Summary

Introduction

Price Action

Solana is more decentralised than ever

DEX Volume

DeFi & TVL

DePIN

NFT Lending

Conclusion

Introduction

Solana's price has recently exploded from monthly lows of $13 to $31 last night. In the last week, the Twitter timeline was filled with users sharing their thoughts on Solana, showing signs of a broad pivot towards the fastest blockchain today. Data shows an acceleration of DeFi, with DEX volume reaching monthly highs.

The last two years have not been easy, especially for the Solana community, is that about to change? Let us take a look at the data.

Price Action

Over the past three months, the Solana token price ($SOL) witnessed a period of high volatility. Just before the end of the year, Solana plunged to a multi-year low of $8.90, right before initiating a drastic shift in momentum to a high of $27.00 in February.

Solana was consolidating for months until the SEC's lawsuit against Coinbase and Binance, which named SOL a security in both cases. Just yesterday, news came out of XRP winning their case against the SEC, meaning that XRP is not a security. The news sent Solana higher as it boosted investors’ confidence that it may not be classified as a security in the future. Solana briefly hit pre-FTX levels of over $30 and is currently consolidating at the $26-$29 area.

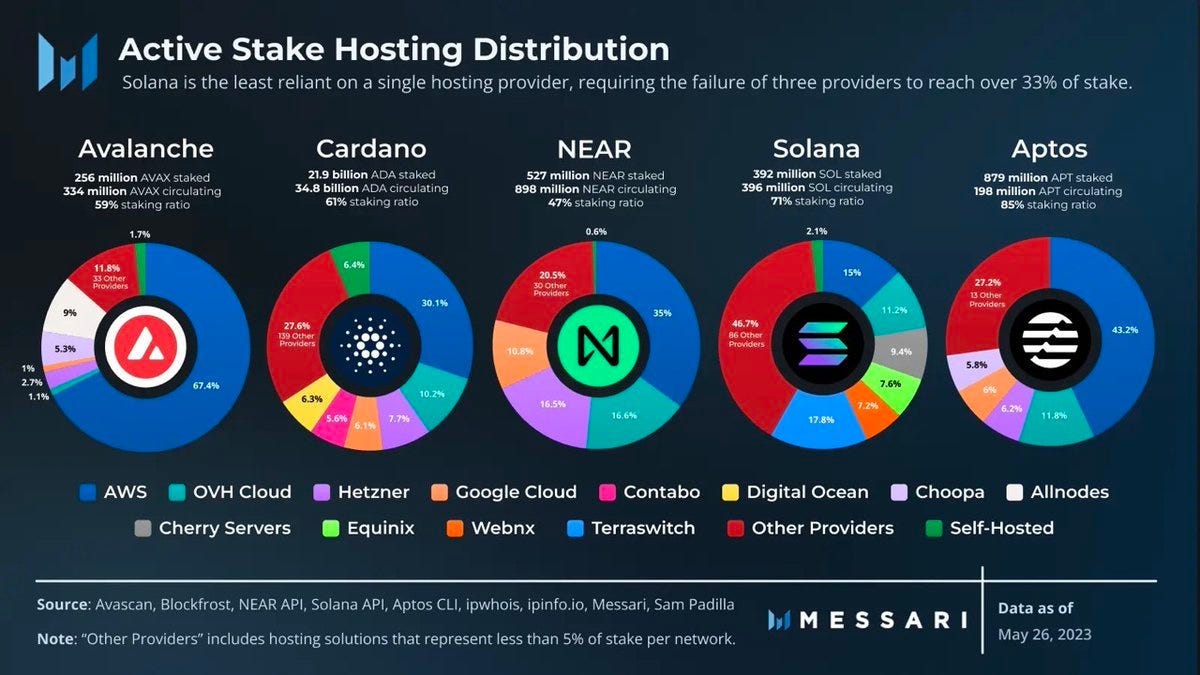

Solana is more decentralised than ever

Solana is not only decentralized, but it is more decentralized than most blockchains, such as Avalanche, Cardano, NEAR and Aptos. Active Stake Hosting distribution is one of the most balanced, which provides further proof that Solana is resilient and decentralized.

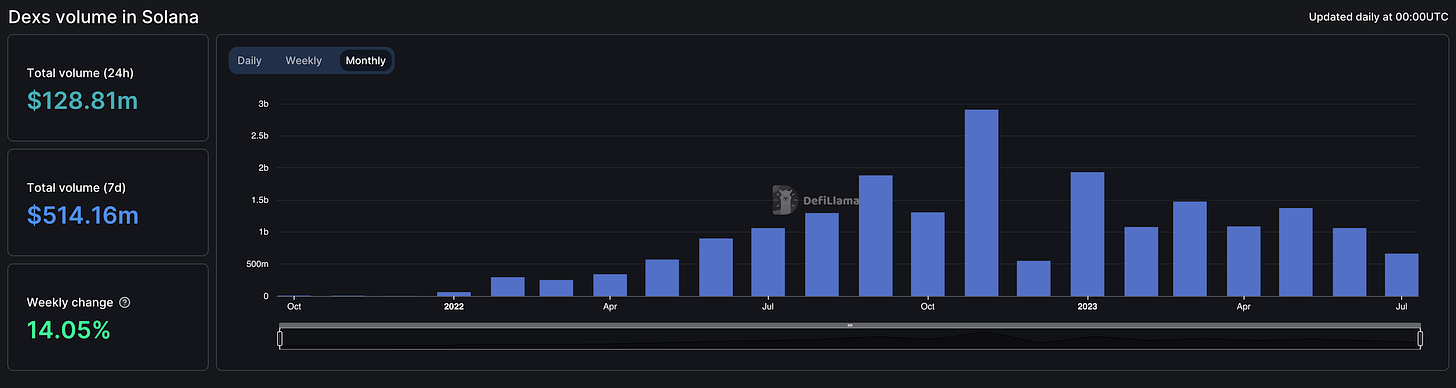

DEX Volume

One of the main narratives for Solana has been decentralised trading, due to Solana’s low transaction fees and speed.

Year-over-Year, volume on decentralised exchanges is on average, four times higher in the first 6 months of the year when compared with the same period of 2022. The sharp increase is explained by the investment and development of DEXs and Perpetual Trading DEXs like Drift Protocol, Jupiter Aggregator and Zeta Markets, among many others.

Data shows that the FTX collapse did not slow down Solana DEX Volume. So far in 2023, the monthly volume has always hit over $1B in volume.

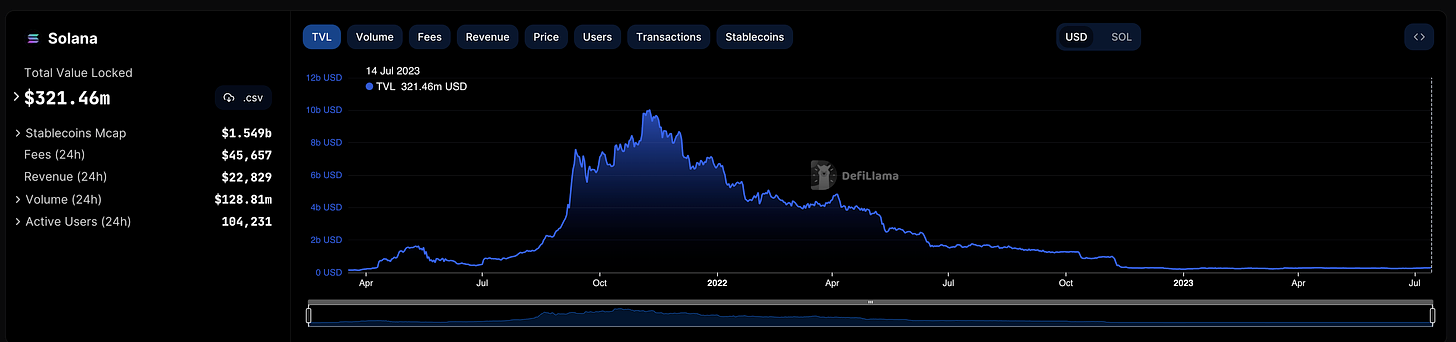

DeFi & TVL

The Solana DeFi ecosystem is expanding with the growth of projects like Marinade, Cypher Protocol and marginfi which have consistently been developing incentives for DeFi adoption, such as incentives to lending, borrowing and depositing stablecoins or SOL.

Recently, Solana TVL hit a post-FTX high of $320M total-value-locked.

DePIN

Many analysts and thinkers argue that DePIN will play a vital role in the future of Blockchain Technology. Due to its infrastructural and technical advantages, several DePIN projects are building on top of the Solana network.

Decentralised Physical Infrastructure Networks are networks designed to distribute physical infrastructure and resources across a network of nodes, rather than relying on a centralised infrastructure. In these networks, each node is responsible for maintaining and managing a portion of the infrastructure.

DePIN can be applied to several infrastructure systems, such as energy grids, transportation networks, and water systems. By decentralising the infrastructure, these networks can increase resilience, reduce the risk of catastrophic failures, and improve efficiency by reducing the need for long-distance transportation of resources.

NFT Lending

The Solana NFT Lending ecosystem is rapidly growing. In the last 30 days, Lending Volume corresponded to 50% of the Solana NFT Trading Volume.

Solana's biggest NFT DeFi platform, Sharky surpassed Magic Eden and Tensor’s monthly volume. Sharky recorded over 1 million SOL volume, followed by Magic Eden’s 940K SOL and Tensor’s 850K SOL. Data shows the NFT market is maturing and growing beyond trading.

The growth of the NFT Lending market has attracted a new category of users who fall between high-risk and low-risk profiles. This group of users neither favours NFT Trading due to its high-risk nature nor staking their SOL as they don't consider the potential yield worth the delegation risk. These users likely keep their SOL in hot wallets and now have an opportunity to earn substantial gains with a smaller investment.

Conclusion

Based on data, its history and sentiment, it is possible to make the argument that Solana may have a chance at revisiting all-time-highs. It is one of the tokens which has suffered the most in the bear market. Through all the suffering, it retained a core community of hundreds of thousands of monthly users with an innovative, hardworking developer community. Analysts compare Solana’s current state with Ethereum’s first bear market.

Love your writing Gumshoe.