Step Data Insights: Product-First NFT Projects

An analysis of Blocksmith Labs, GhostKidDAO and MKRS following the royalty debates within the Solana NFT community.

Advisory

This article is not financial advice and is meant to be treated as an informative piece. Always do your own research before investing or trading any cryptocurrencies.

Introduction

Over the past month or so, the broad Solana NFT community has been turbulent and constantly arguing about creator royalties; do projects deserve them, should people pay them? Should buyers be punished if they don’t? Who knows. It is a very subjective topic and quite case dependent, with lots of different and valuable viewpoints. The change this brought to Solana have been very impactful, but where did it all begin?

It started with Yawww back in June 2022 when they launched their P2P NFT trading platform that lets sellers avoid royalty charges. This royalty-free trading was followed by the decentralized exchange Hadeswap and Solana’s very first NFT marketplace, Solanart. Not only did these exchanges cut revenue from projects, but at the same time, these platforms began to encroach on Magic Eden’s market share following their adaptations to avoiding creator royalties.

In mid-October, Magic Eden was eventually forced to acknowledge that the Solana NFT market has been shifting towards optional creator royalties and introduced their optional royalty payment model.

The news of this change was countered with skepticism by NFT creators and their communities, with concerns that they could harm the sustainability of the Solana NFT ecosystem. According to the data analytics platform SolanaFloor, since the start of September 2022 volume has dropped almost 45% at the time of writing. The impacts have been large for the bulk of the space. Are Solana NFTs dead, or is there going to be a new wave of differently modeled NFT projects?

The Rise of Product-First NFTs

As the Solana NFT ecosystem leans towards the optional-royalty policy (with the exception of NFTs that are punished for not paying royalties when purchased), creators will not be able to secure revenue flows by just buyers purchasing their NFTs. This brings up the concern that NFT projects will give up on their community/project if they run out of funds for development or operations.

This environment of uncertainty does present a window of opportunity though, as established NFT projects that can generate revenue that’s not just through royalty fees or have a long run way stand the most to gain. These types of projects have started garnering attention, as they are most likely able to continue to work on their project and to sustain their treasuries, and that sustainability is what buyers are looking to find.

In this week’s edition of the Step Data Insights, we will be covering three NFT projects with sustainability and revenue generation at their core.

Blocksmith Labs

Blocksmith Labs (BSL) launched on 24th of March with a supply of 4,444 and mint price of 2.2 SOL on Magic Eden’s Launchpad. As one of the top collections in the Solana NFT ecosystem (ranked sixth by total floor value), they have introduced 4 different products since launch. These are called Mercury, Bifrost, Shift and Raven. BSL holders can also stake for their native utility token, FORGE, which is used by all of their products.

Mercury

Mercury is the first product that BSL launched. It is an easy-to-use whitelisting management platform that allows people to distribute whitelists to those with particular roles within a discord, as well as to create whitelist giveaways. Projects that use Mercury allocate a small percentage of the whitelist supply to BSL as a payment, and those whitelists are auctioned or raffled using FORGE. This aspect of the platform creates the first use case for the native token of Blocksmith Labs.

The team has onboarded 952 projects through Mercury, and distributed 2.6M whitelist spots for those projects as of today. There are 367.5k registered wallets using the platform, and 56,421 of them are unique users at the time of writing.

The data has shown exponential growth to Mercury’s use, with the number of unique users and the number of projects onboarded per day reaching an all time high this week. Despite the general NFT market slowing down, there seems to be no stop for those who want to use BSL’s products.

This is a good sign of sustainability in Mercury’s product model, and also FORGE has at least one strong use case, which all come back to how strong BSL NFTs really are despite optional royalty omissions.

Bifrost

The second product launched by BSL is Bifrost, Solana’s first launchpad with a built-in price discovery mechanism. This means it capitalizes on demand as price increases alongside, which lets projects maximize their capital raise. The mints on Bifrost start with a predetermined price and gradually increase with the demand. This feature also makes the minting process bot-free. However, if the projects prefer a fixed price mint without a price discovery mechanism, BSL also offers a fixed price anti-bot mint option. Another feature Bifrost offers is that projects to be launched have the option to freeze NFT transfers before being sold-out to prevent them from getting listed on any marketplaces.

As a payment, projects that launch on Bifrost allocate a small percentage of the collection to be minted with FORGE which goes to the treasury of Blocksmith Labs. This feature of the platform allows the demand for Bifrost to also increase the demand for FORGE.

These are the 3 projects that launched through Bifrost at the moment.

Shift

The third product by BSL is Shift. A dynamic art generation tool that enables NFT creators to change, customize, or evolve their art. The change in the art happens through the change in the NFTs’ metadata which is triggered by any external off-chain or on-chain factor. Using the platform, holders will be able to make changes on their NFTs if they meet predetermined requirements.

Shift’s platform has already started allowing client projects to upgrade their art (i.e. Primates toxification), with a greater potential for its possible use case in the Web3 gaming industry. Unlocking new items or cosmetics for gaming NFTs could be done through Shift and the platform could be a hub for NFT upgrades in the future.

Shift will also provide a way for BSL holders to use their FORGE pre and post art upgrade, and they also intend to build products on top of Shift that will be monetized in FORGE. At the core of all their products, is the token that their primary collection yields. As FORGE becomes more valuable with their products, their NFTs are likely to follow.

Raven

Raven is a platform that allows its users to increase their engagements on Twitter. It operates with the recently trending raid-to-earn model, where clients allocate FORGE to increase their engagement. Users like and retweet promoted tweets to earn a portion of the FORGE allocated. As such, Raven is also designed to grow alongside FORGE.

Blocksmith Labs Overview

Each product of Blocksmith Labs has a strong use case. As the products become more and more adopted, Blocksmith Labs stands to become an even larger part of the Solana ecosystem. Especially with competition struggling to find sustainability or revenue generating models amidst all the noise of royalties.

Apart from their products, the community side of BSL looks strong as the holders are relatively less likely to list their NFTs. The listed count of BSL NFTs have been notably low since their launch, never exceeding 89 NFTs listed since early May 2022. Looking at this information, it can be assumed that BSL owners believe in the vision of the team. They have been convicted holders and supporters for many months.

The unique holder ratio of Blocksmith Labs NFTs also looks quite strong. There are 2,446 unique holders of the collection, which is equal to 54% of the total supply. The largest holder has 73 NFTs, while the top 10 owners have 9.65% of the supply. 1806 holders, which makes up around 41% of the holders, only hold a single NFT.

Blocksmith Labs also has an art upgrade on their agenda. This might be a catalyst that will heat up the demand for the FORGE token, where the Blocksmith Labs NFTs and team stand the most to gain. This project is designed to last and to be used by other creators in the space, and with favorable analytics, they stand to take on a much larger role in the Solana NFT ecosystem.

Ghost Kid DAO

Ghost Kid DAO (GKD) is a unique pixel-art pfp collection that had a stealth launch on May 11, 2022 with a supply of 5,000 and mint price of 0.09 SOL. Despite the lower amount of capital raised, GKD hit a floor price of 24.5 SOL after only one month from mint, and much of it can be attested to the amount of noise they were able to generate on Twitter. They then built a gamified raid-to-earn platform in a 3-month period, called Boonties. This monetizes the process to which GKD’s built themselves upon, and provides value to holders who engage in the Boonties program. They also have a native utility token called BOO, and a non-SPL in-app currency called SPOOKIES with its own use case.

Boonties

Boonties is a raid-to-earn platform, where users are rewarded for their engagement with Twitter posts. Both holders and non-holders of GKDs can use the platform to earn prizes. Non-holders can complete bounties, which requires them to connect their twitter accounts to the platform and engage with targeted tweets. Users who complete bounties are rewarded with the non-tradable currency SPOOKIES and XP which could be used to participate in raffles.

GKDs holders are able to participate in raids and stake their GKD(s) to earn BOO. Raids are where paying clients use the Boonties platform to increase their engagement on Twitter. GKD uses a revenue sharing model for the raids, where each raid has a prize pool (a portion of the raid fee paid to Ghost Kid DAO) of SOL which is then distributed to raid participants. NFT holders participate in raids and earn SOL by engaging with the tweet that pay to be raided. Apart from being able to join raids to earn SOL for tweeting, holders can also participate in raffles with the BOO they earned while staking.

The Boonties platform also uses other gamified monetization techniques to generate revenue. Users can purchase a ‘Season Pass’ to be able to win additional prizes for each raid season.

GKD has paid out around 1,000 SOL to holders who have participated in the Boonties raids as of today. The value of the awards they have distributed in the raffles so far is about 300 SOL. For GKDs, the value lies within their extremely strong community. As long as they continue to be a dominant and recognizable unit on Twitter, the Boonties program will be here to stay.

GKD Overview

Following the success of the first season of Boonties that was recently finished, they had an announcement about their new roadmap (3.0). There are currently 242 GhostKidDAO NFTs listed, which corresponds to 5% of the total supply. Looking at the wallet activities of top 10 holders of GhostKidDAO in the past month, the total net change in NFT numbers of the top 10 wallets is +81. This indicates that top holders have increased the number of GKDs they hold in their portfolio, which shows strength within the community with what the team at GhostKidDAO is doing.

GhostKidDAO shows extreme strength, especially coming from an underfunded beginning. With option royalties bringing the pressure to NFT projects, GKD is unlikely to be affected by it, as they have proven to be able to manage despite little funding, while also providing revenue for themselves and their holders by monetizing their own community.

MKRS

MKRS are the collection under Based, who are building a communications product intended to reshape the experience of gathering around NFTs. They were launched on August 5, 2022 as a stealth mint with a mint price of 3.5 SOL and supply of 6,000. They have a fully doxxed team which consists of professionals with startup experience who have gone through multiple exits.

Before their mint, the team had raised $3.5M in pre-seed funding. Among individual investors, there are crypto-native investors and KOLs which include SolBigBrain. The pre-seed financing of Based is planned to fund the operations of the team, so that the funds raised through NFT mint can be recycled back to the MKRS community. The team has sufficient funds to develop both the community and the product without needing to rely on royalties or mint funds.

The MKRS collection has a dynamic rarity system which consists of 15 levels. At each level, holders are introduced with new traits and new rarities. Levels are unlocked by staking MKRS NFTs. Other than the levelling system, holders can also customize the visual traits of their NFTs by using MKRS studio.

The Based App

Based is an app where people create and gather around NFT sub-communities and micro-networks. The app is currently only available for MKRS NFT holders. In order to sign in to the app, users are required to connect their Solana wallets. The app is in a testing phase with approximately 500 daily active users.

In the second half of September, the team started the MKRS pool initiative which is currently funded with $10k per month. The purpose of the pool is to reward NFT holders who use and test the app, and also to incentivize the community to provide feedback. As MKRS holders use the app, find bugs, and provide feedback, they earn pool points. The more NFTs users hold, the more pool points they earn. At the end of each month, $10k allocated for MKRS pools is distributed to users as SOL, taking into account how much pool points they have earned.

Although the amount allocated for that month was $5k since the pool was opened in the middle of the month, a holder had a payout of 9 SOL at the end of September. As for the sustainability of these pools, there is no doubt from the community side as the team does not rely on the funds that they have raiders through minting.

MKRS Overview

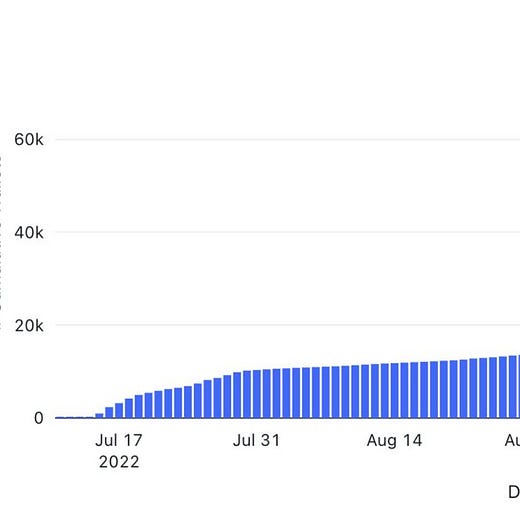

As the team continues to build the Based app and incentivize NFT holders with monthly payouts, the platform steadily attracts web3 users who are interested in the x-to-earn model. Looking at the unique holder chart of MKRS over time, we can clearly say that the number of owners are in a clear uptrend.

The uptrend in the number of holders since the launch in August shows that the team has been steadily consolidating both the tester base for their app and their community. In these periods when sustainability is one of the hot topics of the NFT ecosystem, teams that sustain and grow their operations in a self-sufficient manner are more likely to be in the spotlight.

Conclusion

The recent developments and controversy about creator royalties will have obvious effects on the NFT ecosystem. Figuring out which NFT projects will benefit from those, and verifying these hypotheses with on-chain data would help in finding the projects that are going to outperform. NFT projects that can generate revenues other than royalty fees, and the ones that have healthy on-chain data are expected to be more prominent in this period of uncertainty.

Author: @levvercetti