Step Data Insights: Solana Stablecoins

Analyzing the growth/adoption of Solana-native stablecoins such as USDH & UXD and where they fit within USDC's market dominance

Advisory

This document is not financial advice and is for education purposes only. Always do your own research before investing or trading cryptocurrencies.

Introduction

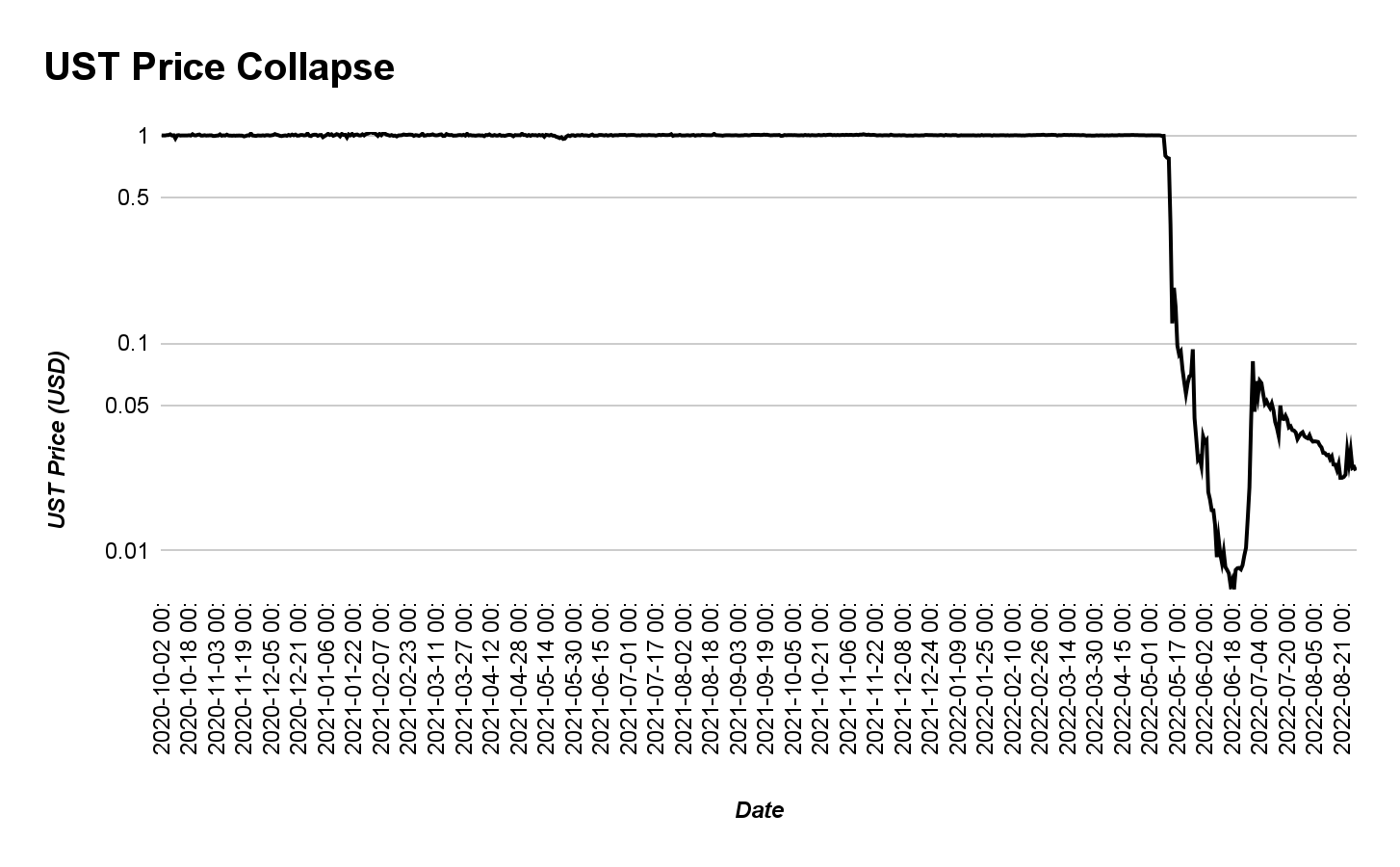

The stablecoin market has seen dramatic shifts since the start of 2022. The most notable change within this market sector was the collapse of UST (Terra USD).

Meanwhile, recent news events such as the freezing of USDC coins have raised numerous questions about cryptocurrency stablecoins. In this week's newsletter we will dive into the current stablecoin market state, analyzing trends across this market niche.

Solana Stablecoin Market

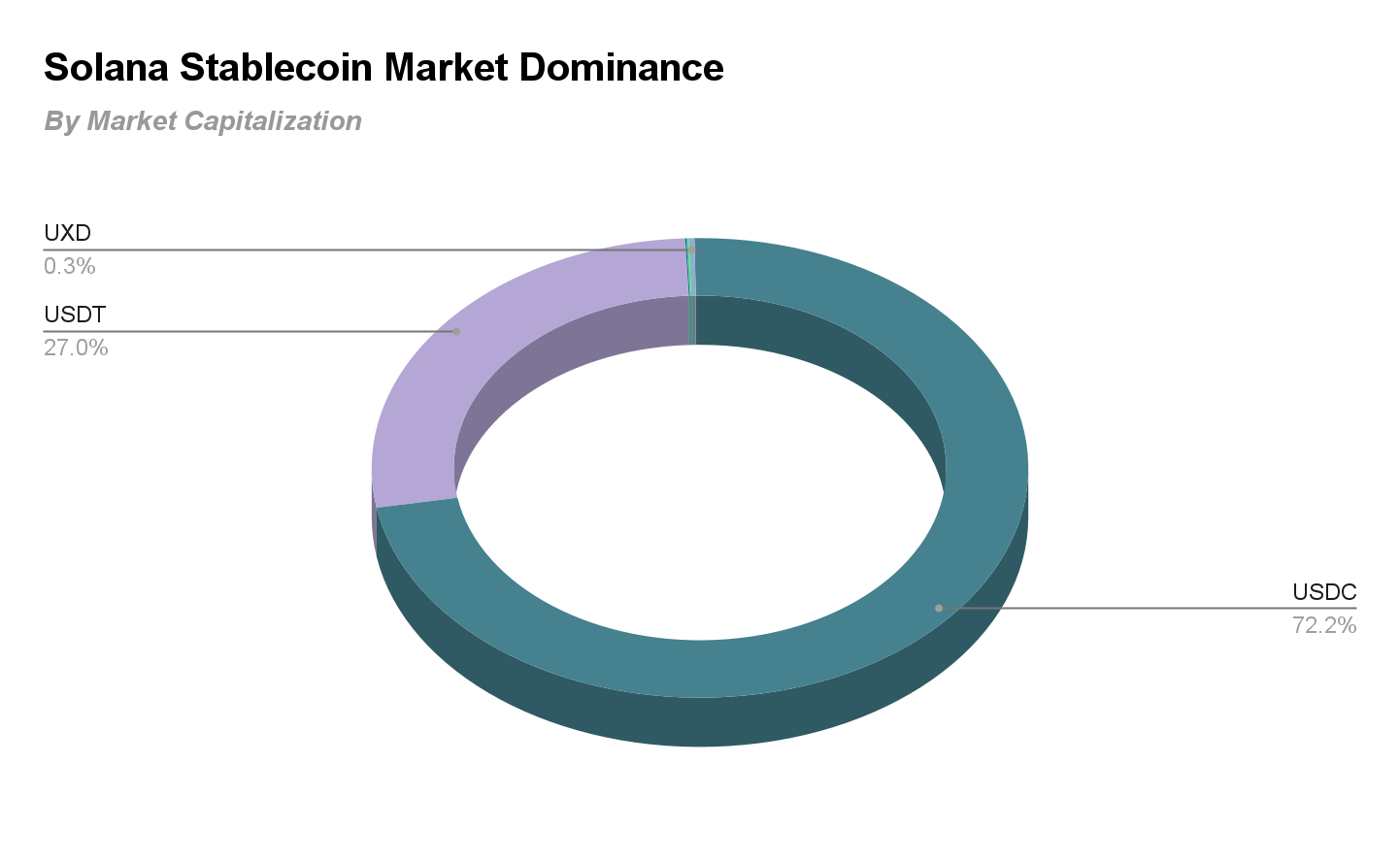

When evaluating the Solana stablecoin market, we can see that there are two coins which dominate stablecoin usage. These two coins are USDC with a Solana chain market capitalization of x>$5bn USD, and USDT with a respective x>1.75bh USD. These are the only stablecoins within the Solana ecosystem with a market capitalization of x>$1bn USD, dominating the Solana stablecoin market.

The focus on Solana from these stablecoins varies significantly. This is displayed by significant variations with the percentage of total market capitalization derived from Solana. We can see that nearly 10% of USDCs market capitalization is from USDC coins on Solana, in comparison to 2.79% with USDT.

The reasons for these differences is due to the adoption across DeFi protocols (which will be touched on later). However, the low percentage of market capitalization across UST, DAI, and BUSD is due to the reliance of wrapping or wormholes in order to utilize these coins.

The largest competitor to USDC and USDT is UXD with a market capitalization of x>20m USD, as shown below.

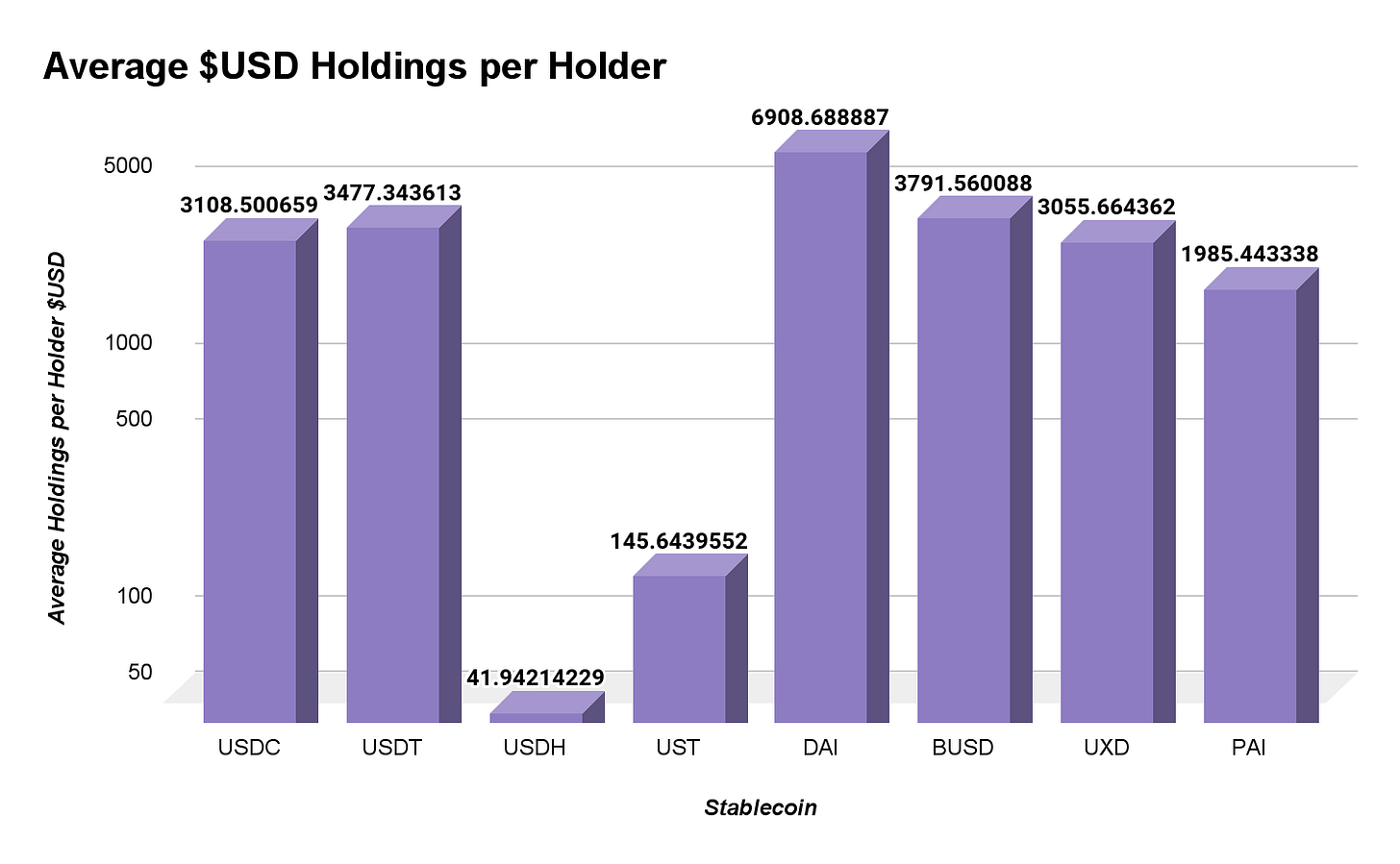

The average holdings of each coin across the market with the majority of coins does not vary significantly, with USDC, USDT, DAI, BUSD, UXD, and PAI having a $4,922 USD spread. The outliers from this are USDH and UST which both have extremely low average $USD holdings per user, as shown below.

When evaluating the market capitalization of native Solana stablecoins (stablecoins originating on the Solana blockchain), we can see that UXD leads the way followed closely by PAI and then USDH. In terms of stablecoin holders, USDC and USDT continue to lead the way. In total, there are 2,201,429 wallets holding stablecoins across the Solana ecosystem. From this, 98.4% of wallets hold USDT or USDC stablecoins.

However, when evaluating the smaller coins, we can see that UST makes a surprising appearance as the third most held stablecoin, followed by PAI, UXD, and USDH. Furthermore, we can see that DAI and BUSD have a significant lack of holders across the Solana space, pointing towards a lack of adoption.

The high holders of UST is due to the adoption of UST across Solana DeFi prior to the UST crash. From research, we can see that UST still has various liquidity pools across major selected Solana DeFi platforms (Orca, Crema Finance, and Solend). However, these pools are drained of value with a total volume across Orca and Cream (past 24hr) totalling $773 USD, all from a single pool.

Adoption of Stablecoins Across Solana

When evaluating the utilization of stablecoins across DeFi protocols, it is clear that USDC leads the way. In each DeFi protocol evaluated, we can see that USDC has the highest adoption. This is most apparent with Raydium where 92% of evaluated pools utilize USDC.

Overall, 71% of pools evaluated across selected DeFi protocols utilize USDC. This was expected due to the dominance of USDC by market capitalization.

Intriguing results occurred when evaluating the remainder of coins (USDT, USDH, UST, DAI, PAI, BUSD). When evaluating the remaining 29%, we can see that USDH is the primary player at 43.5% followed by USDT with 23.9%. Additionally, UXD at 2.5% outperforms PAI, DAI, and BUSD.

These results indicate that DeFi projects across Solana are gearing up adoption of native stablecoins such as USDH and UXD. However, the adoption of these coins by mainstream Solana users has not yet occurred. This is somewhat presented when analyzing the market capitalization of projects / number of DeFi pools. From this we can see that USDH and UXD have some of the lowest values, in front of the failed UST and with UXD ahead of DAI (wormhole requirement), as shown below.

Centralization

A crucial element of cryptocurrencies is decentralization. Upon analyzing the percentage of coins held by the largest address, we can see major differences between Solana stablecoins. The most centralized coin is BUSD with 96.59% of coins held by a single wallet address. In comparison, UXD is the most decentralized functioning stablecoin with 27.93% of all coins held by a single wallet.

From wallet analysis we can determine that all native Solana stablecoins are below the average centralization rate (42.19%). When the two primary outliers are excluded (UST & BUSD), the average holding rate becomes +37.74%. Despite this, native Solana stablecoins remain below the average, outperforming DAI, USDT, and USDC. This trend continues as the top 20 wallets are analyzed with BUSD, DAI, USDT remaining centralized, PAI, UST, USDH, UXD being decentralized, with USDC striking a middle ground.

The most striking result from this analysis is that of UXD. With UXD being the most decentralized functioning stablecoin, native to Solana, and average USD holdings being similar to that of USDC and USDT; we shall evaluate the growth of this coin, comparing it to that of USDC, USDT, and SOL.

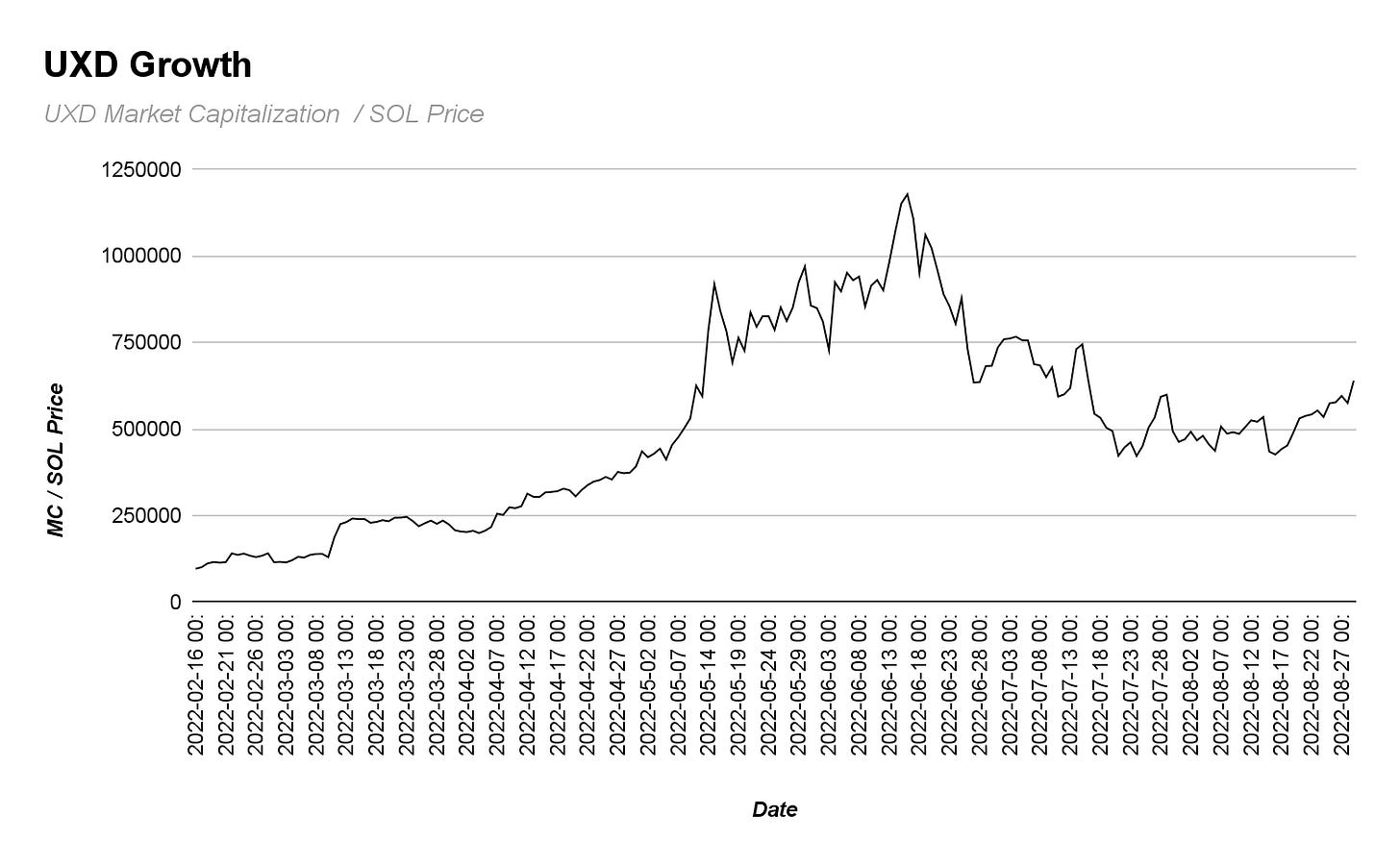

UXD Growth

Between February 2022 to May 2022 UXD saw explosive growth. During this period, the market capitalization of UXD soared from $10,055,065.06 USD to $41,655,148.95 USD marking a +314.27% increase. However, since May the market capitalization of UXD has consistently fallen, with the market capitalization of UXD now at $20,336,221.59 USD (-51.28%). This potentially points to a loss of confidence in UXD. Although, during this period USDT had a major decline (-14.33%), while USDC was stagnant and BUSD saw a minor positive increase.

UXD is the only algorithmic stablecoin in figure (16). On 10/05/2022 UST lost its peg, draining algorithmic stablecoins of investor confidence. This is a likely cause of the drop which UXD faced. However, since February 2022 UXD is up x>100%, displaying long term positive growth. This growth is well displayed when evaluating the UXD market capitalization / SOL price, mitigating negative market conditions, as shown below.

From the chart above we can see that the growth of UXD has begun to recover, despite the continued negative price action across both cryptocurrencies and the traditional markets.

Conclusion

Overall we have identified which stablecoins dominate the Solana stablecoin space, while analyzing details surrounding current trends and patterns across Solana stablecoins. Furthermore, we can conclude that there is a willingness to adopt alternative algorithmic / new stablecoins across the Solana ecosystem, as shown by USDH pool figures and UXD growth.

Author: @page_analyst