Step Data Insights: POLIS Tokenomics

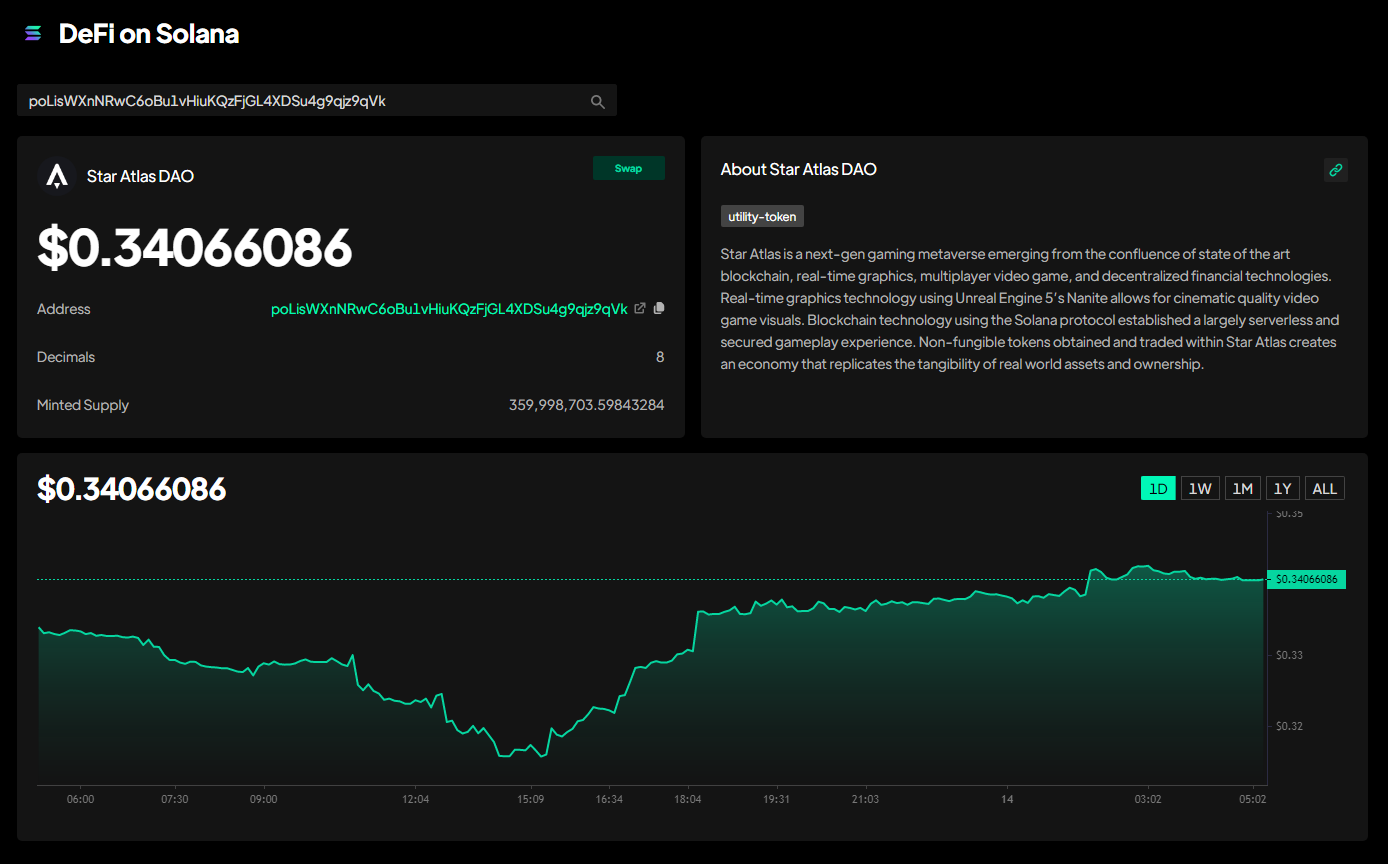

The DAO Governance Token for Solana's Premiere Web 3 Blockchain Game, Star Atlas

Advisory

This document is not financial advice and is for education purposes only. Always do your own research before investing or trading cryptocurrencies.

Introduction

In our last newsletter, we covered the tokenomics of three Solana-native SPL tokens which were largely distinct from one another, and uniquely created for different purposes within their respective projects. Previously we covered SAMO, Solana’s premier dog coin, Step Finance’s STEP and the in-game currency token ATLAS from Star Atlas.

In this issue we’ll be expanding on the Star Atlas ecosystem by focusing on POLIS, the governance token which dictates much of the game’s direction through the Star Atlas DAO’s proposals and voting systems.

“POLIS is the governance token used at each level of governance, representing financial stake in the game, voting power in the DAOs where it is staked, and control of the Treasury. It has a fixed supply that will not grow (unless a decision to the contrary will be made by governance down the line”

POLIS vs. ATLAS

POLIS and ATLAS are the two tokens within Star Atlas’ ecosystem and economy. ATLAS is the in-game currency and payment token, designed to have more inflationary metrics with a goal of maintaining the pace of the growing economy within the Star Atlas universe. Whereas POLIS has more long term store of value potential, with a fixed supply and functionality for DAO governance by means of voting within the Star Atlas political and economic ecosystems.

Upon initial launch, speculation drove the ATLAS price higher relative to POLIS. However, at almost one year later, the trend has completely reversed. This is likely due to superior tokenomics, emissions schedules and genuine demand for the POLIS token being used in DAO governance voting.

POLIS Distribution, Initial Allocations and Price Action

The initial public sale of POLIS was held across various IEO and IDO launchpads throughout the final week of August 2021 at a price of 0.138 USDC per 1 POLIS.

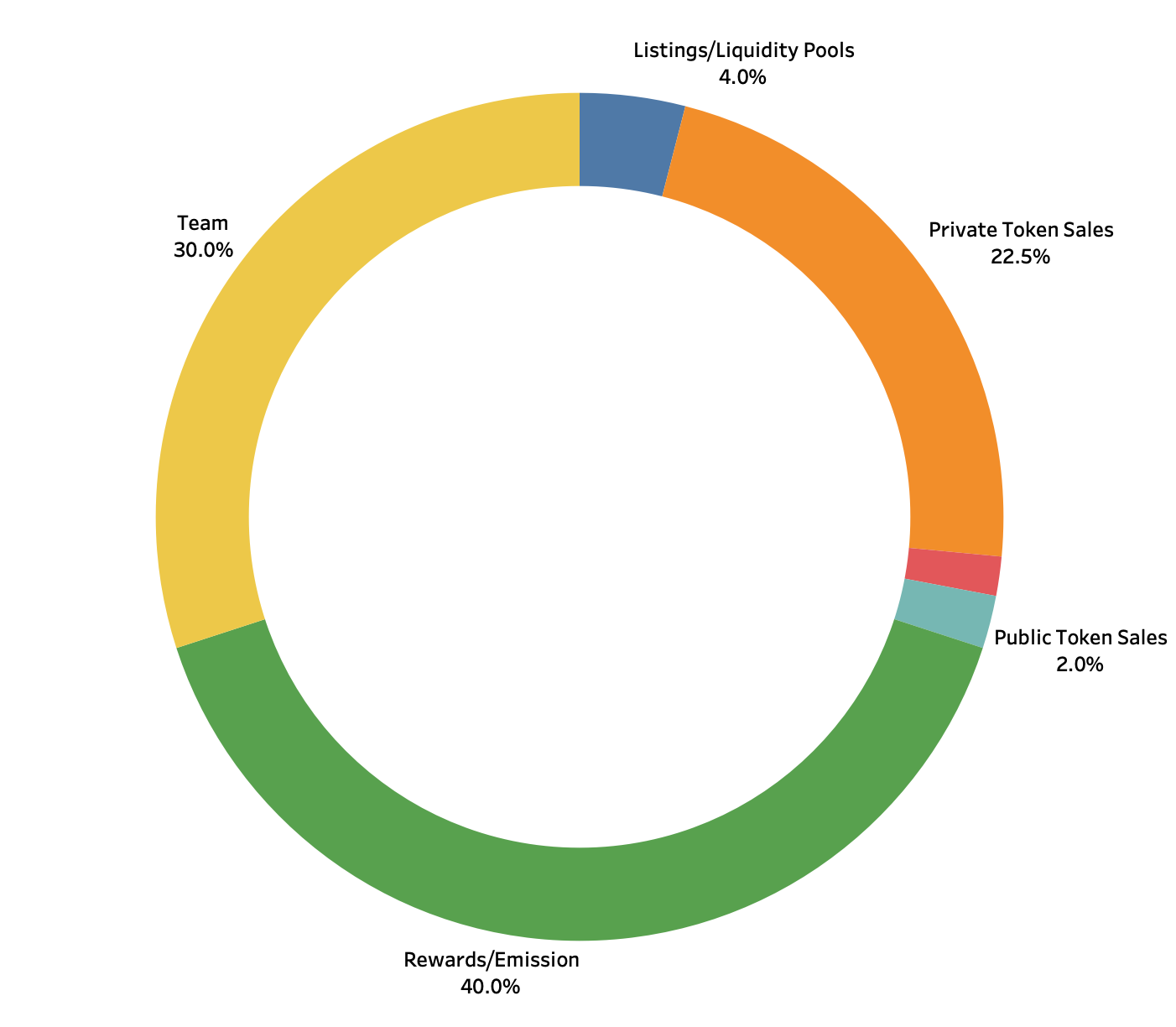

During that time, 7,200,000 POLIS (2% of total supply) was sold.

3,600,000 via FTX

1,800,000 via Raydium

1,800,000 via Apollo-X

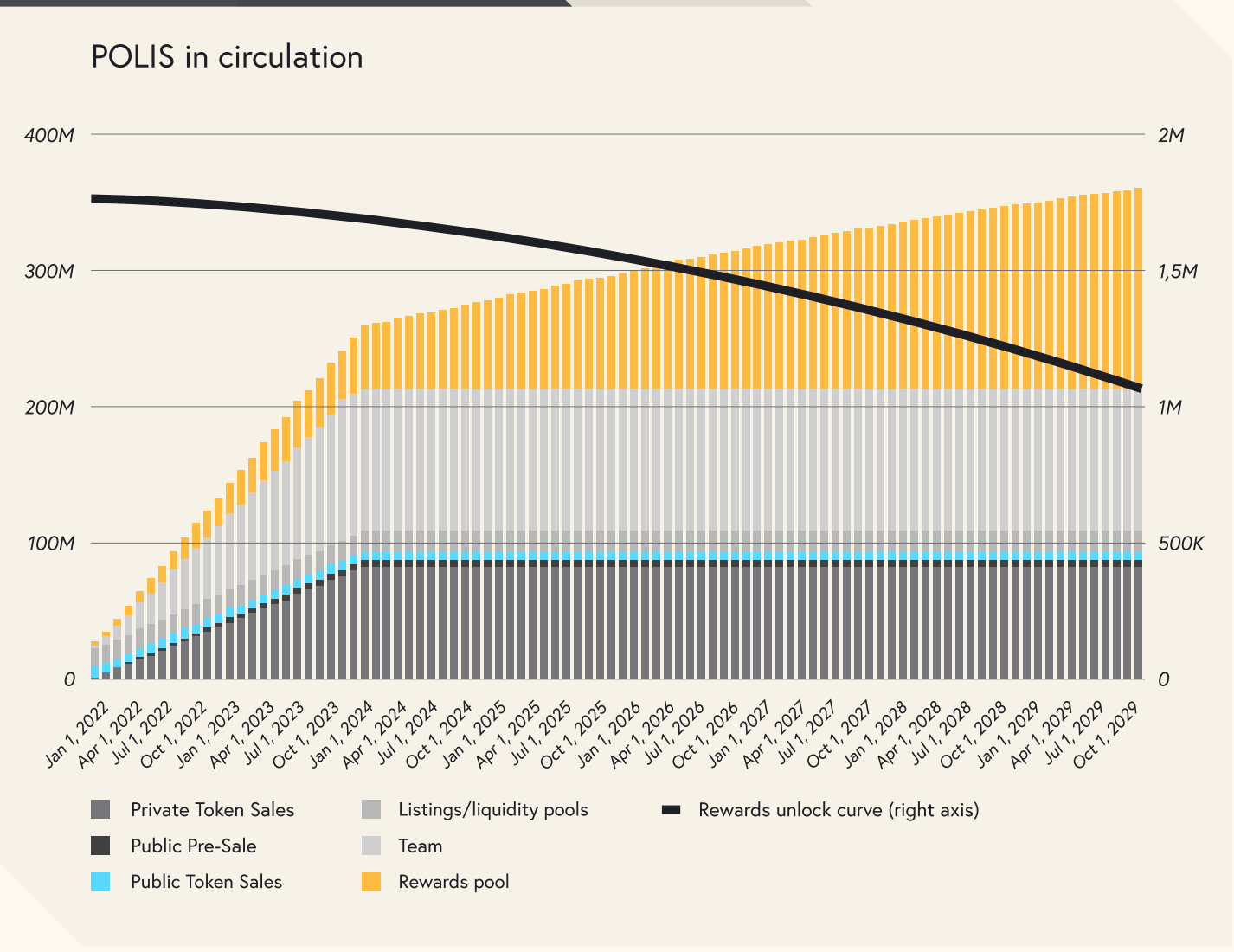

The second largest allocation of POLIS, besides the 40% allocated to the seven-year emissions/rewards, was the 30% allocated to the team. The vesting schedule for team tokens is set on a 104 week emissions schedule, similar to the public pre-sale and private token sale fund raises. The initial private sale of POLIS represents 22.5% of total supply, or 81,000,000 POLIS and carries that same 104 week vesting schedule as the team.

As of now, and likely to stay this way unless the DAO were to create and vote on an altering proposal, the total supply of POLIS is fixed at 360,000,000 tokens.

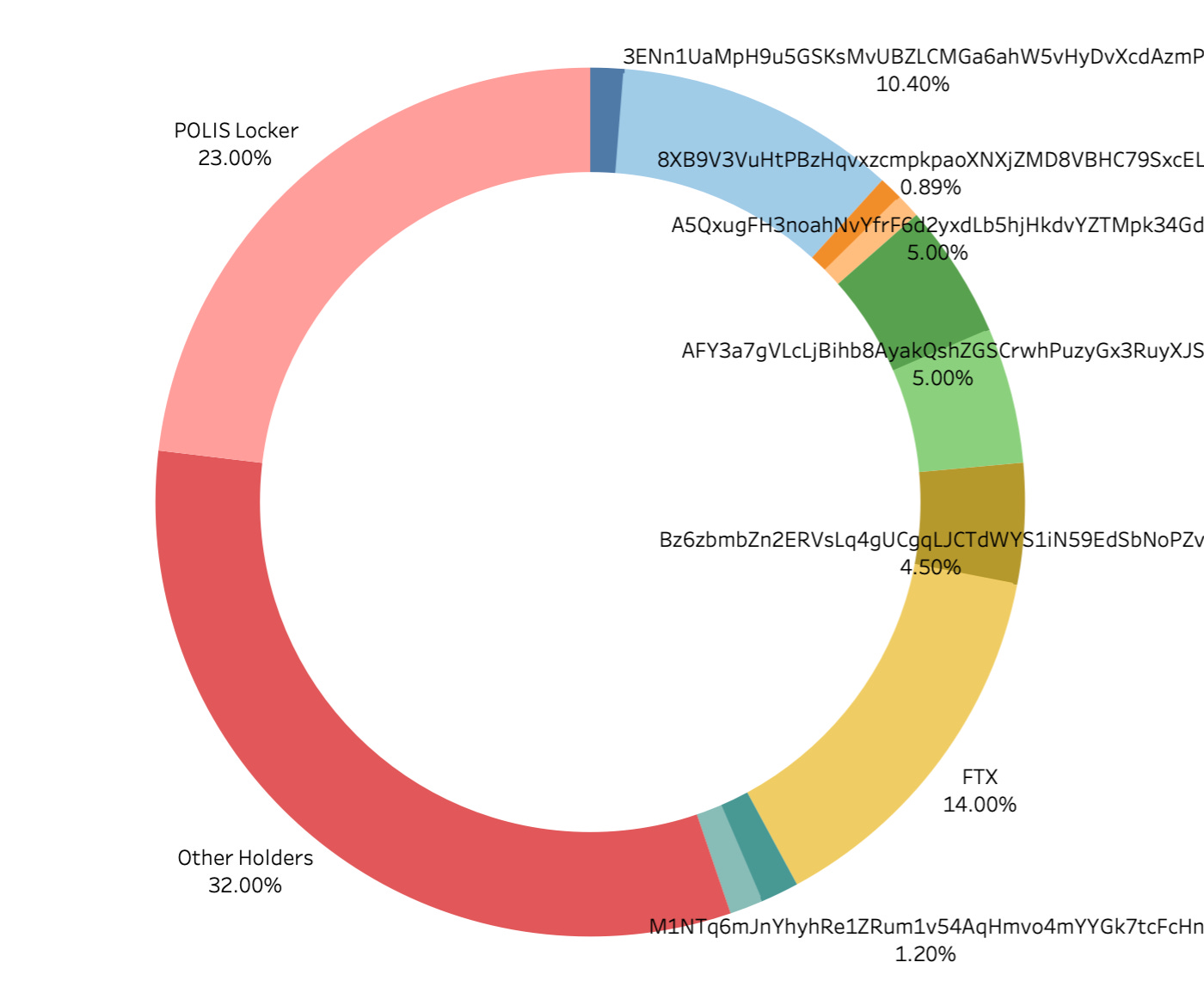

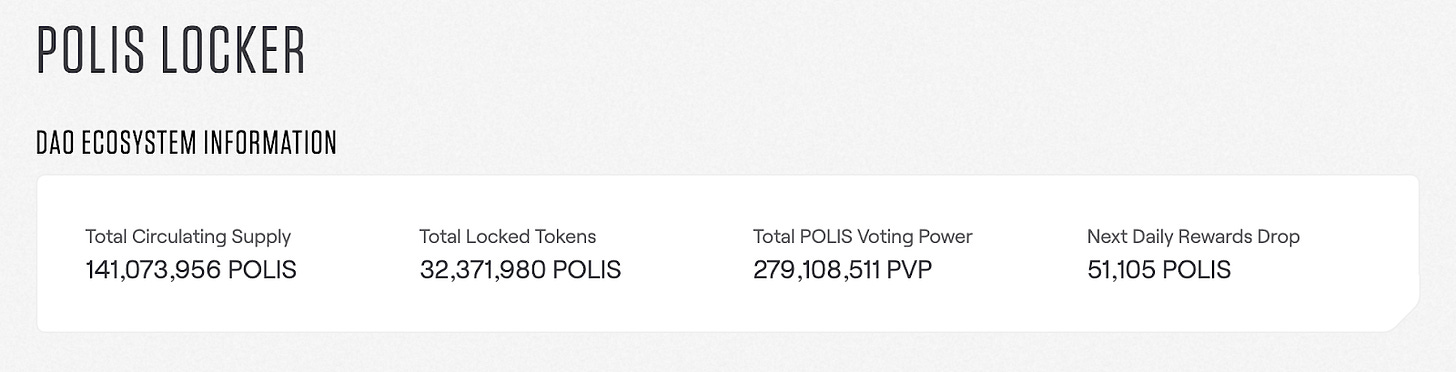

Of the total supply, there are currently 141,073,956 POLIS in circulation, with the largest concentration being communally staked in the Star Atlas DAO POLIS Locker, accounting for ~24% of circulating tokens.

Excluding staked POLIS within the DAO Locker, the top 10 largest holders of POLIS account for ~45% of circulating supply. The largest wallet being owned by FTX, which holds 20,380,640 POLIS, roughly 14% of circulating supply and 5.66% of total supply.

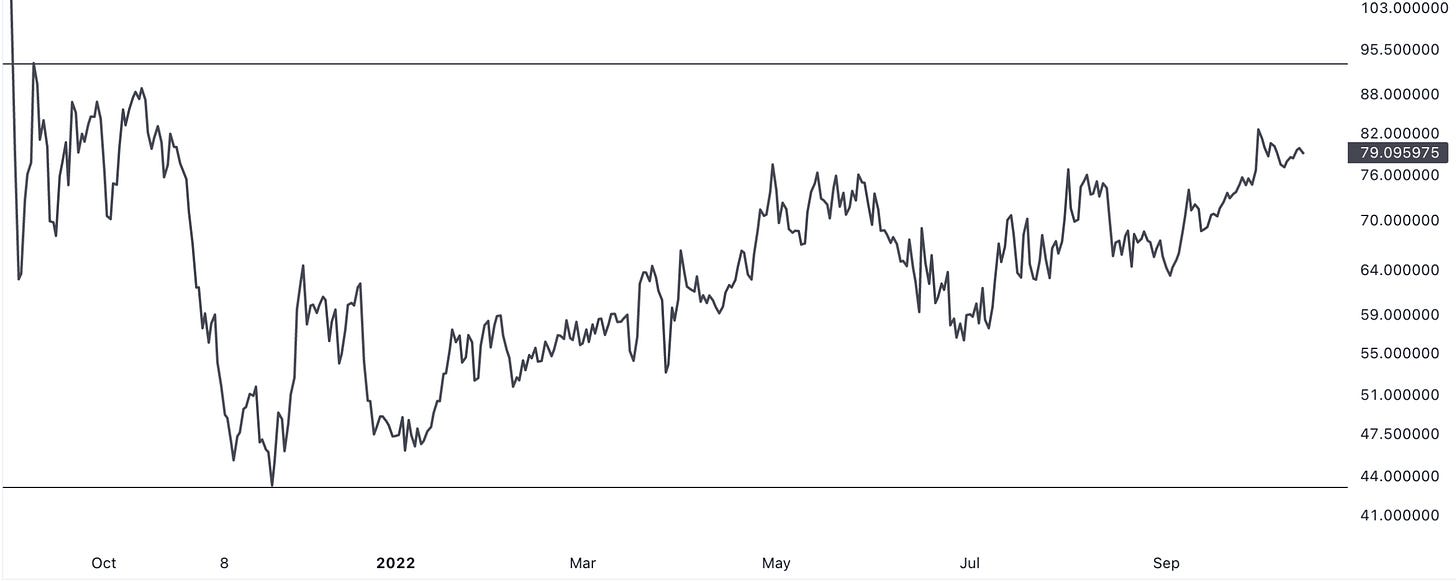

At first weeks of launch during Fall of 2021, nearing the end of Solana Summer, POLIS mostly traded within a range of ~.03-.05 SOL, as the speculative crypto markets reached their peak. However, the bear market of 2022 has brought on a significant downtrend across all markets, with significant effects being seen in smaller market capitalization tokens, and POLIS being no exception.

POLIS Governance, Voting Power and Locking Rewards

In order to use POLIS tokens for governance voting, holders are required to lock them within the DAO Lockers in exchange for ‘POLIS Voting Power’ (PVP). The amount of PVP received for POLIS tokens is determined by the time period in which a holder chooses to lock their tokens within the DAO Lockers. The longer lock-up times offer a higher multiplier for PVP received, and therefore more voting power towards future DAO proposals. This design intends to add additional depth to the voting system, allowing devoted players the ability to increase their voting power without requiring additional capital.

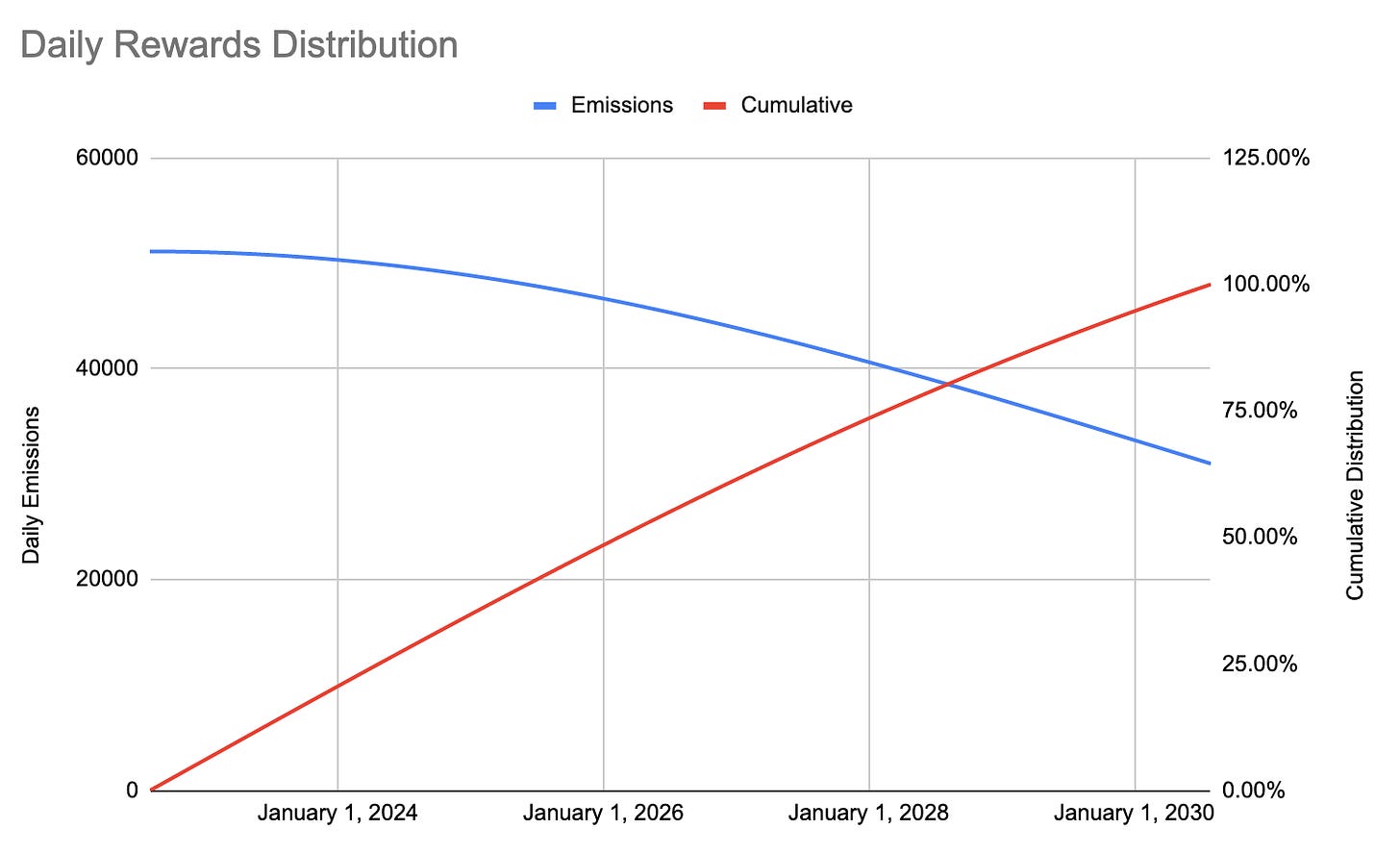

POLIS reward emissions for stakers with the DAO Lockers follow a set emission schedule, with distribution based on holder’s voting power, or otherwise, equivalent PVP share. Of total supply, 127,800,000 POLIS tokens are reserved for staking rewards and are held in the Star Atlas DAO treasury wallet. Daily POLIS rewards started on August 2, 2022 at 51,121.27 POLIS and have a tapering emissions schedule following the graph below in Figure (8).

Each holder’s share of daily staking rewards are calculated simply by User Rewards = (User's PVP / Total PVP) * Daily Emissions

At time of writing there are currently 32,371,980 POLIS locked for a total voting power of 279,108,511 PVP. This means the average lockup multiple is ~8.62x, showing the majority of staked POLIS is locked for a time period of 4 years or longer.

Acquiring POLIS and POLIS Emissions Schedule

For those who weren’t a part of the initial public and private sales, the main methods of acquiring POLIS at this time are through secondary market purchases, providing AMM liquidity and other DeFi integrations or receiving POLIS Locker rewards via staking with the Star Atlas DAO.

Other emissions via DAO organized Metagame rewards are also slowly becoming available to community members.

These might include the following:

Actively attracting new users that stay for some amount of time or generate some amount of value.

Organize existing users into guilds/factions and more, based on what these guilds/factions produce.

Guilds/Alliances will be rewarded with an amount of POLIS based on how long they have actively participated in the universe. The reward structure will be calibrated to disincentivize churn.

Following the game’s release, additional ways to earn POLIS rewards by completing certain in-game missions will become possible as well, providing unique opportunities for the actual players of Star Atlas.

Conclusion

For fans and investors of Star Atlas, the tokenomics for POLIS appear much more favourable as a long-term store of value when compared alongside the ATLAS token.

Additionally, the utility bearing governance token, POLIS presents a stronger investment thesis, as the next-gen blockchain game experience grows in popularity. Potential for POLIS Voting Power to increase in demand throughout the user base could expand rapidly, as it is not only tied to gaming experience, but to economic outcomes in and out of game as well.

Those looking to learn more about Star Atlas, the POLIS and ATLAS tokens and the Star Atlas DAO should check out their Official website and read the whitepaper at StarAtlas.com.

Finally, if you want to stay up to date with the latest Step Finance news and data insights, be sure to follow us on Twitter and join our Discord as well.

Author: gg