Step Data Insights: Tokenomics

A look into the on-chain tokenomics of the Step Finance token, the SAMO dog coin and Star Atlas's in game currency token, ATLAS.

Advisory

This document is not financial advice and is for education purposes only. Always do your own research before investing or trading cryptocurrencies.

Introduction

At time of writing there are x>10,000 cryptocurrencies in existence. These cryptocurrencies have a variety of use cases and purposes. For example, DeFi tokens are created in order to provide access to financial applications. Whereas DAO tokens are used for governance, allowing individuals to vote and pass through proposals.

Cryptocurrencies require a tokenomic outlook. This revolves around the supply, distribution, and issuance of tokens over a selected period of time. The tokenomics deployed is influenced by the need and wants of a project and its investors. From this, we see major differences in tokenomics between projects across the cryptocurrency space. For example, in figure (1) below we can see variations in the total supply of selected cryptocurrencies.

In this week's newsletter, we will be evaluating the tokenomic progression of STEP, SAMO, and ATLAS.

Samoyedcoin

Overview

Samoyedcoin have deployed a simple tokenomics system, with a single coin (SAMO). Due to the coin being a memecoin, the price of SAMO is effectively driven by pure speculation. The project aims to bring awareness towards Solana and cryptocurrencies, acting as a stepping stone for individuals into the space.

Details

There is no technically derived value (e.g. DEX fees paid in SAMO). Thus, when creating the SAMO allocation, the team decided to implement an extremely aggressive burn strategy. This burn strategy involved sending SAMO tokens to various designated burn addresses. For example, on 28/04/2021 a transaction of 289,780,000 SAMO was transferred to the burn wallet BurnAirdropSamooooooooooooooooooooooooooooon. This saw $608,648 USD burned in a single transaction (which cost just 0.002 SOL).

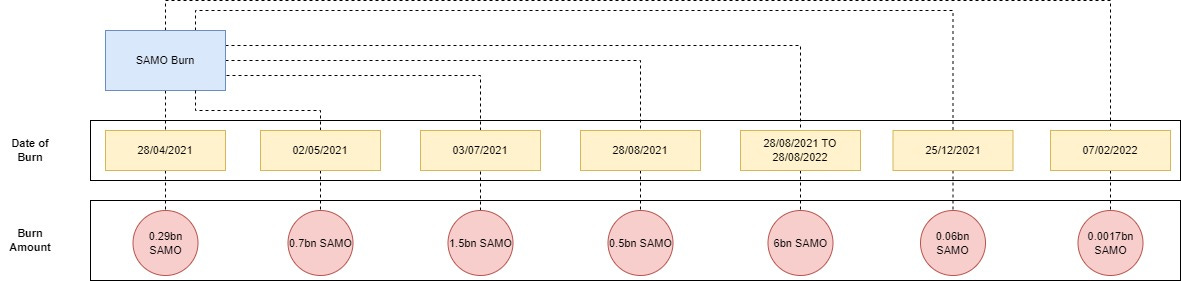

The wallet which SAMO was sent to is inaccessible, therefore removing this SAMO from circulation. The transaction can be viewed here. Overall, SAMO conducted seven burn events since its inception. These token burns deployed equate to 66.1% of the project's total supply, as demonstrated below in the overall allocation.

At its inception, SAMO had a total supply of 14bn tokens. According to data from CoinGecko, 4,746,913,623 SAMO coins are currently circulating, comprising 100% of the total supply. Therefore, 9.254bn SAMO have been burned (equating to 66.1% of allocation). Thus, we can derive that all scheduled SAMO token burns have taken place. The events displayed in figure (3) have occurred.

Price Action

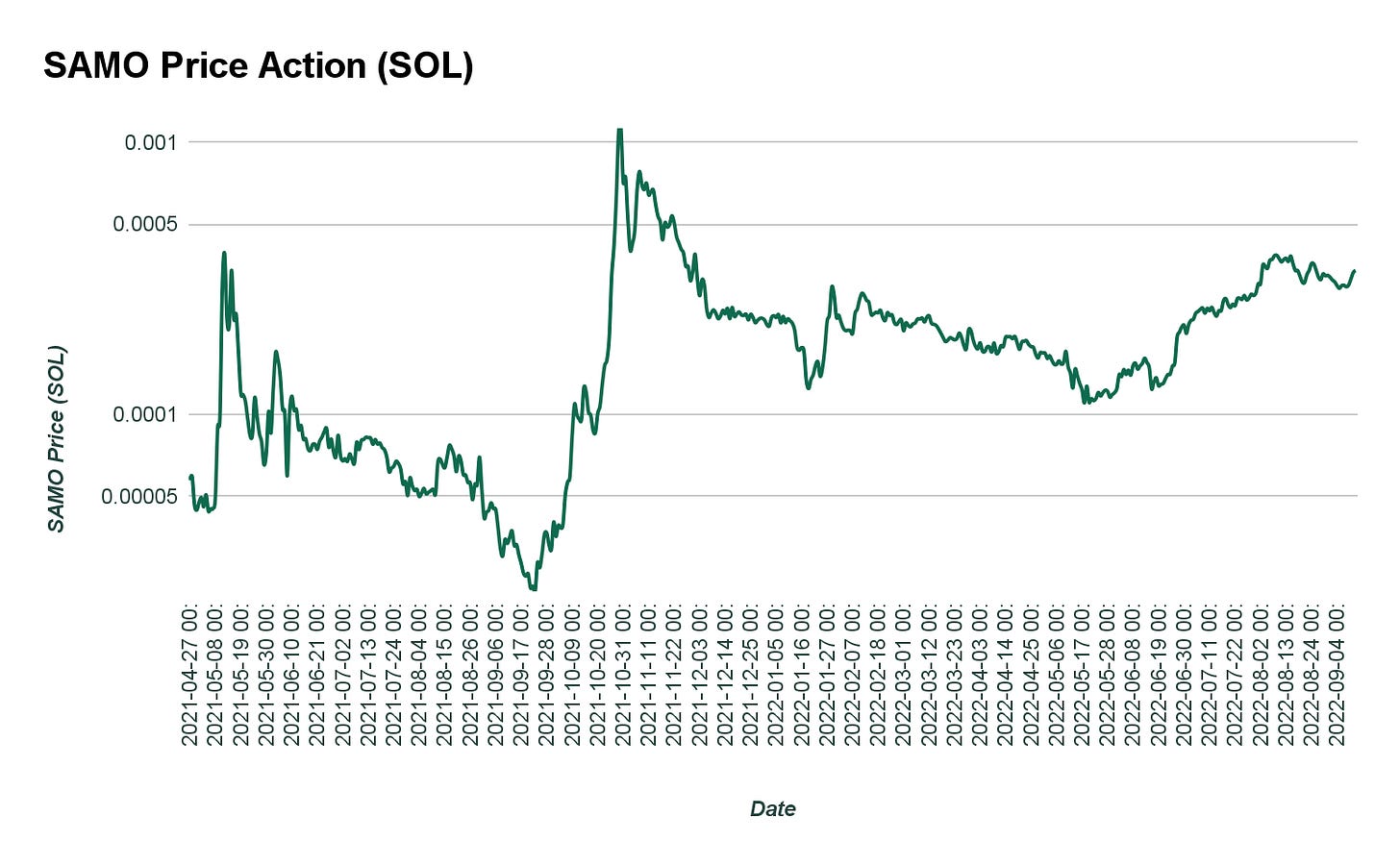

These token burns have likely had a profound positive effect on the price of SAMO. This is demonstrated when evaluating the SOL price per SAMO since the project's inception.

Conclusion

Overall, the vesting schedule of SAMO is coming to a close, meaning that the coins will be driven by speculative market value, unless the team decides to implement additional burns, as seen on 25/12/2021. The simple yet effective tokenomics deployed by the SAMO team has resulted in major positive price action. Furthermore, it has significantly aided the project's decentralisation, with the largest holding address having 14.4% of the circulating supply, and x>20 top wallets holding 33.40% of the circulating supply.

Star Atlas

Overview

Star Atlas is a space strategy game, built on Solana. Unlike SAMO, Star Atlas has implemented a more complicated tokenomics system. The organisation has deployed a dual tokenomics system, with two native cryptocurrencies. These cryptocurrencies are ATLAS and POLIS. For this newsletter we will be focusing on the cryptocurrency ATLAS.

ATLAS

ATLAS is the payment token used for economic interactions within the game itself. Whether this be in game mining, technology crafting, or for production purposes. This token is rewarded in game for activities conducted by users. Through rewarding users tokens in game, while requiring the token to be used for purchases, the supply-demand (upon game release) will be somewhat balanced.

Token Raise

When conducting the public round for ATLAS, the organisation raised a total of $1m USD, with public capital from FTX and Raydium.

Through rewarding users tokens in game, while requiring the token to be used for purchases, the supply-demand (upon game release) will be somewhat balanced. For the ATLAS public funding round, 2.0% of the total supply was allocated which equates to 720m ATLAS tokens. When evaluating the token distribution is dominated by rewards / emissions, with this segment containing 65% of the total supply.

These emissions will be primarily distributed upon the games release through the following outflows:

Mission rewards

PVP rewards

Staking rewards

Mining rewards

However, significant emissions have already been released by the team. Some of the rewards / emissions have been released. This has primarily occurred through LPs with additional set rewards, such as the ATLAS / USDC pool on Raydium. However, emissions mainly released have been allocations separate from the rewards segment e.g. team.

This has had a profound negative effect on the market capitalization of ATLAS. Currently ATLAS has a SOL market capitalization of 325160 SOL down from 3638095 on 05/09/2021. This represents a market capitalization loss of 91.063% against SOL.

Major market capitalization contractions have occurred in part due to the savage exponential decline of the cryptocurrency market since the launch of ATLAS. However, this market capitalization contraction is further due to the increase in ATLAS supply during this time period. Between 2022 to 2023, ATLAS has a projected inflation rate of 184.72%. The inflation rate of ATLAS will only match the US inflation rate of 8.3% by January 2028.

Current ATLAS Tokenomics State of Play

According to the ATLAS emission schedule, the current circulating supply should be approximately 10.5bn, representing 29.16% of the total supply.

At time of writing, 68.125% of emissions currently being released are from the team, listings / liquidity pools, private, and public sales. Thus, the remaining 31.875% are from the rewards / emission allocation. Emissions will gradually shift away from elements outside rewards e.g. team, with the final non rewards emission occurring in December 2023.

Wallet Analysis

When evaluating the current top ATLAS holders, one address sticks out as it owns 59.5% of the total ATLAS supply.

Since January 2022, this wallet has released a total of 1,847,493,784 ATLAS and has a current balance of 21,415,314,374.9 ATLAS. The total of these two figures is 23.263bn ATLAS, which is 64.61% of the total supply. Therefore, we can derive that this is the ATLAS wallet releasing tokens for the rewards emissions.

Conclusion

Major emission releases are incoming for ATLAS. However, the inflation rate of ATLAS will gradually decrease over the coming years, with the worst of the ATLAS inflation passed. Despite this, major value of the ATLAS has been lost, and emission of tokens continues at the suggested rate in the Star Atlas whitepaper. From analysis, no tokenomic changes have been adjusted due to the exponential value shrink, continuing the downside pressure on the ATLAS cryptocurrency.

Step Finance

Overview

Step Finance is the leading data insights platform on Solana. Step Finance allows users to interact directly with their favourite protocols across Solana from within the dashboard e.g. entering / exiting pools. Similarly to Star Atlas and Samoyedcoin; Step Finance has its own native SPL cryptocurrency, STEP.

STEP

The primary utility of STEP is that it allows users to conduct specific interactions with the Step Finance dashboard. Fees collected from platform services purchase STEP and sent to the xSTEP staking contract, with STEP distributed to stakers. Step Finance is currently moving towards a subscription based service with a focus on providing on-chain data.

Original Tokenomics

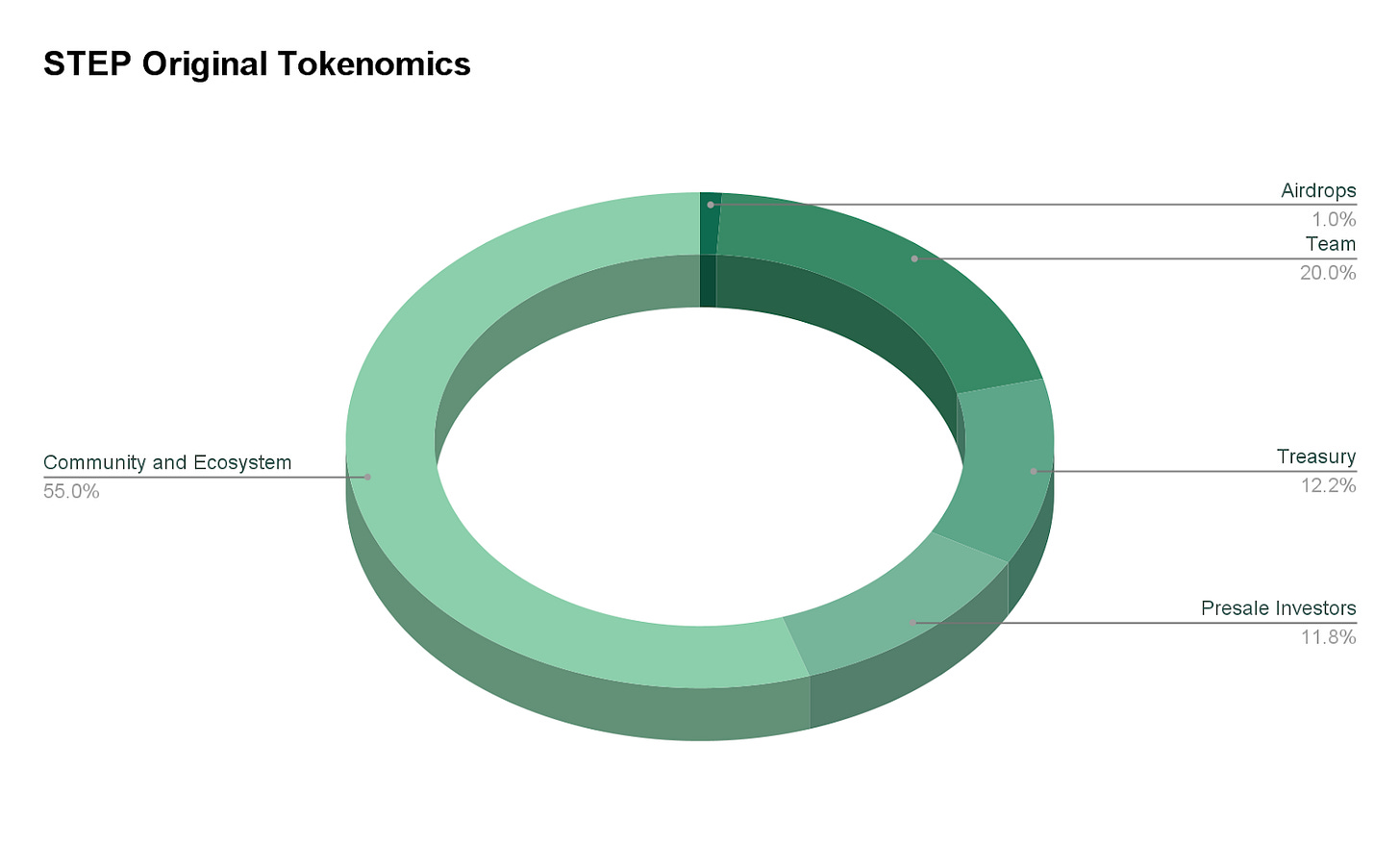

Upon the inception of STEP 1bn tokens were implemented as the max supply. From this, the following allocations demonstrated in figure (x) were implemented.

The 1bn tokens created were to be released over a two year period with a weekly emission reduction of 4% p/w. Furthermore, there were lockups for team and presale investors. Original emissions were primarily released through incentivised LPs with the pairs being STEP/USDC and RAY/STEP on the Raydium platform. During this period official STEP LPs on Raydium had an APY upwards of 50,000%. From STEP LP farms 92,507,486 STEP has been emitted. This equates to 16.2% of the 550m allocated community and ecosystem fund. These farming emissions have now ended with STEP, with final incentivised farm emissions occurring in July 2021, with no intended future farming emissions.

Tokenomic Adjustments

The direction of Step Finance has shifted from a DeFi focused platform towards on-chain data. Thus, the tokenomics of the protocol have changed. The main tokenomics shift occurred in the community and ecosystem segment. Originally 55.0% of the total allocation was designed for community and ecosystem. However, 50% of the community pool emissions have been burned, equating to 232,398,073 STEP. This was not the only burn to occur, with 37% of the total supply burned (369,893,208 STEP). Burn segments are demonstrated in figure (x) below.

Price Action

During the period of high STEP inflation and incentivised LPs, STEP lost significant value against SOL, falling 98.87% from April 2021 to 2022. However, this was anticipated, with tokens used to compensate for this loss in value.

However, this has changed since the start of 2022, with STEP performing well against SOL, as demonstrated below.

Vesting and Emissions

STEP vesting has not yet been completed, with vesting due to be completed on 25/04/2023 (221 days). No further emissions are currently underway, while negative pressure on the supply of STEP is being driven by the fee wallet which is used to buy STEP tokens which are then distributed to xSTEP holders.

Supply Changes (Reward Options)

As mentioned previously, STEP no longer has liquidity pool emissions as these ended in July 2021. However, supply in the community pool remains. In order to prevent these tokens from simply dumping onto the market, we introduced ‘reward options’. Should a user use the Step Finance AMM, they are paying fees and are an active participant in the Step Finance ecosystem, which is beneficial to the protocol. Thus, in order to reward this, users will be airdropped ‘reward options’. It should be noted that these are not the same as traditional call options. Through deploying these options, the Step Finance treasury gets USDC which can be used to buy back STEP or for other purposes. Furthermore, it encourages positive price action, as users are incentivized to hit the strike price for the long call. If negative price action occurs, users receive nothing. We believe that call options are an innovative way to reward those within our community. If you want to learn more, be sure to read our medium article on this.

Conclusion

In conclusion, the total supply of STEP has been dramatically reduced. Having excess supply provides no benefits to users or investors of STEP. Thus, in order to match our changing organisational products, we have adjusted the tokenomics in order to compensate for this.

Document Conclusion

Overall, through evaluating STEP, SAMO, and ATLAS we have demonstrated the different tokenomic routes which various cryptocurrency organisations take in order to suit their needs.

If you want to stay up to date with the latest Step Finance news, be sure to follow us on our social channels!

Author: @page_analyst