The biggest crypto narrative only works on Solana

Introduction

Why do Stablecoins matter?

Remittances

Payments

Growth of Stablecoins on Solana

Solana Pay integrates with Shopify

Introduction

When we talk crypto, stablecoins are generally not mentioned before Memecoins, NFTs or other tokens. However, crypto analysts and enthusiasts make the case that Stablecoins are the only killer use case for Cryptocurrencies to date. Today, we will look into the reasons why Stablecoins are a pillar of blockchain adoption and why Solana is well-positioned for this narrative.

Why do Stablecoins matter?

Stablecoins are digital assets built on blockchain technology, making them accessible to anyone with an internet connection. Individuals in regions with limited access to traditional banking services are able to seamlessly use stablecoins. Stablecoin transactions typically take seconds or a few minutes, regardless of weekends or holidays, whereas traditional bank transfers may take hours, days or even weeks depending on the type of transaction. In addition, stablecoin transactions generally have lower fees compared to traditional cross-border banking transactions, which can involve currency conversion fees or intermediary bank fees. For reference, a Solana transaction generally costs on average $0.00025.

Remittances

Stablecoins are especially important to tackle the issues with remittances, as they facilitate cross-border transactions with little to no friction, and remove the need for multiple currency conversions and intermediaries which often drastically reduce the total amount received by the receiver. Although in Europe and the United States of America a large percentage of citizens are banked; this is not true for African, South American and Asian countries. Stablecoins can provide financial services to underbanked populations who lack access to traditional banking infrastructure.

Access to blockchain also creates more opportunities for individuals to capitalize on their money. Stablecoins are widely used within DeFi ecosystems, enabling users to participate in various financial activities such as lending, yield farming and trading. Stablecoins also remove the friction of sending money or completing payments with volatile assets such as Bitcoin.

Payments

Blockchains provide the best of both worlds: fast cryptocurrency transactions and the stability of traditional currencies such as the US Dollar. As the stablecoin market grows, crypto adoption will develop accordingly. When the demand for blockchain grows exponentially, the pressure on the existing technology will grow as well. Although today’s technology is not prepared to handle mass adoption, some networks are more prepared than others. Solana is arguably the most well-prepared blockchain for the payments narrative to grow.

Growth of Stablecoins on Solana

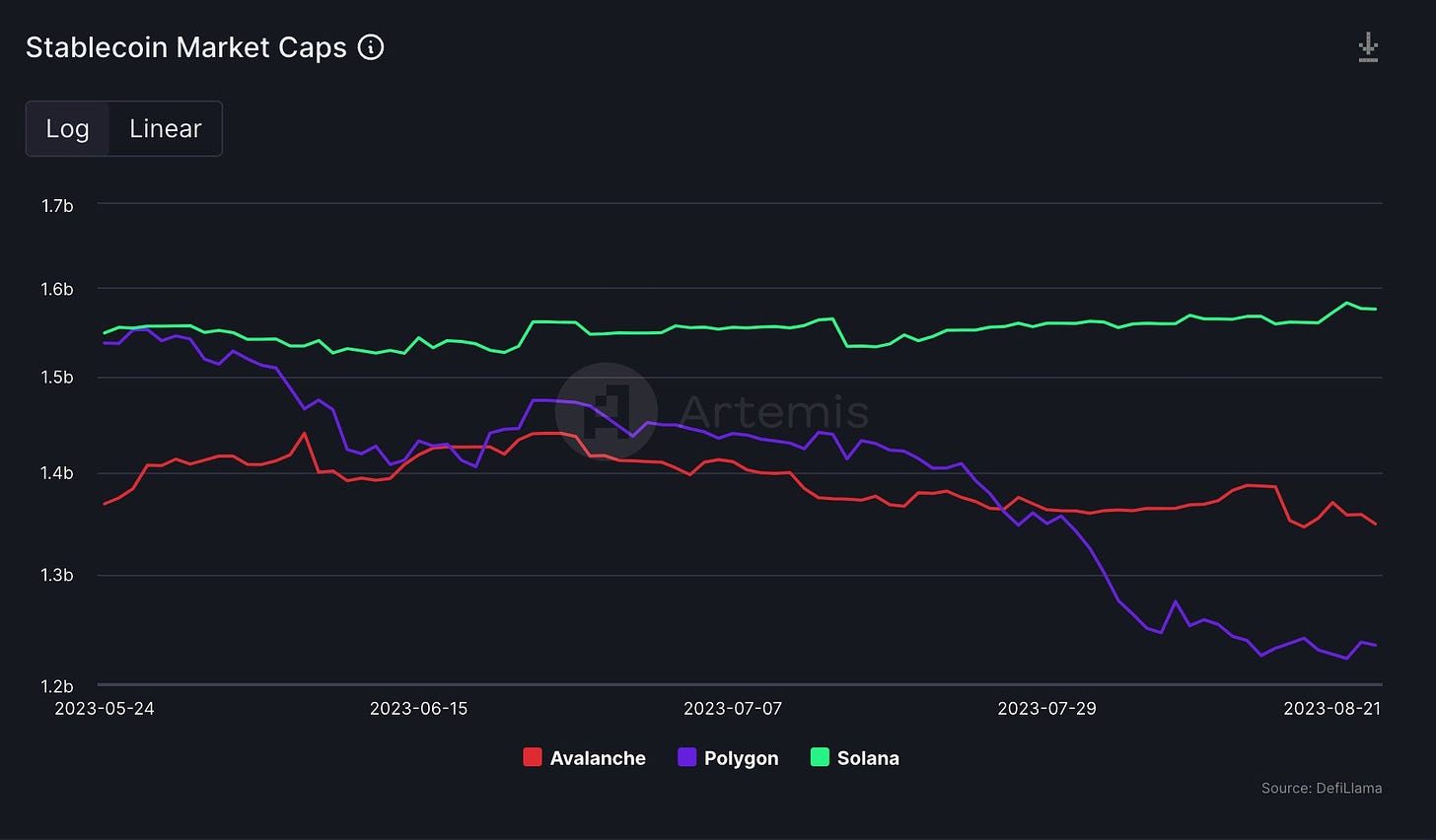

The stablecoin market cap is important for measuring the health of an ecosystem. A higher market cap signals increased liquidity, user adoption, and economic activity within the ecosystem. It reflects the ecosystem's vibrancy, engagement in DeFi, stability, and utility.

Year-to-date, Solana’s stablecoin market cap has grown 2%, from $1.55B to $1.58B. Other chains such as Polygon and Optimism have seen negative growth of -20% and -2%, respectively.

Solana Pay integrates with Shopify

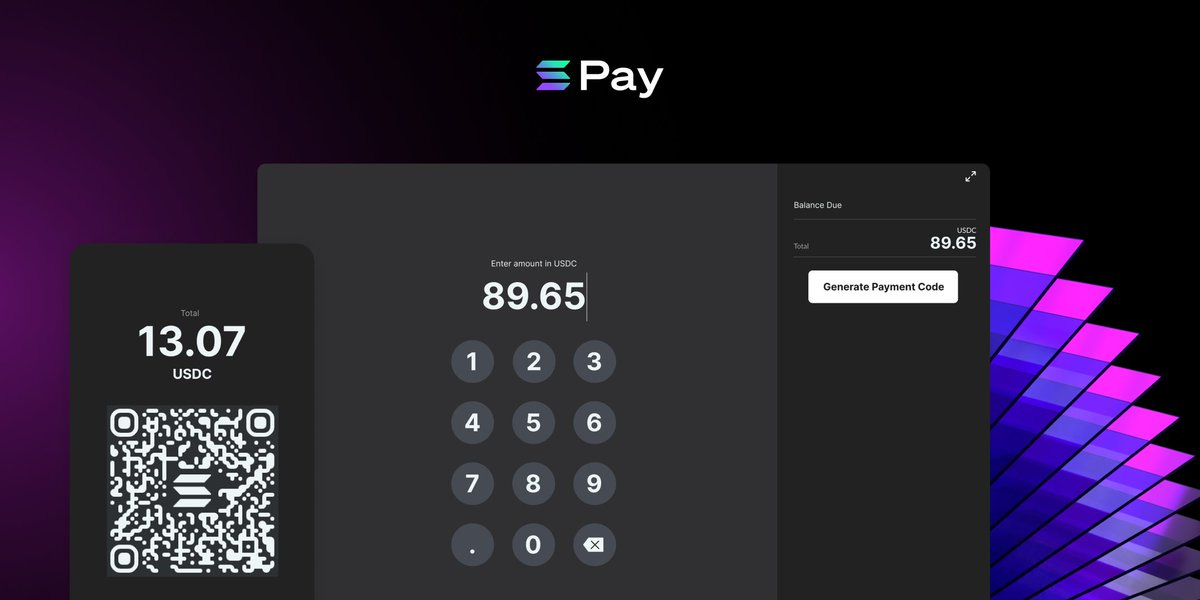

Recently, Solana Pay announced an integration with Shopify, allowing businesses and users to transact using USDC.

USDC, the second-largest stablecoin with a market cap of $25.9 billion, will be the initial payment option for this integration. Josh Fried, business development and partnerships at Solana Foundation, mentioned that cryptocurrencies like SOL and BONK could be added to the list of available currencies for payment in the future.

Shopify accounts for 10% of total U.S. e-commerce and $444 billion worth of global economic activity.

Credit card processing fees usually cost a business between 1.5% and 3.5% per transaction, far more expensive than the average cost of $0.00025 per transaction on the Solana blockchain.

Conclusion

Stablecoins are likely to be one of the first areas of crypto to see mass adoption due to their lack of friction, peg to trusted currencies and greater censorship resistance over traditional digital dollars held or sent through traditional banking systems. Solana is the blockchain with the best chance of handling the tech requirements of the mass adoption of crypto. Solana Pay is pushing the narrative forward with developments and integrations such as the most recent with Shopify.