Step Data Insights: Staking SOL

An analysis on the current state of the staking ecosystem on Solana

Advisory

This article is not financial advice and is meant to be treated as an informative piece. Always do your own research before investing or trading any cryptocurrencies.

Introduction

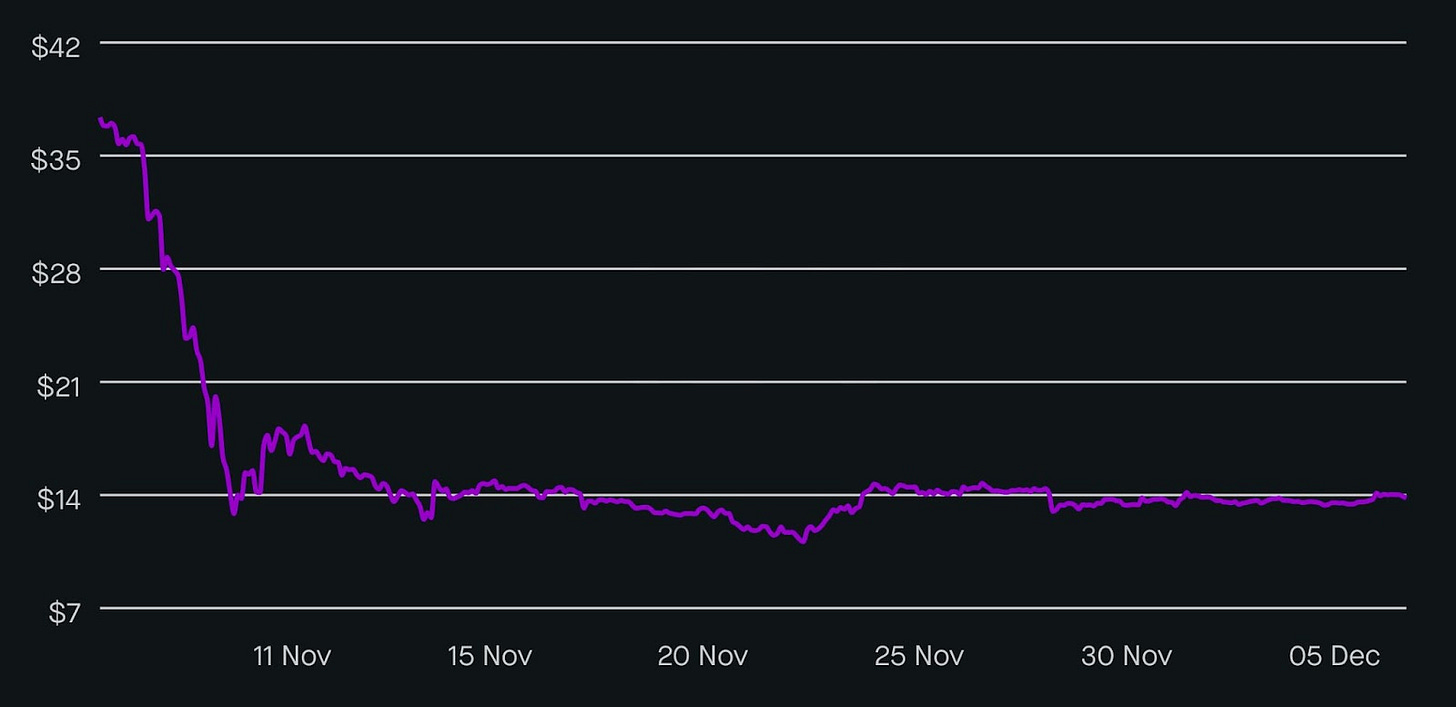

The FTX bankruptcy events that started on November 7, which we talked about in detail in the Special Edition of Step Data Insights, caused a significant decrease in the price of SOL. After FTX announced Chapter 11 bankruptcy proceedings on November 11, the price of SOL went down 60% from its price in early November.

The price of SOL, which has now withdrawn to the range before its run in the summer of 2021 – also called Solana Summer – has been hovering in a narrow range of 20% for about a month, excluding short-term deviations. As the SOL price currently ranges within the demand zone that started the big bull run of SOL during Solana Summer, many investors consider current prices as good buying opportunities that could bring high yields in the long run.

The following question comes to the mind of long-term investors who think that SOL might be in an accumulation phase: How can SOL collected from current prices be used to generate passive income? To address that question, we'll explore staking options of SOL in this issue of Step Data Insights.

Staking on Solana

The Solana network uses a Proof-of-Stake consensus mechanism (PoS). Due to the PoS mechanism, individuals and entities can run programs on specially designed computers, who are known as validators, to support the maintenance and security of the network. Validators can participate in the consensus by voting which blocks should be added to the blockchain and confirming valid transactions in those blocks. As the total amount of stake on the Solana blockchain increases, it becomes progressively harder for attackers to shift the outcome of consensus votes. SOL holders can stake their SOL by delegating them to various validators who process transactions to increase the security of the network. By doing so, they become eligible to receive staking rewards.

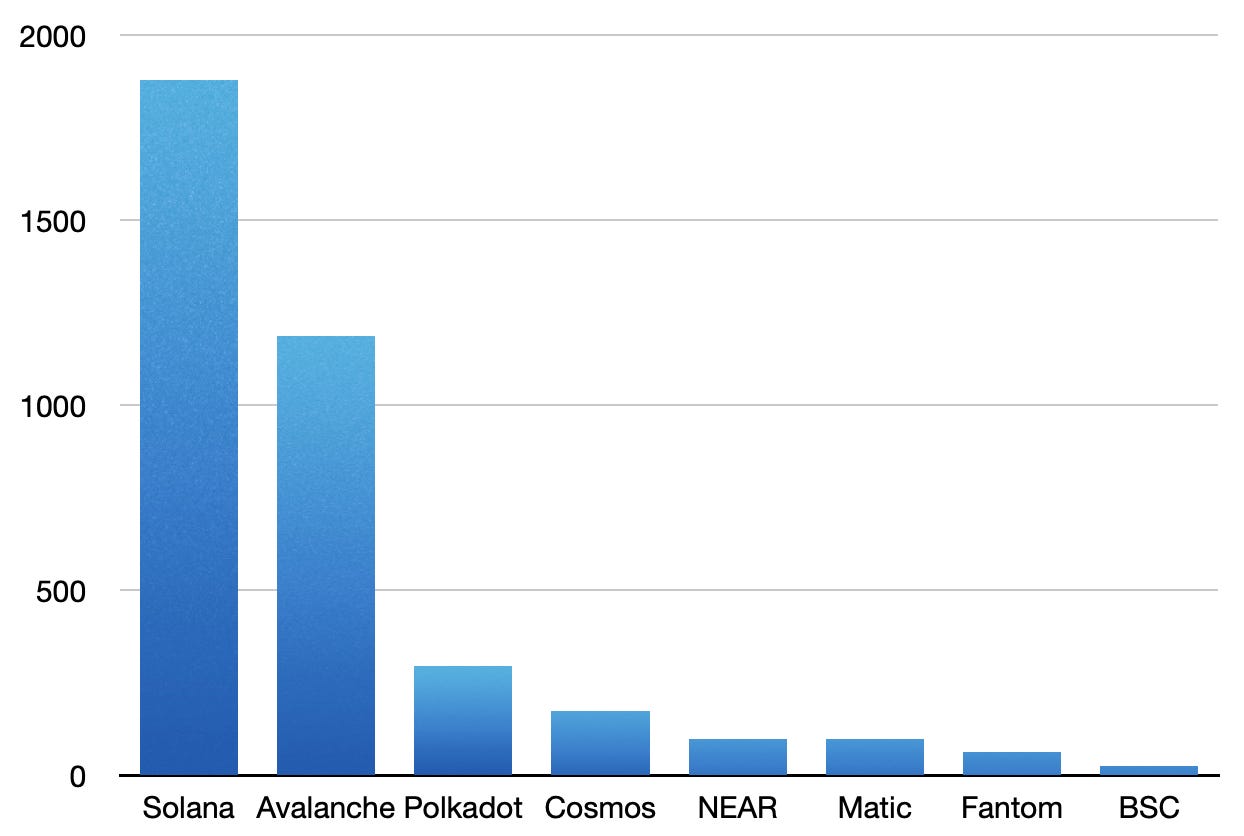

The interest of individuals and entities to strengthen the network as validators has risen with the increasing popularity of the Solana blockchain. Since June 2021, the network has seen approximately 71 new validator nodes joining every month. Currently, there are 1,879 consensus validators on the Solana’s mainnet beta, which is relatively high compared to other major PoS networks. Among those validators, 30 of them constitute superminority, which represents the lowest number of validators that control at least 33.3% of the total stake on the network. Also known as the Nakamoto Coefficient, this superminority number is crucial for a blockchain to be censorship-resistant. Solana's Nakamoto Coefficient, which was 20 at the beginning of this year, has been increasing since the network's mainnet launch.

While all these indicators give long-term hope for the staking ecosystem in Solana, it is a fact that the entire ecosystem went through a hectic month as the two entities with the biggest stake in Solana suddenly went bankrupt. To comprehend how these recent events have impacted the staking ecosystem in Solana, let's take a look at the on-chain metrics of validators and delegators.

Current State

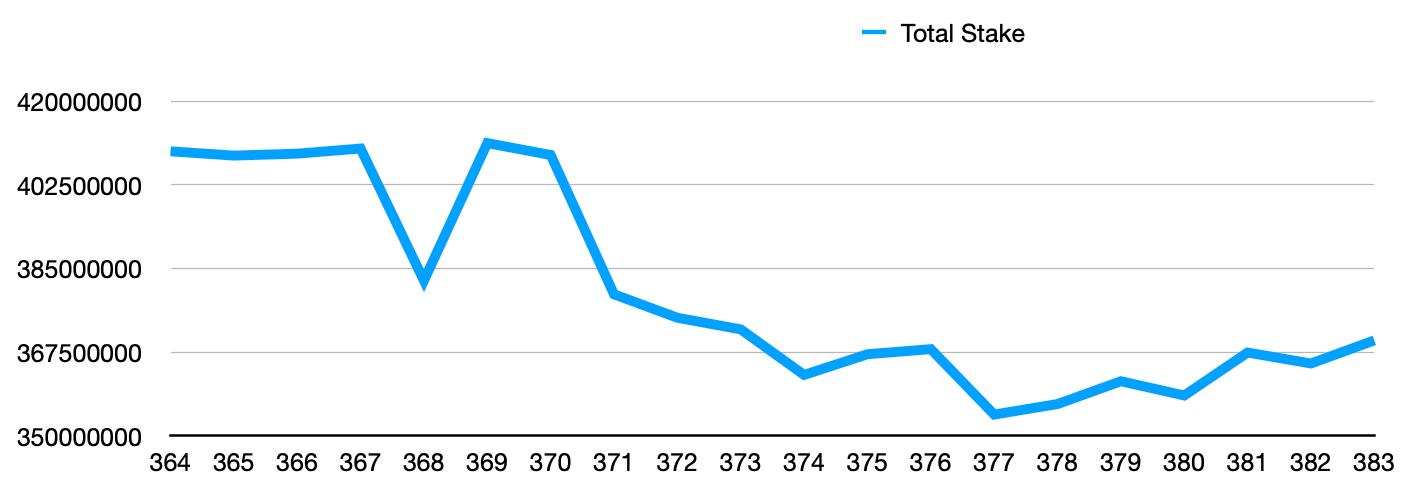

On the Solana blockchain, staking rewards are computed and distributed once per epoch, which lasts approximately 2 days. Accordingly, staked SOLs can be locked or unlocked on an epoch basis. At the time of the downfall of FTX, the Solana network was in its 370th epoch (November 7-10). To understand how the FTX incident affected the staking ecosystem of Solana, we will evaluate the validator and delegator activities after the 370th epoch of Solana.

Including the locked supply, there are approximately 369.5M SOL staked at the time of writing. This corresponds to 68.1% of the total supply. However, the number of staked SOL was approximately 408M before the FTX incident, or about 76% of the total supply. The net change in the total number of staked SOLs at the end of the 370th epoch was -29,153,269 SOL. In this epoch, where more than 5% of the total SOL supply was deactivated, 15,679 stake accounts were deactivated while 6,058 stake accounts were activated

After the peak hysteria at the 370th epoch, the net change in the number of active stakes decreased, but we see that not many stakes were activated until the 374th epoch (Nov 17-19). In epoch 374, Solana Foundation activated the stake of 12M SOL from their treasury by strategically delegating the tokens to a variety of validators to support the decentralization of the network. After the large negative change in the number of active stakes in the 376th epoch (Nov 22-24), the volatility of the net change in the number of stakes on Solana has subsided.

Looking at the stake growth graph, the number of total staked SOL seems to have stabilized. This indicates that the trend of deactivating stakes, which originated from the panic wave that started with the bankruptcy of FTX, could be over. If we look at this data considering that long-term investors think the SOL price is in a high time frame demand zone, it is possible to derive that the total number of staked SOL has found a local bottom.

For investors who would want to evaluate these scenarios to stake SOL, in this episode of Step Data Insights we will go over a couple of factors that stakers should consider before choosing the most suitable validators for them.

Validators

The higher the stake delegated to validators on the Solana blockchain, the higher the chance that the validators will be selected to write new transactions to the ledger. The rewards that the validators and their delegators earn increase in proportion to the transactions that the validators write to the ledger. Hence, validators with more stake tend to earn more staking rewards as they keep the network running as fast as possible.

There is a cost for validators to run and maintain their systems. This cost is deducted from the rewards earned by the delegators as a fee, which is called commission. Validators with fewer stakes can compete with validators who earn more rewards for having more stakes by keeping their commissions lower for their services. These commission fees generally range between 0% and 10%. Smaller validators charge lower commission fees to attract new stakes, while larger validators usually have higher commissions.

However, it is not always necessarily the best option to filter out validators with the largest stakes when choosing validators. All stakers choosing the most popular validators to stake could lead to an increased risk of malicious attacks and network halts. The more the stakes on the network are distributed among the various validators, the greater will be the Nakamoto Coefficient of Solana, and hence the security of the network. In this regard, to improve the health and decentralization of the network, stakers are more often than not encouraged not to choose the largest validators and to distribute their stakes across different validators. For example, Laine, which is one of the leading validators on Solana, divides validators into three categories when evaluating them: high stake, medium stake, and low stake. Validators with less than 250,000 SOL stakes are considered 'low stake'. When calculating Laine's validator ranking score, validators with 200,000 SOL staked get the highest score from the stake size criterion. Although many other factors are taken into account when calculating the validator ranking score, Laine ranks 1354 in their ranking system because they have a high number of stakes (4,213,788 SOL) and they are in the validator superminority.

Juicy Stake, which is a 'low stake' validator, can be cited as a counter-example to Laine in terms of factors to consider when choosing a validator. With a total stake of 208,353, Juicy Stake ranks 4th in Laine's ranking system. Juicy Stake operates with 0% commission like many other smaller validators. Staking rewards and APY vary according to the commission rates of the validators, although they also vary according to the operators of the validators.

Stake Pools

While stakers are often encouraged to split their stakes into independent validators, it is still one of the biggest potential improvement areas for Solana to be more censorship resistant. Accordingly, Solana introduced stake pools as an alternative method of earning staking rewards. Staking in stake pools is an innovative approach that allows users to earn staking APYs without delegating their tokens and locking their liquidity. For this reason, staking in staking pools is also called ‘liquid staking’. Stakes delegated to a stake pool are distributed across hundreds of different validators. For example, stakes in the stake pool of Marinade Finance, the liquid staking platform with the largest TVL on Solana, are distributed across 464 distinct validators. This way staking pools reduce the staking concentration on the validators. Reducing the stake concentration supports the network with improved censorship resistance, decentralization, and security.

Stakers on Solana need to wait until the end of the latest epoch to start earning staking rewards for their recently activated stakes. Deactivated stakes must also go through a cool-down period until the end of the latest epoch before they become tradable and transferrable. In addition to supporting the network, liquid staking pools allow the stakers to enter and exit pools without any warm-up or cool-down periods.

Liquid staking on Solana is an easy one-step process. Stakers start earning staking APY as soon as they exchange their SOL with any tokenized form of staked SOL from liquid staking protocols or any DEX. Examples of some of the most commonly used tokenized staked SOLs are mSOL and stSOL. These tokens allow their holders to both leverage staking APY and use these staked SOLs in DeFi protocols.

Current State

The TVL on the liquid staking protocols on Solana is approximately 9.7m SOL, which only captures ~2.8% of the total share of native staking. One of the reasons this rate is relatively lower is that the concept of liquid staking is not that old for Solana. Namely, stake pools on Ethereum were introduced in 2020, while on Solana they were first introduced in the summer of 2021. Considering the advantages of liquid staking over native staking and the novelty of the liquid staking ecosystem on Solana, it would not be wrong to expect growth opportunities in the future.

Currently, two liquid staking protocols account for about 90% of the TVL of staking pools in Solana alone: Marinade and Lido. In this environment where those two players are clearly much more dominant than the others, there is still room for new players who develop different strategies. For example, even though it's been a little over a month since its launch, Jito Labs' staking pool is already at #4 in terms of TVL.

Conclusion

Looking at the on-chain data on the staking ecosystem on Solana, the damage caused by FTX's bankruptcy seems to have been absorbed. The largest decrease in the total number of staked SOL was at the end of the 370th epoch, indicating that this sudden decrease was due to panic in the environment of uncertainty. The total number of stakes on Solana, which has stopped falling and has been flat for a while, may have found a local bottom.

For those who think these prices are good buying opportunities in the long run and want to stake SOL, there are many validators of all sizes on Solana. However, stakers are encouraged to delegate their stakes to smaller validators to support the decentralization of the network. Stakers can use the ranking systems of leading validators (such as Laine’s) to find the most suitable validator for them to delegate their SOL. The fact that the leading validators give higher scores to the smaller validators in their own ranking systems also shows that the big players in the ecosystem focus on supporting the network rather than increasing their commission income.

Even if it does not constitute a large share in the staking ecosystem for now, there is also a liquid staking ecosystem that can be beneficial for stakers on several counts. Following the developments in a relatively new ecosystem such as liquid staking may present various opportunities for investors in the future.

Author: @levvercetti

If you want to stay up to date with the latest Step Finance news and data insights, be sure to follow us on Twitter and join our Discord as well.