Summary

Introduction

SEC accuses Solana

Solana Responds to the SEC

What is a Security?

How does being a security impact Crypto?

Binance US

Robinhood

Conclusion

Introduction

What a week. Monday started with the news of the SEC charging Binance for selling unregistered securities. On Tuesday, the SEC attacked Coinbase with a lawsuit. In just 24 hours, the two biggest Centralized Exchanges in the world got sued by the SEC, which many consider a full-blown attack on the crypto industry. Several cryptocurrencies were cited as being unregistered securities, which caused the biggest liquidation event of 2023, and the biggest since the FTX collapse.

In its Binance.US and Coinbase lawsuits, the SEC identified tokens issued by foundations and companies or tied to protocols Cardano (ADA), Polygon (MATIC), Sandbox (SAND), Filecoin (FIL), Axie Infinity (AXS), Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), Near (NEAR), Voyager (VGX), Dash (DASH) and Nexo (NEXO) as securities.

The good news is that Jim Cramer called “Solano a counterfeit coin”, which gave back hope to Solana’s investors, as he is seen by many as a counter-indicator.

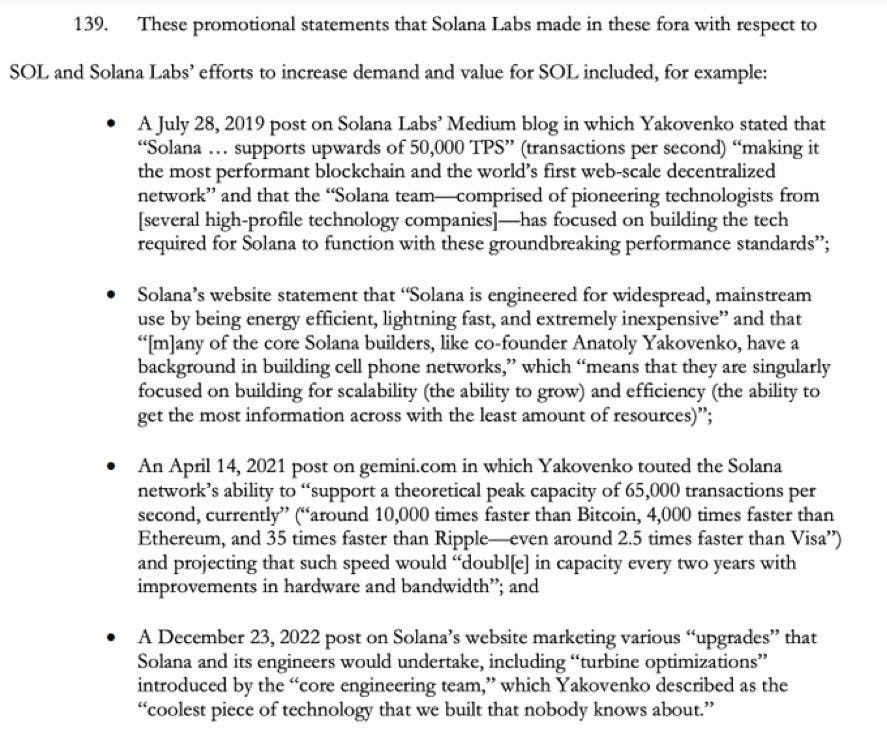

SEC accuses Solana

The SEC lawsuit accuses Solana Labs of making promotional statements to increase the demand and value of the Solana token $SOL. Many crypto natives showed disbelief at these accusations, as Solana’s speed, transactions per second and decentralization are facts. Solana is energy efficient, lightning fast, and extremely cheap, as transaction fees are virtually non-existent. The energy cost of a Solana transaction is 40% lower than the energy cost of a Google Search.

Solana Responds to the SEC

The Solana Foundation disputed the U.S. Security and Exchange Commission’s (SEC) classification of its SOL token as an unregistered security.

The Solana Foundation strongly believes that SOL is not a security,” the Solana Foundation told CoinDesk in a statement. “SOL is the native token to the Solana blockchain, a robust, open-source, community-based software project that relies on the decentralized user and developer engagement to expand and evolve.

What is a Security?

If a token is classified as a security, it is considered a form of project ownership. The Securities and Exchange Commission (SEC) is responsible for regulating securities. Gary Gensler and the SEC declared several cryptocurrencies as securities, such as Solana.

To determine if a token qualifies as a security, the SEC applies the Howey Test, which considers whether there is an investment of money, a joint enterprise, an expectation of profits, and whether the profits primarily come from the efforts of others.

If a token meets these criteria, the SEC may classify it as a security. This classification imposes certain obligations on the issuer, such as registration with the SEC, disclosure of financial information, compliance with anti-fraud regulations, and adherence to securities laws.

How does being a security impact Crypto?

Classifying a cryptocurrency as a security has significant implications for the crypto ecosystem. It involves regulatory compliance, enhanced investor protection, trading restrictions, and impacts on market value and perception. Stricter regulations may hinder innovation and funding. Regulatory frameworks and classifications vary by country, and jurisdictions are evolving their rules for cryptocurrencies and blockchain technology.

Binance US

Binance US has announced the delisting of over 100 trading pairs. In addition, they are suspending USD deposits and will disable USD fiat withdrawals as early as June 13th. These actions come when the speculation increases about Binance shutting down its American platform.

Robinhood

In fear of being the next target of the SEC, Robinhood took action today, by delisting Cardano, Polygon and Solana.

If you don’t want to sell your ADA, MATIC and SOL, and you live in a state where transfers are available, you can send it to another wallet or crypto platform. However, any ADA, MATIC, and SOL that’s still on Robinhood after the deadline will be automatically sold and credited to your Robinhood buying power.

Conclusion

This has been one of the toughest weeks in 2023 for crypto. The US is arguably attacking the Crypto industry as it pushes the CBDC narrative forward. Although these accusations are serious, it is important to remember that the ongoing SEC case against the XRP is rumoured to be going well for XRP, which could potentially hinder the odds of the SEC succeeding against Coinbase and Binance on the allegations of selling unregistered securities. Will the SEC kill Solana if it wins the case for Solana being a security? No, but it will most likely have a negative impact.