Introduction

Are memecoins good, or bad for Solana?

Daily Active Addresses

DEX Volume

Why does the DEX Volume increasing matter?

How do memecoiners become millionaires?

Solana’s best wallets of the week by PnL

Rug Check

Conclusion

Introduction

Many people claim that Memecoins are the easiest way to becoming a millionaire. Although in theory there may be some arguments supporting it, in practice it doesn’t look that way.

Today we will cover the most up-to-date data on the memecoin season and its impact on the Solana ecosystem.

Are memecoins good, or bad for Solana?

Meme coins can be beneficial for increasing crypto adoption due to their low barriers to entry, which can attract newcomers to the market. They also tend to have strong communities that provide support and education to reduce the learning curve and create a sense of camaraderie. Memecoins are often a gateway into crypto, as seen with the growth of Dogecoin, which brought a considerable inflow of new market participants.

In addition to adoption, memecoins can benefit the DeFi ecosystem in several ways such as increasing liquidity and trading volume on decentralized exchanges, which can benefit other tokens on those platforms. The communities built around meme coins can provide a valuable source of user engagement and feedback for DeFi projects. This can help to improve the overall user experience and adoption of DeFi platforms.

It is important to remember that investing in meme coins can be risky due to their volatility and should be approached with caution. While not for everyone, meme coins can still be useful for increasing awareness and adoption of cryptocurrencies.

Daily Active Addresses

Solana is seeing a prolonged uptrend in daily active addresses in the last 30 days. While Ethereum and Bitcoin’s gas fees increased sharply due to the memecoin season and the introduction of BRC-20 tokens to Bitcoin, Solana has been consistently performing well. The number of active addresses on various blockchains can be compared as follows: Solana has 573K active addresses, Polygon has 370K, Ethereum has 300K, and Bitcoin has 500K.

Contrasting with the increase of daily active addresses on Solana, Polygon and Ethereum have seen a month-long downtrend.

Daily active addresses are a useful metric for studying the health of a blockchain as they provide insight into the level of activity and engagement of its user base. A high number of daily active addresses suggests a healthy and engaged user base, which can lead to increased liquidity and potential success and longevity of the blockchain. However, it is important to consider other factors, such as transaction volume, mining activity, and developer activity, when assessing the overall health of a blockchain.

DEX Volume

Solana DEX Volume shows no signs of slowing down. In the last seven days, on-chain volume increased 87%, totalling $566M transacted on decentralised exchanges.

In the first 12 days of May, DEX Volume surpassed 50% of the total volume in April. In addition, it is already higher than December 2022, the month followed by the FTX crash.

Why does DEX Volume matter?

Growing DEX volumes on a blockchain are crucial for the success and development of the blockchain ecosystem. It provides benefits such as increased liquidity, improved decentralization, reduced risk, and greater adoption of DeFi. Higher volumes on a DEX make it easier for traders to buy and sell assets, reinforce decentralization, and reduce the likelihood of any one entity having too much influence. Additionally, the growth of DEX volumes can attract more investment and development resources to the ecosystem, leading to further innovation and growth.

How do memecoiners become millionaires?

Luck. Unfortunately, more than 99% of memecoins either rug in the first 24 hours, slow rug or trend to zero over time. The odds of scoring the next DOGE, SAMO, PEPE or BONK are as low as hitting a jackpot, however, some have done it. While trading memecoins is risky and definitely not recommended, profitable investors have a rulebook which does not prevent them from being rugged or scammed but helps reduce the risk of losing money.

Be cautious of the token supply distribution, as a higher percentage held by the Top 10 wallets may lead to exit liquidity. Higher liquidity in the starting Liquidity Pool is favourable, but the team may still drain it. To boost confidence, look for projects with locked liquidity and burned keys.

Check for social media presence and avoid tokens with no description, low TVL, and a blatant rug name. Experts suggest spreading investments and taking profits by rotating most of the money into stables and reputable projects and reserving a small percentage for higher-risk bets.

Solana’s best wallets of the week by PnL

This week’s best wallets had one thing in common: memecoin trading. The Top 10 wallets by Profit-and-Loss of the last 7 days profited around $258K. The majority was early in coins like $GUAC, $KING and $SWTS, which allowed them to turn a small investment into a 20X-50X return. The top wallets hold mostly USDC or SOL and invested a speculative portion of their capital into memecoins.

Rug Check

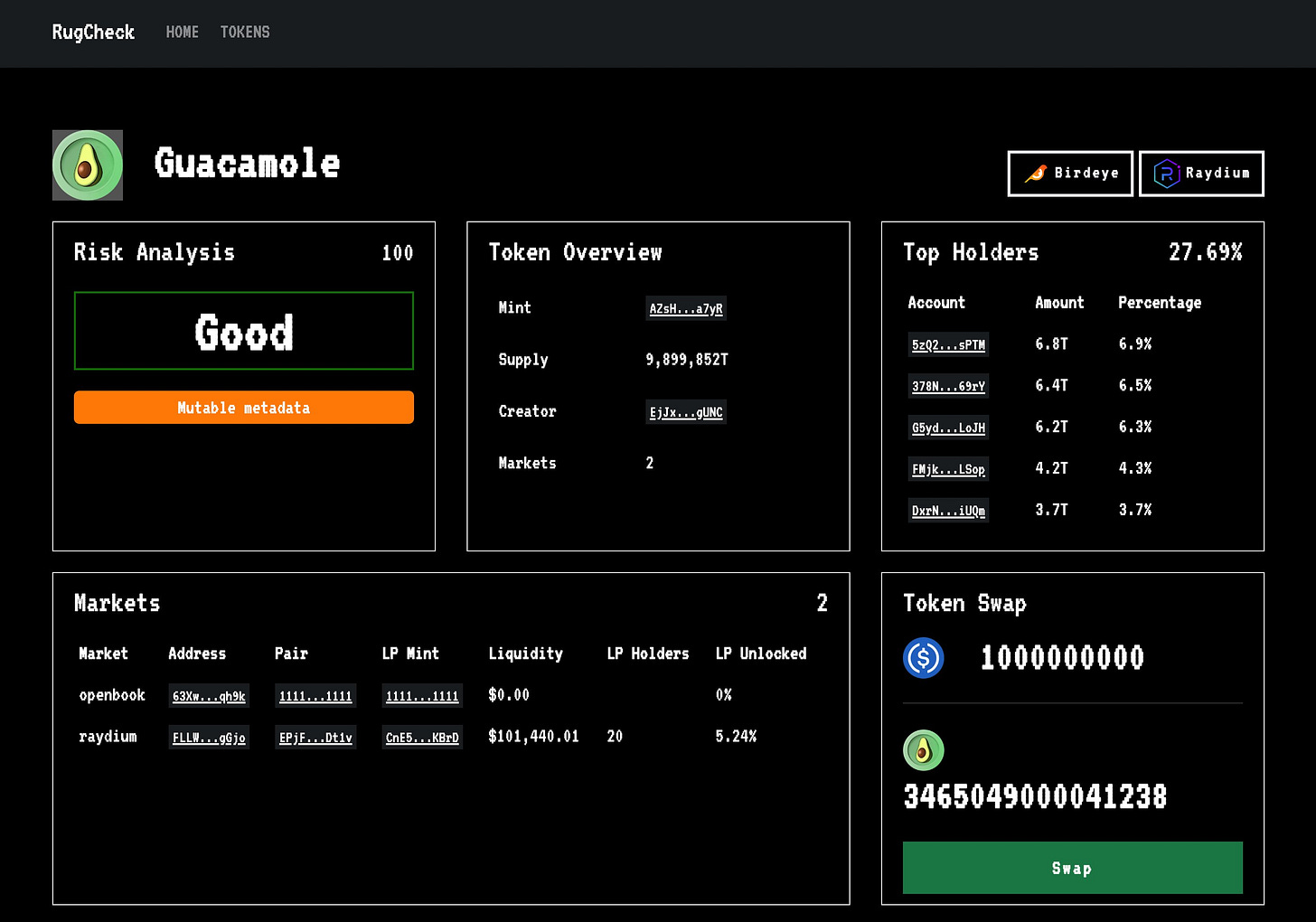

The Solana developer @CloakdDev (on Twitter) built a tool called "Rugcheck" for an anti-rug $SOL memecoin. It provides users with information about the token and LP pools to help keep them safe.

Conclusion

The Solana memecoin season has pushed the Solana ecosystem forward. DEX Volume sharply increased in May, supported by the growth of memecoins such as $GUAC, $SWTS, $KING and more. Solana’s daily active addresses have been trending in the last month, while Ethereum, Bitcoin and Polygon have been seeing a consistent decrease in activity from their users.