Summary

Introduction

Real World Asset Tokenization

There are many advantages to keeping the ownership of real-world items on chain

Owning a fraction of the Mona Lisa

How can Tokenization be settled

Real Estate Tokenization

Real Estate Trading on Solana - Parcl

Parcl has a unique opportunity

Conclusion

Introduction

In the midst of this bear market, we have reached a point where many ask “Why does crypto exist?”. Many argue that crypto companies are investing too much attention and money in continuously trying to revolutionize the web3 world, instead of trying to fix Web2 problems with the power of blockchain technology.

There are, however, projects currently working to bridge the gap between Web2 and Web3 and today we will take a look at what they're doing and why it matters.

Real World Asset Tokenization

The goal of real-world asset tokenization is to create a virtual investment vehicle on the blockchain linked to tangible assets like real estate, precious metals, art and collectables. So instead of the deed to purchase being a physical piece of paper, the ownership is put on-chain. This could be traded between two parties directly, or fractionalized and offered to many people to buy.

There are many advantages to keeping the ownership of real-world items on chain

The implementation of blockchain in asset ownership eliminates the involvement of intermediaries, such as lawyers, brokers, and banks, effectively reducing costs associated with traditional middlemen. Cutting out these intermediaries, participants can directly engage in transactions, streamlining the process and potentially reducing fees and commissions.

Blockchain-enabled ownership allows for swift 24/7 trading of assets, unlike traditional markets and bureaucracy work. Constant accessibility allows for greater flexibility and a more dynamic and responsive marketplace. In addition, Blockchain's democratizing nature significantly lowers the barrier to entry for individuals seeking to invest in or trade real-world assets. Fractional ownership through tokenization allows hundreds or even thousands of investors to own a portion of an asset, creating an opportunity for them to invest in areas such as real estate and art, previously impossible for most of them.

Owning a fraction of the Mona Lisa

For example, if the Mona Lisa was bought by a private investor who then tokenized it through blockchain technology, he could allow thousands of people to buy a fraction of the painting, effectively owning a piece of history. Blockchain creates the opportunity to create and expand several existing markets, while also opening up the doors to millions of people

How can Tokenization be settled?

In the case of fiat currency, stablecoins are the most obvious form of real-world asset tokenization. Tokens such as Tether or USDC are tokenized dollars. Each token represents one actual dollar that the company has in reserve and the tokenized version allows for faster and direct settlements between parties.

Real Estate Tokenization

Real estate asset tokenization involves dividing a property into smaller pieces with equal rights and value, similar to how a private business goes public through an IPO.

When a property is tokenized, investors can acquire tokens representing proportional ownership of the property and receive revenue based on their token holdings. This process adds a technological layer to the concept of shared property ownership.

Traditional real estate investment has challenges like the lack of liquidity, the need for significant capital, finding trustworthy co-investors, and handling complex mortgage processes. Each property is divided into a number of tokens, allowing investors to participate with smaller amounts of capital.

In addition to investing in fractionalized real estate, there is another use case enabled by blockchain: Real Estate Trading.

Real Estate Trading on Solana - Parcl

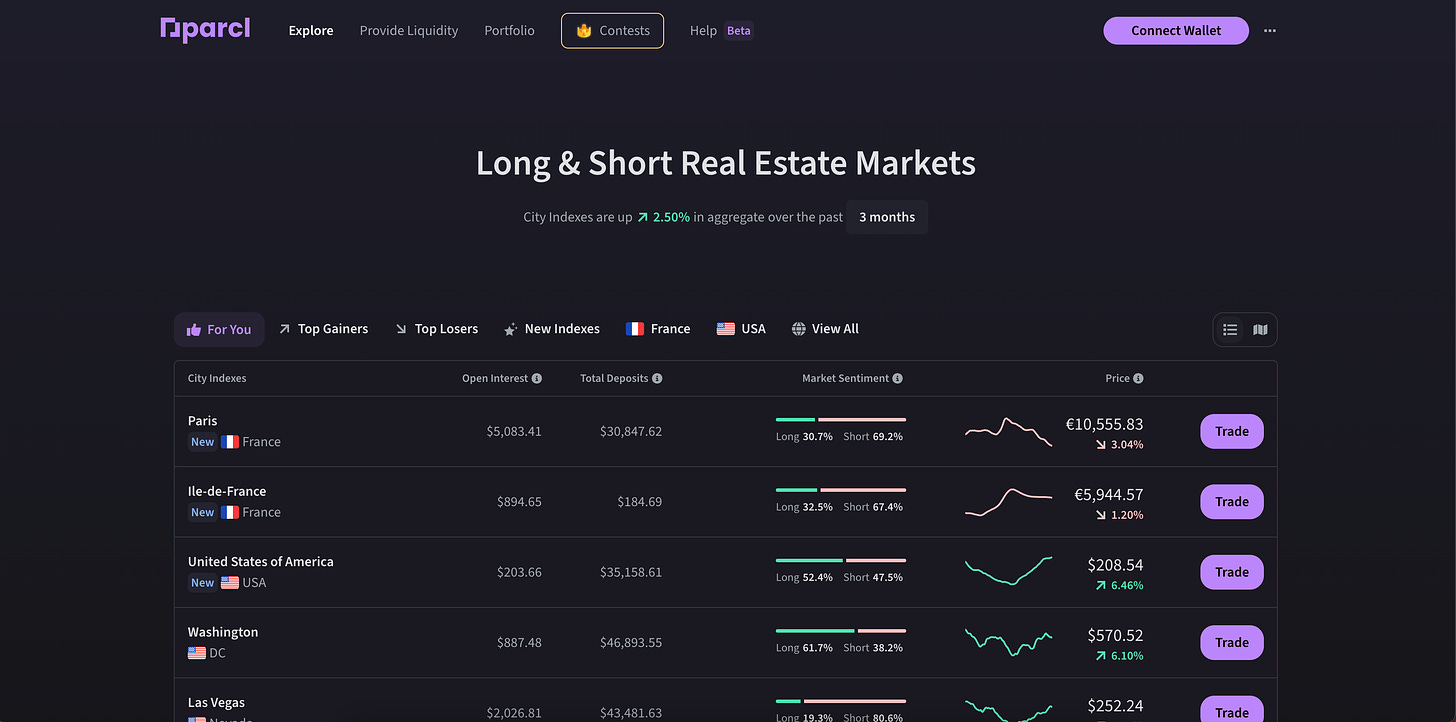

The Parcl Protocol is a DeFi investment platform that allows users to trade the price movements of real estate markets around the world. Users can discover global real estate markets, gain detailed insights, and have the opportunity to either buy or short real estate markets based on whether they think real-world property values will increase or decrease. The Parcl Price Feed provides users with the most accurate and reliable data to trade on. The price feed represents the median price per square foot/meter, aggregated at either the city or neighbourhood level, and updated daily.

Parcl allows users to easily long or short real estate markets through spot or with up to 10x leverage. Although the majority of available trading cities are from the United States of America, just recently, Parcl opened up their first international cities, Paris and Ile-de-France.

In addition to trading the real estate market, users can earn trading fees by providing liquidity to pools.

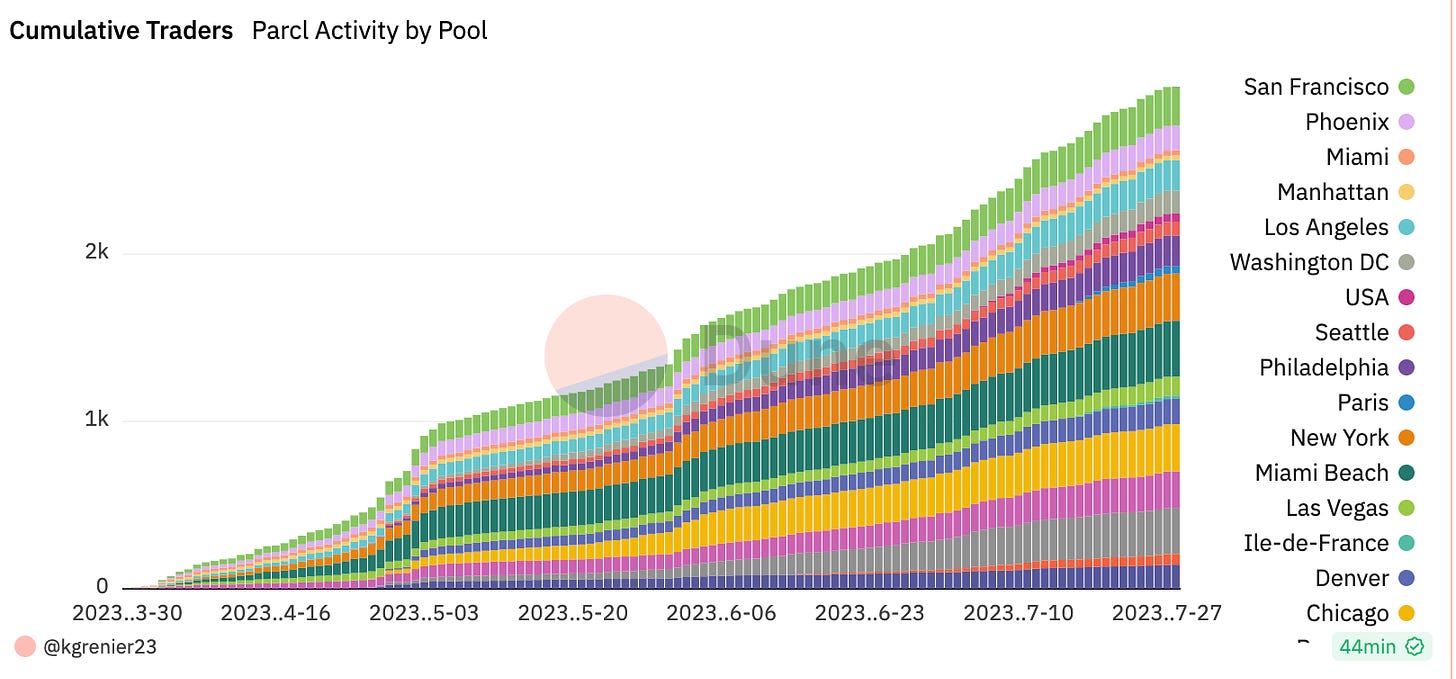

Parcl has been growing exponentially in the last two months, as several initiatives and trading incentives attract thousands of traders to explore the real estate trading market.

Parcl has a unique opportunity

Unlike most crypto apps and platforms today, Parcl is tackling a web2 problem by providing a web3 solution that impacts billions of people in the world. As more cities and countries are added to the trading portfolio, more users may be onboarded and the more interest Parcl may attract from millions of people who wouldn’t otherwise be able to invest in Real Estate. Another important aspect of Parcl is that it may be unaffected by crypto market conditions. A bull market in crypto will obviously have an impact on the number of traders and liquidity flowing into the protocol, but a bear market may not negatively impact the platform as much as it impacts crypto DEX and centralized exchanges, due to its direct correlation to such a robust market as the Real Estate market.

Conclusion

It is important to focus on fixing Web2 problems with Web3 technology, instead of trying to create Web3 problems and deliver solutions. Teams like Parcl are focusing on the Real Estate market, through their trading platform, which allows anyone to theoretically invest in real estate with as little as $1.