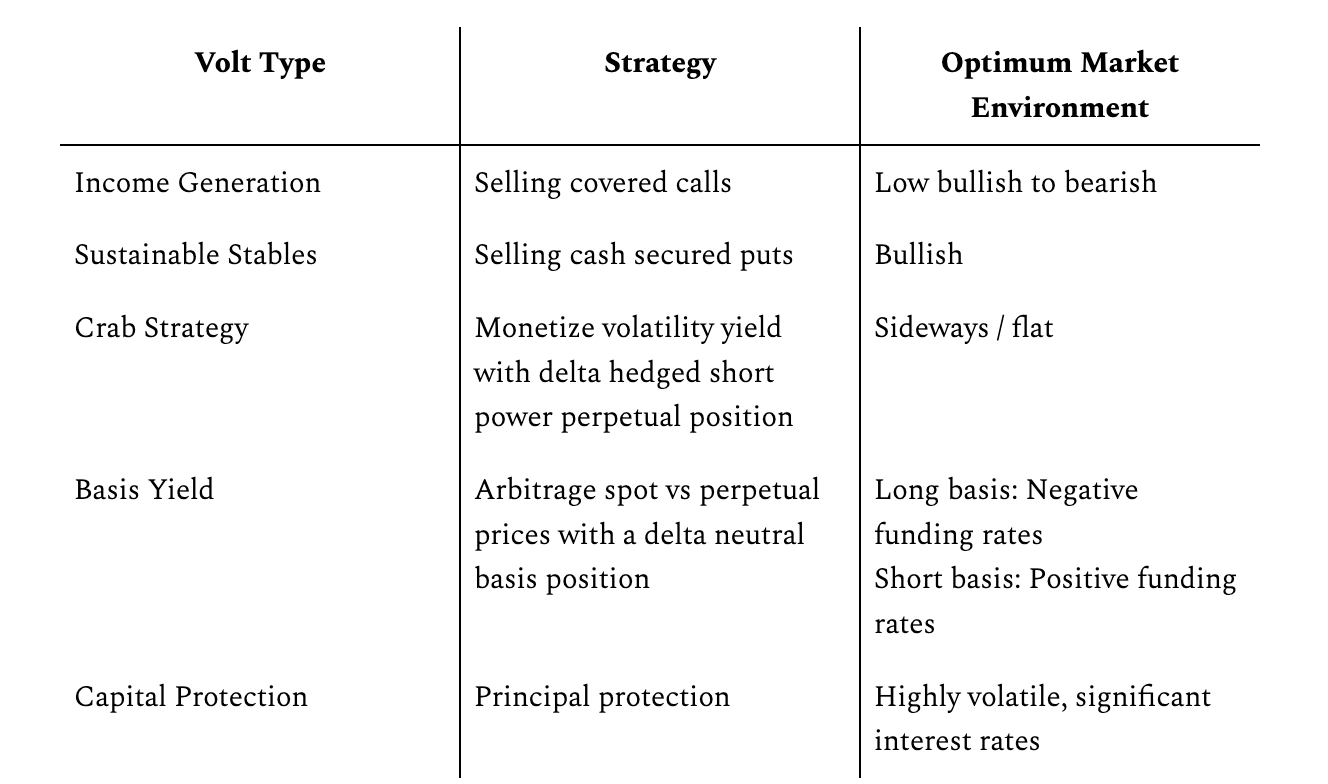

At its core, Friktion has five available products, with no native protocol SPL token. These products are displayed in figure (2).

From these products, volts are primarily focused on ‘Generate Income’ volts, with 60% of all available volts being ‘Generate Income’ volts.

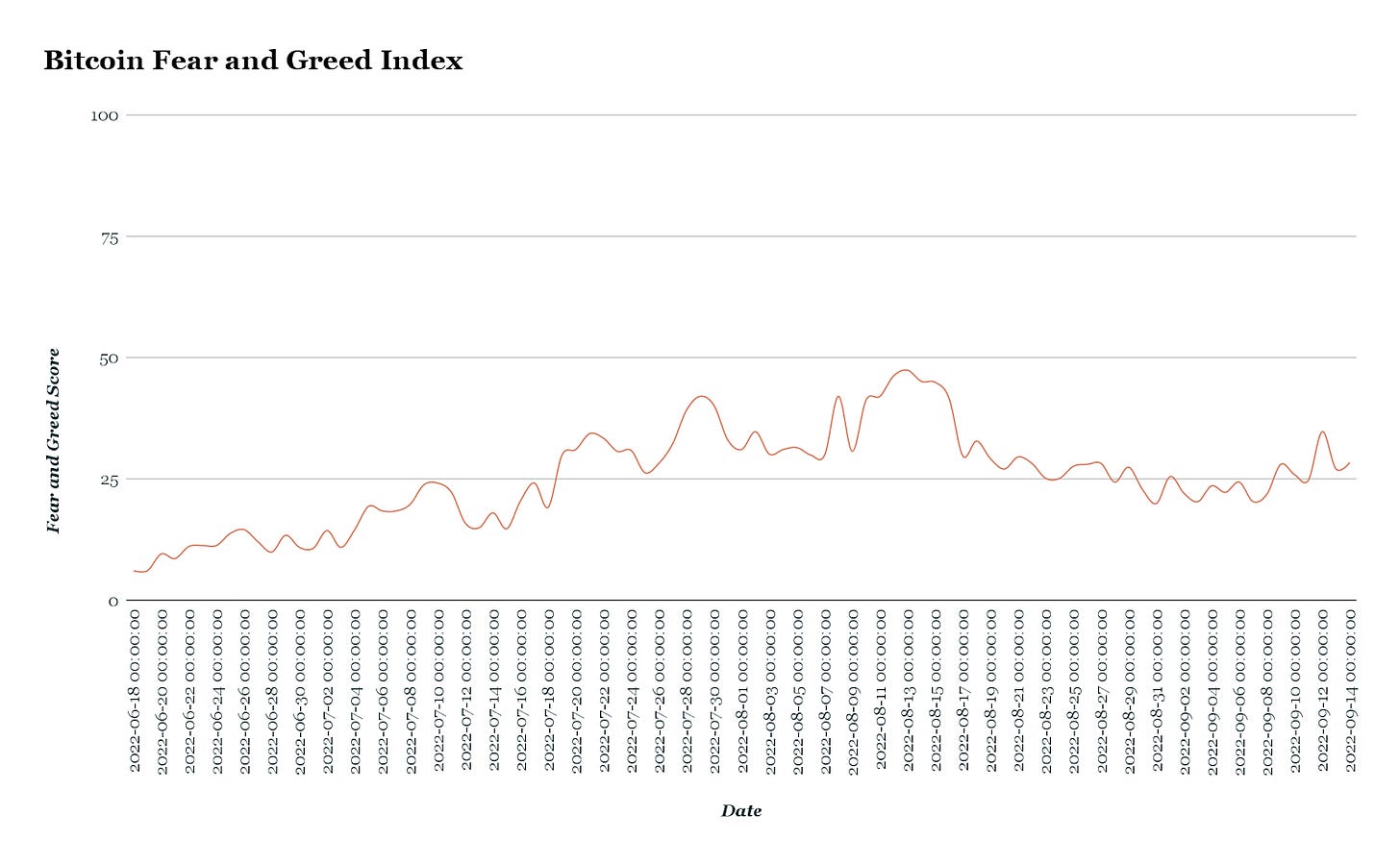

These volts have been focused on due to the current market environment. At present, the market environment is bearish, as displayed by the low (x<50) fear and greed index scores.

Should the market environment change, it is likely that Friktion will add additional volts for alternative volt types.

Generate Income Vaults Analysis

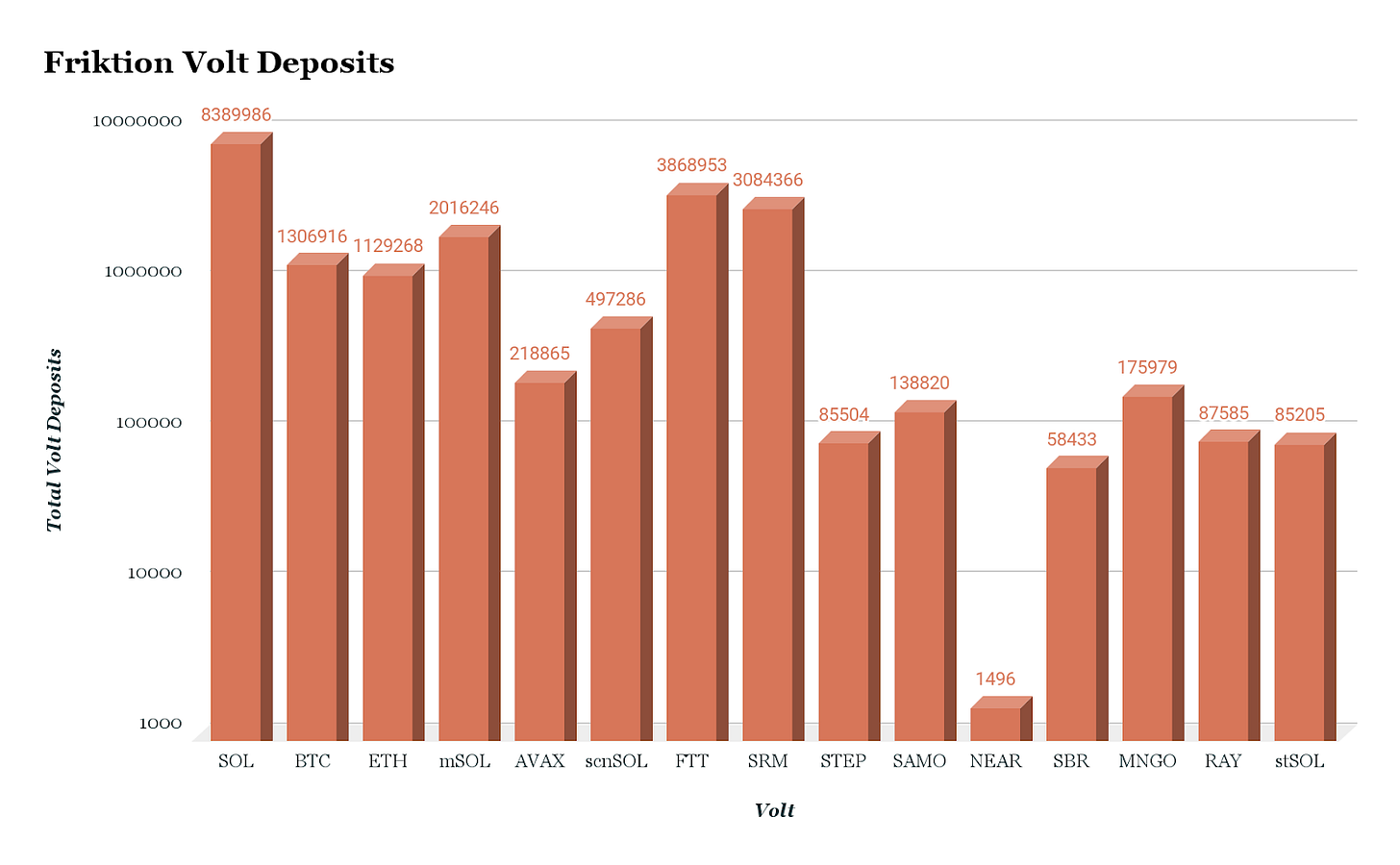

When users participate in Friktion they are required to deposit tokens into their selected pool. For example, if a user wishes to participate in a SOL pool, they will be required to deposit SOL. From volt deposit evaluation, we can derive that the most popular pool on Friktion is SOL, which is 216% larger than the second most popular pool FTT.

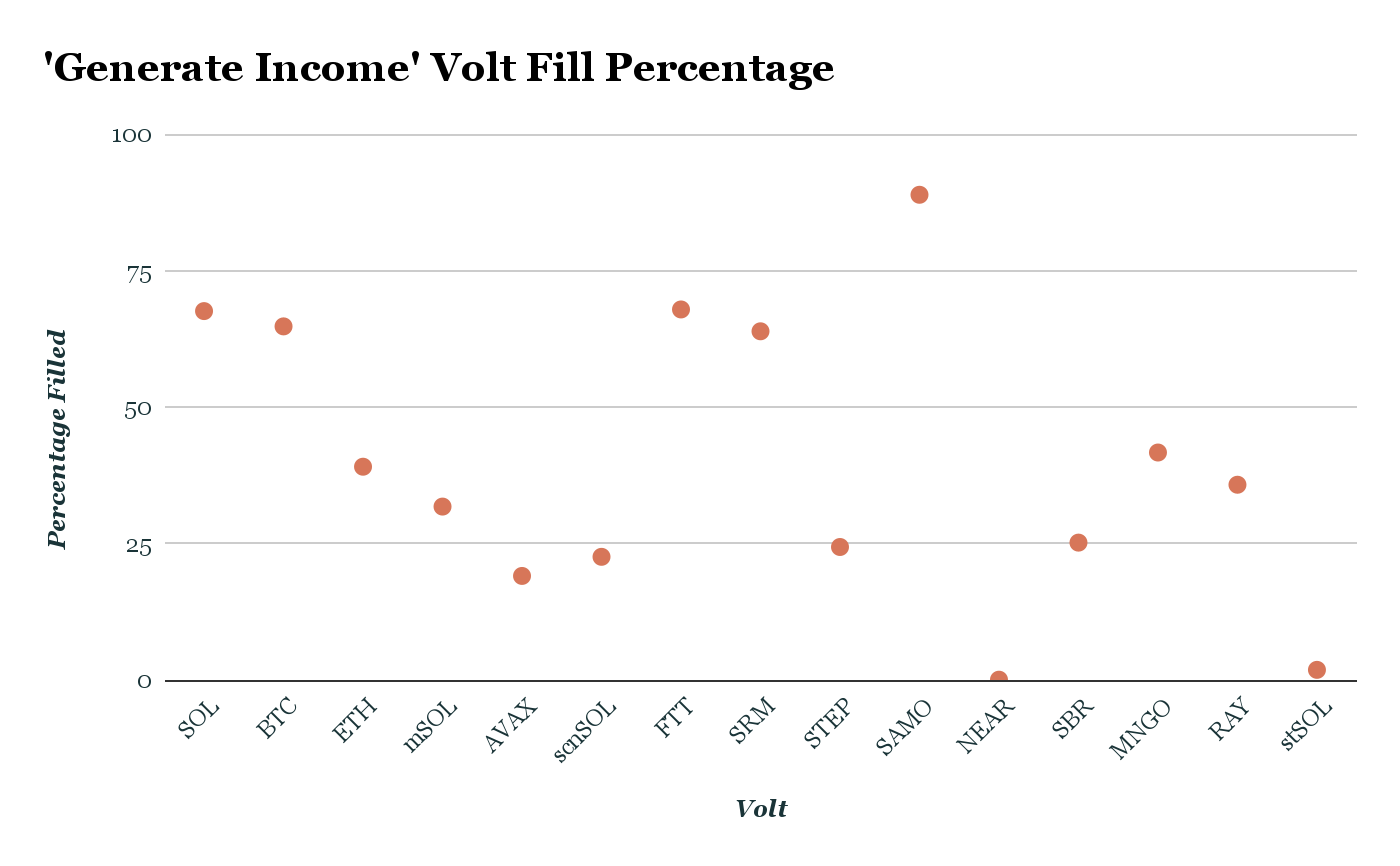

Each pool has a maximum fill limit. For example, the maximum capacity SOL vault stands at 290,000 SOL ($9.726m USD). At time of writing, the majority of pools on Friktion are filled from 40 - 20%. The average pool fill stands at 39.65% with two noticeable outliers.

The first outlier is NEAR, with an average percentage fill of 0.1%. This low fill rate is due to the age of the volt. With no inception date as of yet, this means that no epoch has started. Thus, the low volt fill percentage is to be expected. Secondly, there is the surprisingly high SAMO volt fill percentage. Standing at 88.9%, the volt fill percentage is the current highest, 21% higher than second place FTT. However, this does not represent the true volt popularity, as Friktion vaults have varying deposit capacity. For example, SOL has a volt capacity of approximately 12.41m USD. In comparison, SAMO has a volt capacity of 156k USD, representing a -98.74% capacity reduction. The volt capacity for all ‘Generate Income’ volts are displayed below in figure (8).

Performance

Since their individual inception, SOL has had the best cumulative volt performance, achieving a cumulative APY of 20.2%. The overall average is 6.41%, which is a respectable performance. When compared to the Truflation YoY rate, this represents a net YoY portfolio valuation loss of 2.73% (6.41%-9.14%). However, this negative figure is more a reflection on the world's poor financial state, rather than poor volt performance, as the average performance is 4.08% higher than current interest rates (2.33%). Furthermore, the majority of volts have provided returns between 10% - 15%, as shown below.

From fourteen volts, two have generated negative returns. However, these negative returns have been significantly averaging at -20.925%. These negative returns display the danger of upside volatility when conducting a covered call strategy. This is well displayed in figure (10) below, as SRM was at +4.38% on 11/03/2022. However, by 08/04/2022 the cumulative SRM performance stood at -24.76, representing a 29.14% negative differential.

Conclusion

The performance of Friktion volts has been admirable. Negative market conditions have been a major factor in this. However, it is down to the user in question to successfully identify which Friktion product to use, depending on the overall market condition. When evaluating the total deposits with Friktion, it is clear that there is major interest in the platform.

Katana

Overview

Similarly to Friktion, Kata offers multiple vault products. These products are split into two categories, either put selling vaults, or covered call vaults.

The majority of vaults on Katana are covered call vaults, as displayed in figure (12) below.

In this newsletter, we will be focusing on covered call vaults. These vaults are automated compound vaults, which work in a highly similar manner to Friktion vaults.

Performance

In total there are twelve covered call vaults. The average projected APY performance for a Katana vault is 26.82%. Leading this average is MNGO with a staggering +48.89%, while stSOL is in last with a projected APY of 17.09%.

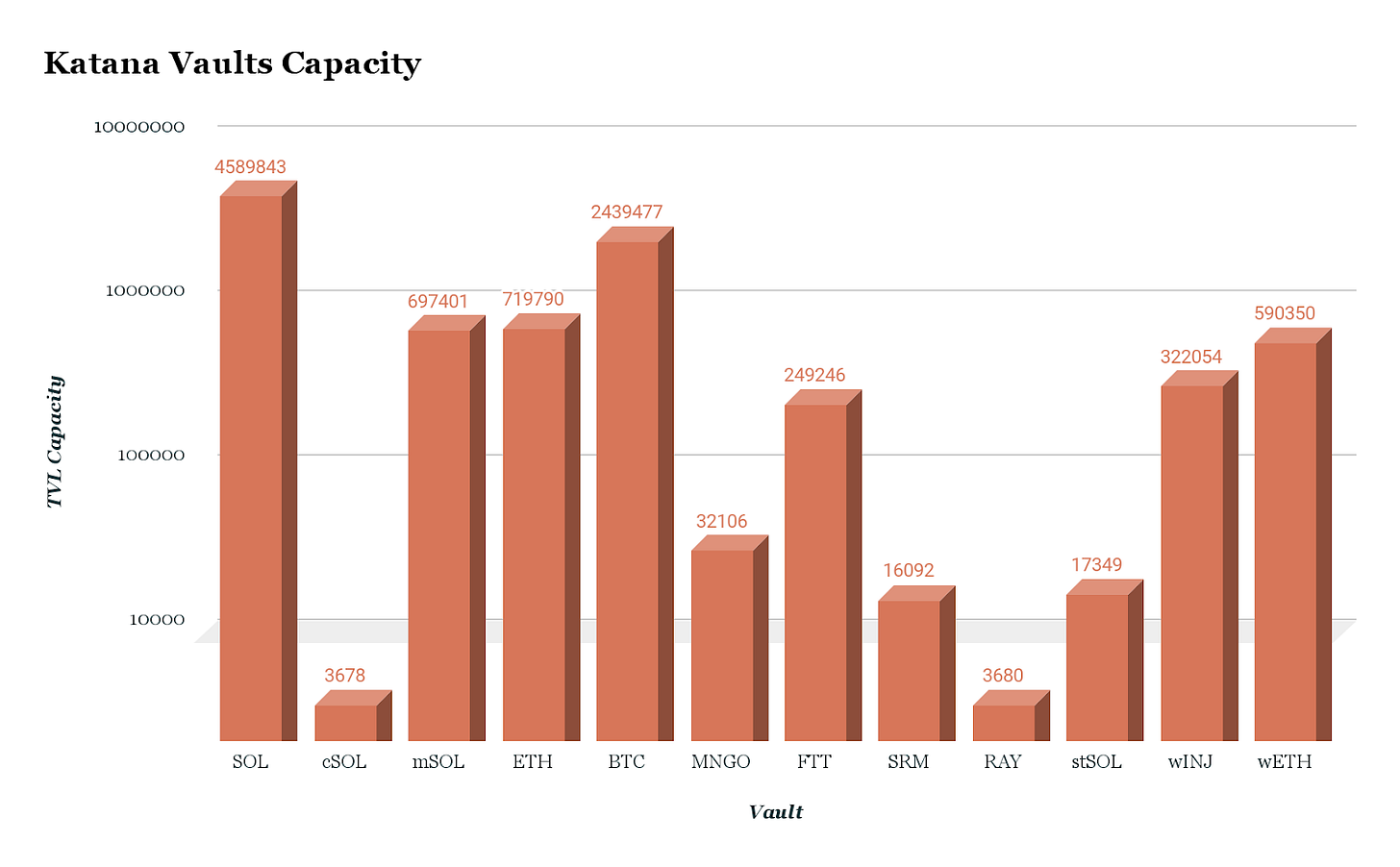

Despite the high APY displayed by MNGO, its total deposits is 0.70% the size of the largest vault by deposit; SOL. The Katana SOL vault has amassed a deposit value of $3.99m USD.

None of the vaults on Katana are full. However, the average percentage fill of vaults stands at 70.08%, while the stSOL is particularly close to being full, with 98% of deposit space being filled.

Over a one year period, 10/11 covered call vaults have had a performance x>0% APY. The single exception to this is SRM, having a performance of -10.1%. The average vault performance was 9.51%, with SRM displaying a negative differential of -19.61%.

Conclusion

Overall, Katana offers very compelling figures, especially in the performance segment. It is clear that significant usage of Katana occurs. In the next segment of this newsletter, we will draw direct comparisons against Katana with Friktion.

Analysis

Vaults / Volts Capacity

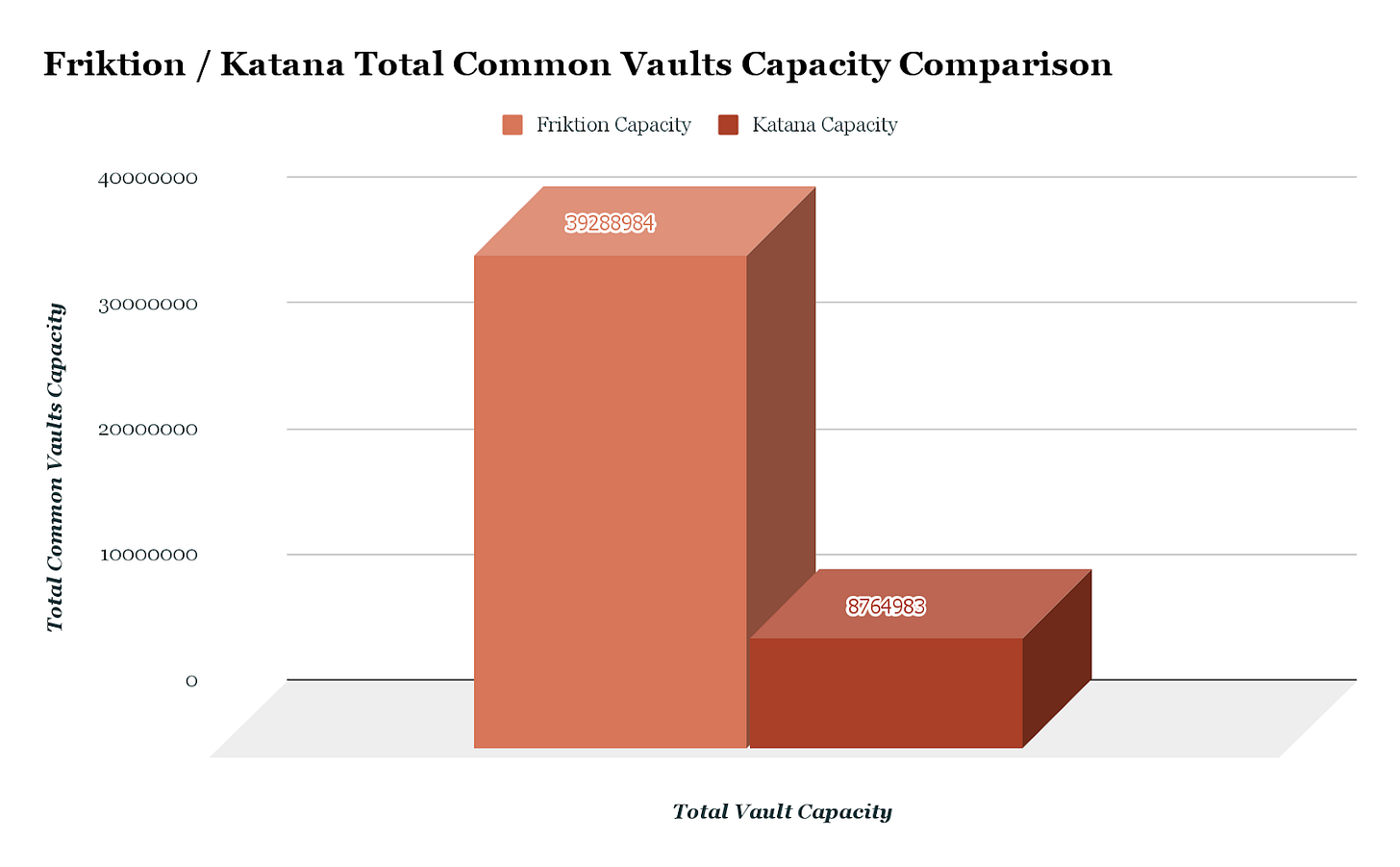

Vault capacity is important as it displays the scalability capabilities which the protocol in question has. When evaluating Katana against Friktion, the latter has superior vault capacity in 88.89% of available vaults, as displayed below.

The only vault in which Katana has superior vault capacity is with BTC, with an additional 20.56% capacity. However on average, Katana has an average capacity 77.69% lower than Friktion. This equates to an overall capacity of $8.764m USD, in comparison to $39.28m USD for Friktion.

Overall, Friktion displays superior vault capacity, and therefore scalability capability at this present moment.

Performance

When evaluating the performance of each protocol, common pools have been evaluated. For example, SAMO is not present in Katana, so has not been factored into comparative analysis. In the figure (19) below, we can see the comparative performance of Katana against Friktion.

From this, we can derive that the average cumulative covered call vaults performance of Katana is generally superior to Friktion, averaging at +10.11% in comparison to 5.51%.

Friktion is superior on both BTC and SOL, while Katana is superior on the remaining cryptocurrencies. When superior, Friktion provides return on average +3.46% return above Katana, while Katana has an average return superiority of +7.83%.

Conclusion

Overall, from seven common vaults, Katana is superior across five. Furthermore, Katana has displayed an overall higher average performance rate. The rate of performance from Friktion is often similar, although has major performance differentials across MANGO (due to the success Katana has seen), SRM (due to significant Friktion losses).

Document Conclusion

In conclusion, both Katana and Friktion offer interesting DeFi alternatives to traditional DeFi services, such as liquidity pools, farms, lending / borrowing services etc. During this bear market we have seen both Friktion and Katana perform admirably, paving the way for new DeFi services.

Author: @page_analyst

have you tried weighting the performance by notional deposited when comparing average performance across vaults? Katana's Mango vault has only 28k deposited and its Serum vault has 14k deposited. Would recommend looking at this dollar weighted.